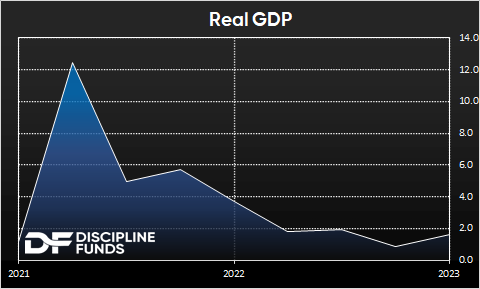

There has been a heated debate in recent months about the risk of recession. On one side you have optimists who have been saying that the US economy remains robust and on the other side you have pessimists who are worried about recession and a potential 2008 scenario. In a way both of these groups have been right. The economy has decelerated sharply in the last year, but we aren’t seeing data that is consistent with what the NBER would define as a “recession”. So how concerned should we be about these technical definitions?

It’s useful to provide some perspective on potential outcomes, but we need to be careful with these sorts of binary views. In our view we’re still in the “muddle through” camp as it pertains to the economy. We don’t see a high probability of a boom or a bust so long as the Federal Reserve is fighting inflation aggressively. We do, however, see continued risk of a policy error if the Fed remains too tight for too long. Our general view on inflation is that the Fed won the battle already and they won’t declare victory until 2024 or 2025. In the meantime, the overnight rate at 5% puts a lot of pressure on credit markets and this increases the probability of an outlier credit event. When you combine this with a very low unemployment rate and high market valuations you tend to see the sort of choppy stock market that we’ve been experiencing in the last few years.

Importantly, however, we won’t even know we’re in a technical recession until well after the fact. The NBER relies on data that gets heavily revised over time and if a recession occurs it will show up in the data long after it’s actually happened. The markets will very likely be ahead of the curve there and the recent price action in stocks is consistent with falling recession expectations.

At the same time, it’s important not to confuse the economy for the markets. The global stock market has been rallying in recent months, but has been flat for 2.5 years. This is not a good risk adjusted return so being less aggressive in recent years has been the right move. But the stock market is forward looking and thus far the economy and corporate profits are holding up better than expected. But at the end of the day asset allocation is about expected future probabilities and it’s worth noting that the current mix of macroeconomic and financial currents is consistent with elevated risks in the stock market. And while we like to communicate that the stock market is an 18 year instrument in our strategies, it’s important to insure against excess volatility if you’re especially sensitive to the outsized short-term volatility that the stock market can cause.

In short, don’t get too caught up in the narrative wars over “recessions”. This sort of binary thinking is counterproductive and entices us to think more like gamblers than investors (or savers). The financial markets aren’t the economy and the economy won’t even show a technical recession until long after it’s actually happened. And as John Bogle liked to emphasize, the best approach is to find a strategy you are behaviorally comfortable with so you can stay the course and make your portfolio behaviorally robust against overreacting one way or another as you read these sorts of narrative wars.