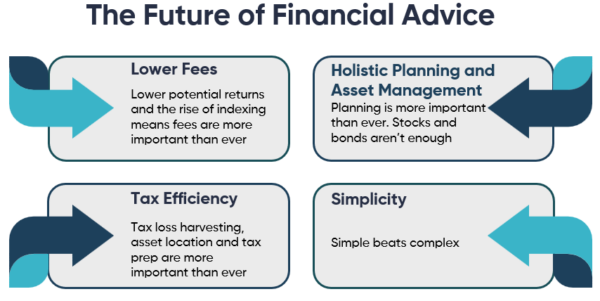

The financial advisory space is changing faster than ever and we want to help you update your practice and ensure that your portfolio management services are up to date and evolving with the times.

Discipline Funds will review your current portfolio models and provide comprehensive feedback about performance, diversification and potential flaws/improvements. Discipline Funds also offers a series of model portfolio indices using our Defined Duration and Countercyclical indexing strategies. This includes:

-

- The Defined Duration Portfolio

- The Defined Duration Income Strategy

- The Countercyclical Indexing Strategy

If you are an institution or advisor looking to improve your practice and asset management service please contact us to learn more.

See how our financial planning based strategies have helped investors stay the course and maintain faith in the strategy their advisors utilize: