Modern Portfolio Theory focuses on assembling the optimal group of assets to achieve the best return per unit of risk. Diversification works well because it blends short and long duration instruments thereby reducing the overall average duration. A diversified portfolio of 60/40 stocks/bonds, for example, is a wonderful portfolio, but in our All Duration model it works out to a homogeneous allocation with an average duration of 12 years because it blends long duration instruments (stocks) with shorter duration instruments (bonds). That’s great if you have a longer average time horizon but it becomes a big financial planning problem if you need liquidity in a year like 2022 and the entire set of assets is deeply negative. The problem of time within an asset allocation is arguably the most important aspect of any sustainable financial plan. Instead of combining assets to optimize return per unit of risk we should focus on optimizing a portfolio to meet our specific financial goals across specific time horizons.

This is the problem I sought to solve with the Defined Duration Investing strategy. I took every single asset class and applied a quantifiable time horizon to them thereby allowing us to build a form of a bond ladder using all asset classes. This is important from a financial planning perspective because it allows us to invest our assets the same way the most sophisticated pension plans and insurance companies do – by matching specific assets to specific liabilities. You start with your short-term liabilities (monthly expenses, annual, 2 years emergency money, etc), continue to 2-5 year liabilities (house down payment, tuition, etc), 5-15 year liabilities (college, marriage, etc) and 15+ year liabilities (retirement, healthcare, etc). Then you take our All Duration model and apply the right assets to the right liabilities. You end up with a portfolio that is not only diversified across asset classes, but more importantly, it’s diversified across specific time horizons thereby helping you better achieve your financial goals by increasing certainty over time.

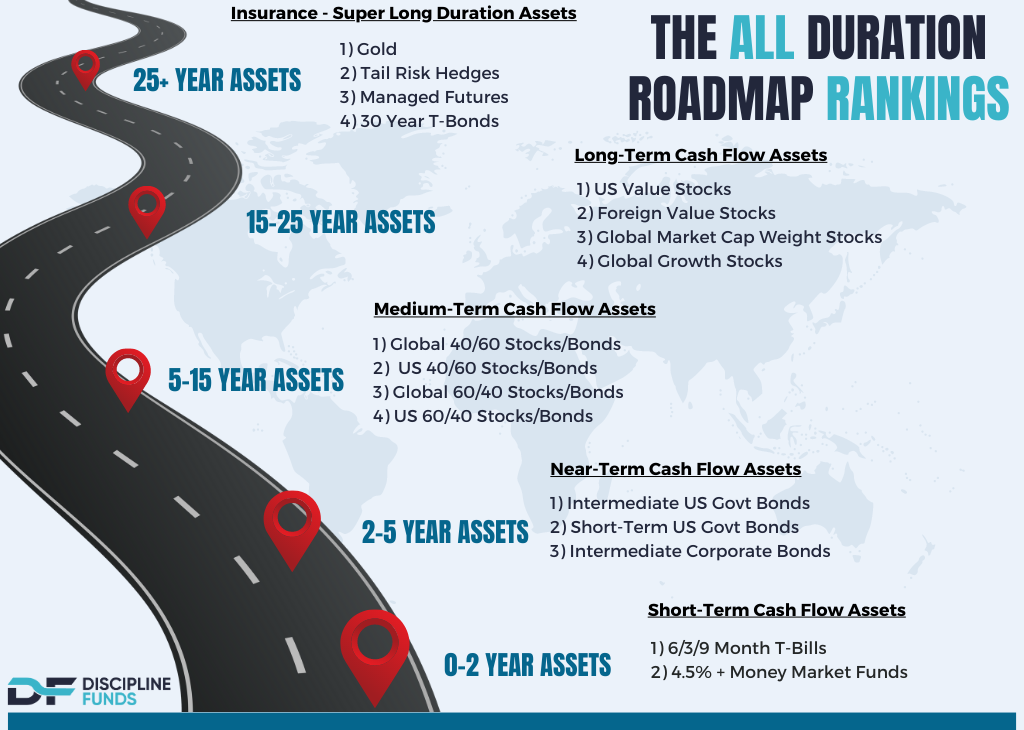

The All Duration Roadmap Rankings.

Instead of ranking assets by their optimal expected future returns, we’ve introduced the All Duration Roadmap Rankings to provide a framework for ranking assets by expected risk adjusted returns across specific time horizons. The Roadmap Rankings take specific time horizons and then help the investor construct a portfolio by matching the assets to their personal liability needs across time. For instance, if you need a cash balance for the next 12 months to manage short-term expenses the July 2023 Roadmap Ranking ranks T-Bills, yielding 5.4% as the optimal allocation for those time horizons. If you need money for a house downpayment for an uncertain 2-5 year time horizon you might consider something fitting the 2-5 year time horizon. 5-15 year time horizons are best matched with a form of multi-asset fund (60/40, 40/60, etc). Retirement funds and long-term assets should be matched with stocks (which are 17 year instruments in the All Duration model). If you need portfolio insurance for whatever reason you might consider a small allocation in gold or tail risk protection.

We’ve been using this specific approach with clients for well over a year now and the feedback I get from it is amazing. I strongly believe that in 10-20 years these time blocking strategies will be how most financial planners implement their asset allocations. The days of chasing “alpha” and charging high fees are dying. The future is all about how to better mesh the worlds of financial planning with sensible discipline based asset allocations. I hope this framework helps you better understand how to match your assets with certain liabilities. And of course, if you’d like us to help you build your own All Duration strategy please don’t hesitate to reach out.

Sources: