Friedrich Nietzsche’s doctrine of eternal recurrence is the idea that time repeats itself in an eternal loop.1 It’s interesting in the context of economic growth as we tend to think of economic growth across “cycles” or repeating ups and downs. But in reality the economy doesn’t look so much like a “cycle”. It looks more like a line from the bottom left to the top right with occasional shocks that create the illusion of a regular cycle. And while the process of economic growth might not be a clean cycle like a sine wave it is a series of repeated asymmetric booms and busts built on the back of human reaction and overreaction. Luckily for us, the booms tend to be the ones that are more often asymmetrically skewed.

Navigating those booms and busts often feels like predicting the reactions and overreactions of someone who is mentally unstable. And difficult as that may be it is a necessary part of life and any good approach to public policy and investment. But while this is an inherently imprecise endeavor it’s one that all of us must engage in in order to navigate the world’s future probabilistic outcomes. So, where are we now and where might we be going?

We believe the last 13 or so years are best viewed as one boom period. The COVID “recession” was not truly a recession in the sense that it was not a natural bust that resulted from a boom. It was a self imposed bust that would not have occurred had we not imposed it. The reaction (and overreaction) to the COVID downturn is best viewed as the summation of the Great Financial Crisis boom. In other words, it was the inevitable overreaction and blow off top from the 10+ year bull market that was already in motion. What we are experiencing now is the digestion of that blow off. In the long run this will matter little (our economy will continue to move from bottom left to top right), but in the scope of the next few years it will feel like the only thing that matters as we navigate the short-term shock.

The COVID blow off top was an eternal recurrence as consumers and businesses chased prices ever higher. The process of correcting those prices is the bust portion of the eternal recurrence. In econonerd language we are trying to find our equilibrium point and it’s taking longer than many people would have liked. But one of the great lessons I’ve learned over the course of my career studying financial markets and economics is that these things almost always take longer than we expect. We tend to focus on economic and market growth across days, months or years. But the reality is that the material changes do not occur over days or months. They occur over many years. That is the natural state of things. It takes time to develop businesses, build homes and do all the things that make life worth living. And we are inherently impatient watching these things develop as we are so acutely aware of how little time we have here. As a result we often fail to appreciate the process of development as well as the necessary struggles along the way that induce that development.

The process of booms and busts, as it is translated from the economy to the financial markets, is best understood thru the lens of unemployment and the way that firms use employees as leverage within their balance sheets. During the booms firms will soak up excess labor. They will essentially leverage themselves on employees as they try to fuel expected growth. As consumption booms across time firms will react and overreact oftentimes hiring more workers than they can sustain. This process will ebb and flow across time and as consumption slows firms will reduce their leveraged exposure to employment.2

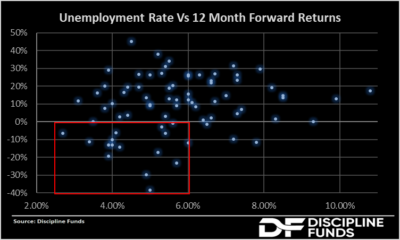

While it’s true that the stock market is not the economy the stock market reflects this ebb and flow and reacts to it accordingly. In fact, as you’ll notice in the chart at left the stock market rarely, if ever, falls meaningfully when unemployment is high. This is counterintuitive to many as a high unemployment rate is generally thought of as being bad. But from the perspective of firms it’s often indicative of a superior operating position as they’re now underleveraged to their largest expense and better equipped to manage future increases in consumption.

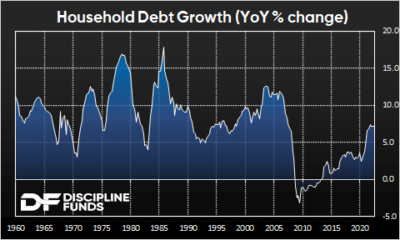

This is part of what makes the current environment unusually risky. Unemployment is low and therefore firms are highly leveraged. Meanwhile, consumers have been binging on 10+ years of organic growth which was thrown into an upside disequilibrium by tens of trillions of dollars in government spending to fend off the pandemic. But as that pandemic aid subsides consumers find themselves running in place now forced to borrow more to maintain the same living standards.

This is another counterintuitive aspect of this part of the economic boom and bust. As the Federal Reserve has raised rates economic growth in certain sectors (especially housing) has slowed materially. But consumer borrowing has remained robust and has actually increased in many ways. This might seem odd, but it actually makes sense as consumers are borrowing more to offset lost disposable income from government spending, the housing slowdown and the large 2022 downturn in assets prices that coincided with interest rate increases. All of this puts us in a highly tenuous situation where assets prices have become increasingly unstable and credit consumption has surged. At the same time the Federal Reserve is maintaining a restrictive policy stance where, if they’re overreacting to the risk of this being a sustained high inflation, it will increase the asymmetric risk of a downside reversal in inflation.

Our view is that inflation risk is now slowly evolving into credit risk. In other words, the persistent price boom of the 2020/21 period is slowly morphing into a more persistent price bust. And if the Fed is wrong about the persistence of inflation then they are at risk of exacerbating that price bust. The Federal Reserve is the master of eternal recurrence. In fact, one might argue that eternal recurrence is the modus operandi of the Federal Reserve as they consistently induce the conditions for booms and then react by creating the conditions for a bust. How bad will the current bust be? No one can know for certain. But one thing we know is that high equity valuations and low unemployment are consistent with periods where firms are overleveraged both in pricing and labor. And that tends to be an environment where credit risk is high and equity m arket risk adjusted returns are unfavorable.

Given all this you can likely begin to predict how we’re currently positioned. We remain underweight equities in our core benchmark, The Discipline Index and have zero corporate bond exposure. In fact, our bond exposure is not only 100% government bonds, but is heavily skewed to the short-end as we view T-Bills and T-Notes at 5% yields as a gift that will not last and will be viewed, in years ahead, as an unusually good risk adjusted return opportunity.

As our “All Duration” strategy alludes, we are inherently obsessed with time in our portfolio management processes. Our goal is to help people navigate life across many time horizons as opposed to viewing the markets as a singular “long run” or “short run”. But this is an unusual period and one where long run investors are exposed to short-term volatility and poor risk adjusted returns that can often turn them into short-term investors against their best interests. Patience remains your most valuable asset.

1 – Apologies to Rustin Cohle who preferred to say that “time is a flat circle”, however, I couldn’t wrap my head around that concept.

2 – This is also a central premise behind our countercyclical indexing strategy. It makes little sense to buy a market cap weighted stock/bond fund because then you’re just always riding the leveraged boom/bust waves of the stock market.