Yields have been surging in recent weeks as markets price in rising credit risk and the likelihood of the Fed remaining higher for longer. Our view on credit risk hasn’t changed this year – Fed tightening cycles are a risky time to take excessive credit risk as the Fed jacks up rates and forces future debt contracts to roll at higher interest rates. Similarly, the rise in rates has a disproportionate impact across the government yield curve as longer duration instruments are exposed to more interest rate risk. But the good news in this story is that the relative risks are highly asymmetric and are now at a point where short duration instruments look super attractive.

We discussed the concept of “escape velocity” a few weeks back, but without getting wonky it’s basically the point where current coupon payments offset the interest rate risk. So, for instance, if a bond with a duration of 5 also yields 5% then a 1% change in interest rates over a year will have no impact on the price because the yield that accrues over a one year period will offset the decline in prices. I call it “escape velocity” because the new starting coupon allows the bond to “escape” its interest rate risk.1

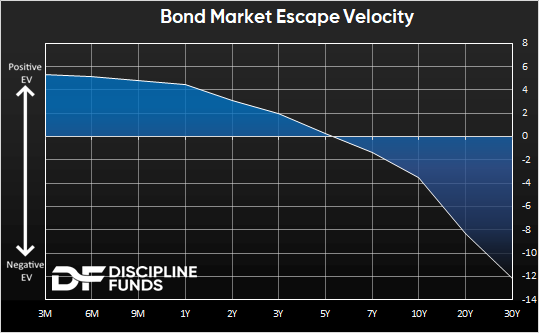

So where are we now and what is the “sweet spot” for US government bonds? The following chart shows the escape velocities across the US government yield curve. We would argue that the sweet spot at present is anything in that 0-5 year time horizon. That’s the point where you are clipping a high enough coupon that you can sleep well without worrying too much about principal risk. The further out you go the more principal risk you have. The current break-even point is at the 5 year and as we go further out the escape velocity looks increasingly unattractive.

As I note in our Defined Duration strategy, the longer maturities can still serve an insurance-like aspect in your portfolio. Specifically, they will hedge your portfolio against deflation and a rapidly declining interest rate scenario. That’s most likely a situation where a recession or credit crisis of some sort is occurring and the Fed is shifting rates lower to combat the slowdown. Alternatively, buying longer duration bonds could be a smart hedge against the bond market being wrong. In other words, if the Fed gradually reduces rates in the coming years investors who lock in 5% 10 year rates will not only clip a coupon for 10 years, but also benefit from the increased principal if the Fed reduces rates over that period. However, that investor is exposing themselves to the short-term risk that inflation remains more entrenched than we think and that rates could go even higher.

It’s a great time to be a short-term saver. And for now, the sweet spot remains on the shorter end of the curve.

1 – This of course assumes just a 1% rise in rates, which, at this juncture looks like a pretty good assumption since the likelihood of the Fed pausing looks very high.