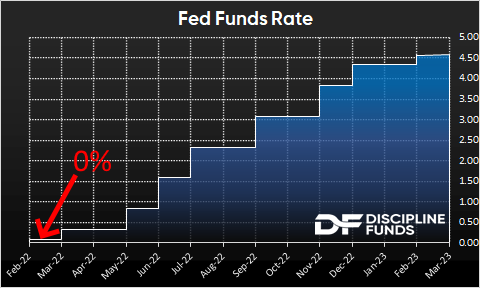

We’re continuing with the theme of time in this chart of the week. The last few years felt like a lifetime for many reasons. And the main driver of that feeling has been the Fed’s aggressive rate hikes. But the crazy thing about this rate hike cycle is that it has only just begun. “Just begun” you might ask? Yes. At this time last year the Fed was sitting on…ZERO. That’s right. At this time last year the Fed Funds Rate was 0%. And they only modestly increased rates month by month before eventually moving to more aggressive 50 bps hikes.

As late as last Summer the Fed was only at 2%. TWO PERCENT. So what’s happened since then is like a tidal wave in credit markets. The situation we find ourselves in now is like an underwater earthquake. We know there’s a tsunami out there somewhere, but it will take a very long time to reach our shores (or other shores).

Milton Friedman was famous for saying that monetary policy works with long and variable lags. The current environment is a great example. It feels like the Fed has been raising rates for a long time, but in reality the impact of what they’ve done is only just getting started because rates were not high enough to have a material impact on the broader economy until late last year. To be clear, I am not saying that they will tighten further. In fact, I think we’re close to the end of tightening. But what they’ve done in the last year is only just beginning to filter through the economy.

In our recent outlook update I wrote that inflation risk is starting to evolve into credit risk. And this morning the financial headlines are all about bank failures as Silvergate and Silicon Valley Bank disclosed material weakness. The S&P Regional Bank Index is off 10% this week and 17% in the last month. Are these the first signs of real material credit problems? Or is this an isolated group of incidents? We don’t know yet, but the current set-up has all the ingredients for a much more material credit event as rates will remain high, house prices will continue to fall, commercial real estate remains fragile and corporate credit runs into inevitable rollovers. Stay patient, my friends.