One of the themes I’ve been discussing lately is how inflation risk has been evolving into credit risk. What I mean by that is that we’re currently navigating the economic bust portion of the cycle where inflation is a falling risk and credit deflation risk arises, in large part, because the Fed has reacted so quickly to bring inflation in. But to understand the bust you really need to understand the boom. As I mentioned in our last piece the current environment is like an underwater earthquake. What you see and what people will blame is the tsunami that causes the actual damage. But to understand the cause of the bust you have to understand the earthquake and its causal factors, even though you don’t see the earthquake.

Markets change over time. The assets change, the companies change, the people change. But one thing that doesn’t change is human emotion. We get caught up in the fervor of the booms and then we overreact in the busts. It’s human nature and it’s the thing that makes markets appear like the eternal recurrence I previously discussed. The Silicon Valley Bank crisis is interesting because people are looking at banking as the tsunami. And yes, the tsunami causes damage and contributes to the overall wreckage, but it’s not the causal factor here.

The banking bust we’re seeing now was sown during COVID. The COVID boom was the inevitable blow off top of the prior 10 year bull market. We were going to get an overreaction on the upside at some point. And the pandemic was the thing that poured gasoline on that fire. Trillions of dollars of stimulus, the Fed sitting at 0% well into the boom and a hefty dose of irrational exuberance and here we are. You might not recall the sheer stupidity of the 2021 bull market but it’s going to go down as one of the stupidest bull markets of all time. It’s hard to even pick the stupidest part of it. Was it the fart jars selling for $250,000? The rock jpegs selling for millions of dollars? The laser eyes? Doge coin? SPACs? Meme stocks? 100 year bonds? Housing prices up 50%? You don’t have to pick just one. And that’s what makes the boom so interesting. It was so widespread that there’s no telling how widespread the bust will be.

SVB is a microcosm of the overarching boom. And many people will look at the SVB situation and blame their poor risk management of the securities portfolio. And that’s at least partially true. They took large mark-to-market losses on their bonds and they were riding the razor’s edge on capital requirements all last year. But the earthquake in the SVB story is this:

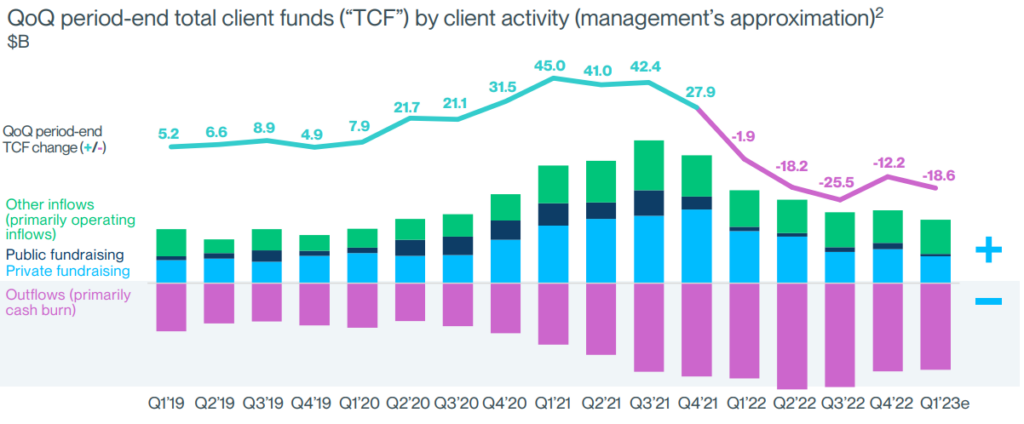

This chart from SVB’s recent quarterly update is a little confusing, but it shows the underwater earthquake. And the earthquake was the irrational boom that occurred in 2020/21. As irrational exuberance took hold of the markets we saw a huge surge in the valuations of private equity firms. Cash poured into these companies and their venture backers. The deposit liabilities of SVB were recorded accordingly and boomed over $40B. This was the nature of SVB’s clientele – during a huge irrational boom they would experience an explosion in deposits. And during a bust the deposits would implode as the burn rates surge. Which is exactly what this charts shows. And as the deposits poured out SVB found itself in a liquidity crunch where they were technically insolvent and for the sake of risk management they needed to shore up the balance sheet. In their attempt to do so they liquidated unrealized capital losses on their bonds. But the losses on the bonds weren’t the earthquake. They were the wave hitting shore as a result of the earthquake.

The fundamental cause of this collapse was the incredible boom and bust of SVB’s clients who eventually forced the firm to reduce risk to control deposit outflows. That’s crucial to understand in the scope of this because SVB wasn’t merely a bank that mismanaged their balance sheet. They just had too much exposure to the boom and the subsequent bust that occurred in a particularly volatile part of the real economy.

The question now is how much more widespread will this all get? It’s impossible to know. The good news is private equity is a relatively small market compared to markets like public equity, bonds and real estate. So SVB is a rather unusual circumstance in that its clientele were unique. But on the other hand we know that this boom was not isolated to private equity. The public equity boom was huge, the real estate boom was unprecedented and we now know that the bond bust, which resulted from the Fed’s aggressive rate hikes, is causing collateral damage. And the extent of the contagion here is largely contingent on how much those other busts bleed into the real economy.

Source: SVB Q1’23 Mid-Quarter Update