Three Things I Think I Think – Bitcoin, Bitcoin, Bitcoin

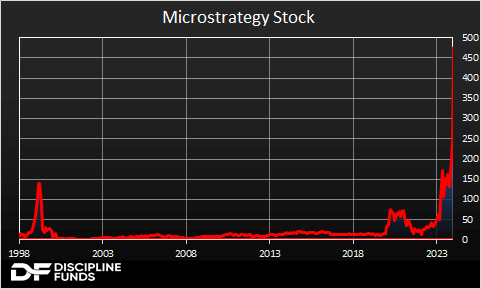

Here is one thing I think I am thinking about three times. 1) The money supply as the cost of capital. In a recent interview MicroStrategy CEO Michael Saylor was criticizing Warren Buffett's cash management. [...]