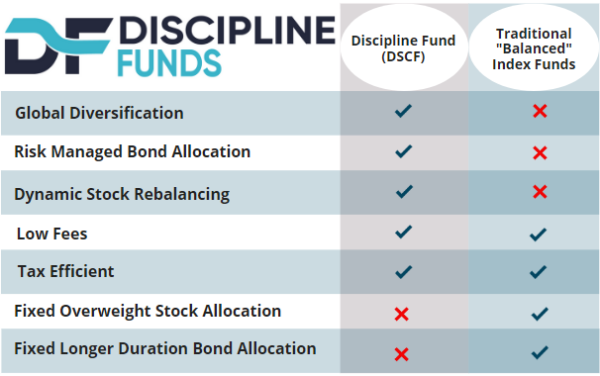

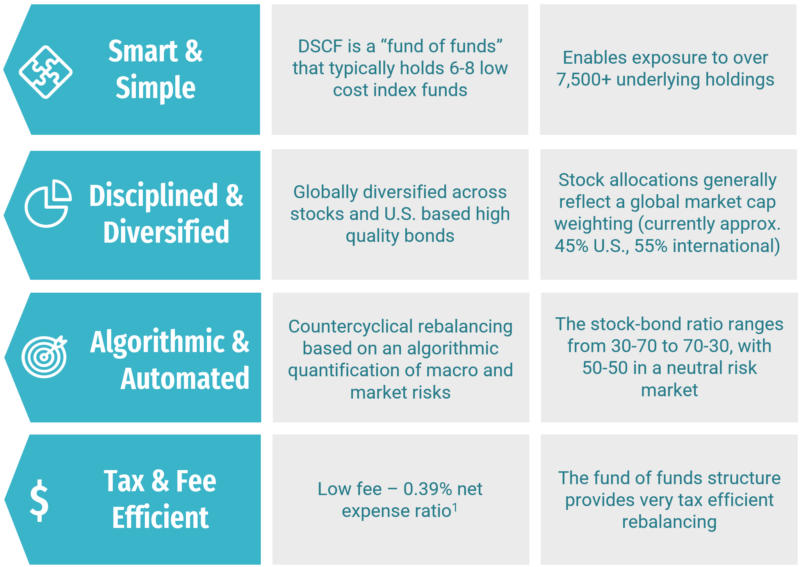

The Discipline Fund ETF (ticker: DSCF) is a fully systematic, low fee, tax efficient, globally diversified fund of funds designed to help you behave better and stay the course. It achieves this by implementing a common sense rebalancing strategy similar to the way John Bogle managed his own portfolio. When valuations were unusually high Bogle would rebalance to 30/70 stocks/bonds and when valuations declined he would do the opposite. This helped him stay fully invested and also kept him more comfortable with his risk exposure.

The Discipline Fund implements a similar strategy using a systematic approach to rebalancing based on macroeconomic and market risks. This helps investors maintain a fully invested and more balanced stock/bond allocation by systematically reducing risk when valuations are unusually high and increasing risk when valuations normalize.

Click here to learn more about how the Discipline Fund works.

1 – This fee is substantially lower than the average broad world allocation fund which has a fee of 0.81% according to Morningstar.

Further, according to Research Affiliates, the estimated tax liability of a mutual fund when compared to an ETF is 0.8% when adjusted for dividends.

The Fund’s investment adviser has contractually agreed to waive all or a portion of its management fee for the Fund until at least one year from the date of the Fund’s commencement of operations to the extent necessary to offset all Acquired Fund Fees and Expenses. The Fund’s gross expense ratio is 0.43%.