We always like to defer to simplicity when it comes to asset management. There are numerous reasons why simple portfolios beat complex portfolios:

- They’re easier to manage and automate.

- They tend to reduce fees and taxes.

- They tend to perform better than overly complex portfolios.

But portfolios can also be too simple. For instance, in theory you might think that a single low cost diversified fund of funds ETF is the single best way to allocate your entire portfolio.1 This creates one super simple all internally rebalancing fund that requires virtually no tinkering. If the fund is managed properly you can defer taxes and perhaps even have your kids inherit it with a stepped up basis.2 Congrats, you just created an active rebalancing tax deferred instrument in a taxable account. What a beautiful plan, huh? But I would argue that this asset allocation is too simple for many reasons:

- It creates homogeneous asset class risk. I’ve calculated the 60/40 portfolio to have a duration that is roughly equal to 12 years. If your one fund is a 60/40 it means you’ve taken a diversified group of assets and turned them into a single 12 year instrument. This is great for buffering the risk of the long-term instrument like the stocks. And it’s terrible for diversifying the short duration instruments like your cash. In other words, if you need cash from this portfolio you don’t really have the option to pick from the cash within the portfolio because if you need liquidity you will have to sell some portion of ALL the underlying instruments. If the stock and bond markets are down significantly like they were in 2022 then you’ll be forced to sell some portion of everything just to get to the cash. This is not efficient.

- It exacerbates behavioral risk. The single holding creates one 12 year instrument. This is great if you have a 12 year time horizon. But everyone has multiple time horizons in their financial lives. So taking all of your assets and putting them in one 12 year instrument creates an asset-liability mismatch in your financial plan. This not only reduces your overall liquidity, as mentioned above, but it exacerbates behavioral biases since virtually none of us are patient enough to let a single 12 year instrument play out for all your assets. 12 years is an eternity in the financial planning world. Heck, most of us can’t even go a few days or weeks without constantly checking our portfolios and worrying about the values. So you might be able to afford being that patient with some of your assets, but certainly not all of them. So aside from the inherent liquidity risk you exacerbate the behavioral risks in the portfolio.

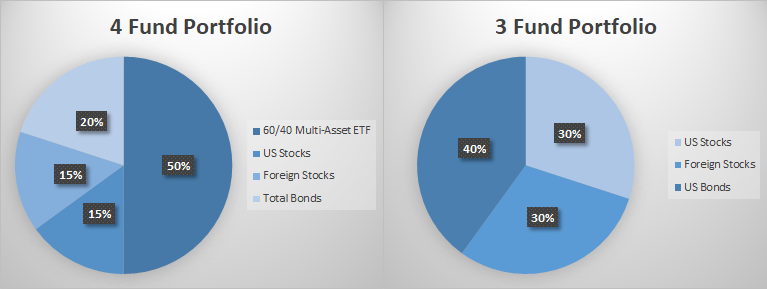

Now, you might say, “of course, that’s why something like a Boglehead 3 fund portfolio makes sense”.3 And you’d be mostly right. Except you have similar problems there that can be solved with even more holdings. For instance, the 3 fund portfolio breaks out the single 60/40 into its more accessible components. Let’s just pretend it’s 30% US stocks, 30% Foreign Stocks and 40% Total Bond Market. Now you have more liquidity because you have specific buckets and you’ve segmented your holdings to create a more behaviorally robust allocation. You’ve solved all the problems in the single fund of funds ETF, right? Not exactly.

I’ll explain this more fully below, but the two portfolios at the right are the same thing. But the more complex portfolio is more tax efficient and more behaviorally robust. Here’s why:

First, you still have the liquidity issue. If you need cash your bond allocation technically holds some cash, but it also holds a bunch of long-term bonds. It’s a 5 year instrument. And if you need 5 month liquidity or 5 minute liquidity you can find yourself in a position like 2022 where bonds are down 10% and you are forced to take a capital impairment to access the cash portion of that portfolio.

Personally, I am a huge advocate of breaking out the bond position and building a customized T-Bill ladder along side it. That way you can roll T-Bills at 5.4% and have a cash equivalent that is compartmentalized from all the duration risk of the bond position.

Second, adding a fund of funds ETF into this portfolio makes it more tax efficient. For instance, if you have a target allocation of 60/40 stocks/bonds your stocks will outperform your bonds over time and you’ll have to rebalance the portfolio back to 60% stocks. If you have $100 invested in a 60/40 allocation across 2 equity holdings and a single total bond allocation and the stocks go up 20% and the bonds go up 4% over the course of 366 days you will have to rebalance your portfolio back to 60/40 to maintain the same risk profile. The problem is, your stocks grew to $72 and your bonds grew to $41.60. In order to get back to your target you have to sell $4.40 of the stocks and add to the bonds. This means you incur $0.88 of capital gains along the way.

Now, an obvious solution is to go back to square one and buy the all in one fund. Boom, no capital gains because the ETF rebalances internally. But what you gain in tax efficiency you lose in liquidity. But you don’t have to pick one or the other. As the kids like to meme, “why not both”?

If, on the other hand, you’d invested in the same allocation of 60/40 and invested 50% of the assets in a multi-asset ETF (with additional individual holdings of 30% in the two stock ETFs and 20% in a total bond ETF) you would have deferred the capital gains in the multi-asset holding because it rebalances in-kind. That 50% holding defers the capital gains until you decide to sell the ETF. Of course, you still end up having to sell some of your stock ETFs, but in this scenario your other stock positions are just 30% and your bond position is 20%. To get back to your 60/40 target the multi-asset ETF rebalances internally (and defers capital gains) and you are forced to sell $1.92 of your other stock ETFs to get back to 60/40. This means you incur a capital gain of $0.38. By making the portfolio more complex you defer $0.50 of your total pre-tax $13.60 return. This is money that compounds in your account, perhaps in perpetuity (if you have adorable children), because you structured a more tax efficient version of a simple 60/40 allocation.

I’d also argue that adding this additional holding makes your overall portfolio more behaviorally robust because it adds a layer of duration that fills in the void between the stock and bond holdings. Stocks are an 18 year instrument in our All Duration approach while a total bond index is a 5 year instrument. These instruments are wildly different, but by blending them you effectively reduce the excess volatility from the longer duration instrument. This helps you remain more comfortable by compartmentalizing the holdings over specific buckets and time horizons. In other words, you aren’t just diversified across more asset classes, but you’re diversified across more specific time horizons. And I’d argue that time is the single greatest behavioral hurdle we try to solve for in financial planning. When you solve for time you increase certainty and when we increase certainty we increase the probability of staying the course to meet our goals.

Anyhow, I am rambling now. But I hope you get the message – simple is great. But simple isn’t always better.

1 – I am sure this is exactly what you’re all spending your holiday weekend thinking about. Right?

2 – Who would plan on doing this? Surely not a 42 year old man with two young, expensive, adorable daughters, right?

3 – You probably didn’t say that because you’ve got better things to worry about, right?

NB – We assumed a 20% capital gains tax rate. I should also add that these examples are overly simplified for ease of communicating the point.