In the 1970s overnight interest rates went from a low of 3% to a high of 20%. This was an especially tough time to be a bond investor as the surge in interest rates caused short-term principal losses and prolonged real losses. But there’s also an interesting and important lesson from the 1970s – higher bond yields create a sort of escape velocity at some point where the interest payments offset the interest rate risk. In the case of the 1970s the investor who bought a constant maturity bond fund at the low yields of 1972 generated a 2.6% annual return until rates peaked in 1980. How is this possible given that rising interest rates make bond prices go down in the short-term? The answer lies in this concept of interest rate escape velocity and the way in which high starting yields can offset the interest rate risk that pulls a bond’s price down in the short-term.

In 1972 you could purchase a constant maturity 10 year T-Note fund yielding 6.4%. Interest rates almost doubled over the coming 8 years, but this investor still averaged 2.6% returns per year because the high yield offset the interest rate risk. To be wonky – the duration, or interest rate sensitivity of the fund was about 7.5.1 Meanwhile, the fund was yielding 6.4% when it was purchased in 1972. This means that if interest rates go up by 1% the bond will lose 7.5% in principal. But it is also earning 6.4% per year so this bond earns a -1.1% total return in year one. In the case of the 1970s 10 year interest rates rose from 6.4% to 13% in 1980. Despite this, a constant maturity 10 year bond fund had an average yield of 8.4% over this period. So the average interest rate more than offset the duration and resulted in positive nominal returns during this period. This point where yields offset interest rate risk can be thought of as a sort of escape velocity where rising interest rates still hurt bond prices, but the starting or average yield has escaped from most of the potential negative impact of interest rate risk.

This is potentially important today because bonds (and especially intermediate and shorter duration bonds) are appearing increasingly close to this point of escape velocity. In fact, most short-term government bonds have already achieved this escape velocity. But the basic thinking is that once upside interest rate risk starts to subside during a high interest rate environment the current high yields mitigate future potential interest rate risk. So, for instance, if you buy a 10 year T-Note yielding 4.2% today you have a duration of about 8. If interest rates rise to 5.2% you will lose 8% of principal as rates rise and earn 4.2% of interest every year. This means you’ll earn a total return of -3.8% after the first year. Not great, but not the end of the world either. More importantly, you’ll continue to earn 4.2% every year despite this one time negative hit of -8% from the interest rate change. This is a very different environment from the one we encountered just a few years ago.

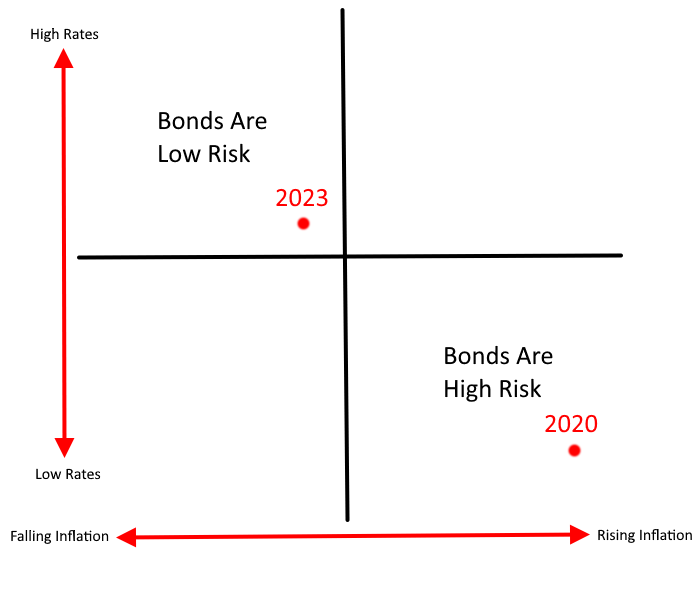

For reference, 10 year yields have moved from 0.5% in 2020 to 4.2% over 3 years. This is the worst of all worlds because you had high interest rate risk and a low starting yield. As a result, a 10 year T-note falls 25%+ because the starting and average yield cannot offset the duration of 8 over 3 years of rising rates. But the math starts to change substantially when yields are 4.2% and the Fed is approaching their terminal rate (peak interest rate) because the starting yield is relatively high and the probability of short-term principal losses declines as the Fed reaches their terminal rate.2

One way to think about this is that zero credit risk instruments like T-Notes become riskier when rates are low (and inflation risk rises) and less risky when rates are high (and inflation risk falls). So the potential risk adjusted return dynamics are very different in a world where rates are high and unlikely to keep rising.

But the crucial question today is “how much upside is there in interest rates” given that the Fed appears closer to their stopping point?

Fed Funds Futures say that the terminal rate for the Fed is 5.5% or roughly where we are today. This would mean that the asymmetric risk in bonds is starting to skew from the downside to the upside. This is especially true in shorter duration instruments like T-Bills where the inflation and risk adjusted returns now look fantastic. It’s less true in super long duration bonds, but anything in the intermediate duration range is approaching escape velocity. Our view is that the majority (and perhaps entirety) of the interest rate risk is behind us and that bond investors should experience much smoother sailing going forward as a result.

In short, bonds with a duration under 5 have likely already reached escape velocity. T-notes in the 5-10 year duration range are close to escape velocity, but not quite there yet. And long bonds are still far from escape velocity. As a result, the US government bond market looks increasingly attractive on the whole and we’d argue that anything in the intermediate and shorter duration range looks especially attractive now and is likely to generate much better risk adjusted returns going forward.

NB – Here at Discipline Funds we like to think of bonds specifically as principal protection instruments rather than inflation protection instruments. You use bonds to create certainty across specific time horizons whereas you use stocks and real assets to protect you from inflation across longer time horizons. So it’s reasonable to accept the fact that bonds will often generate negative real returns in exchange for greater short-term principal stability thans stock often provide.

1 – Duration refers to interest rate risk. For every 1% rise in rates a bond will fall in value by its duration

2 – In our All Duration research we found that long duration bonds operate like insurance. That is, they generate low real returns on average, but can generate very high asymmetric returns in the case of a deflation and rate cuts. This is the most logical argument for owning long-term bonds these days – using bonds as a form of insurance to hedge against an asymmetric risk like a deflation shock that forces the Fed to cut rates rapidly.