Below are some frequently asked questions about The Discipline Fund ETF. To contact us directly please use the “contact” page above.

The Discipline Fund ETF is a low fee, systematic, globally diversified fund in a single tax efficient ETF wrapper that rebalances in the same way John Bogle managed his own portfolio by rebalancing in a behaviorally robust strategy. Bogle has explained how, in 1999, for example, he rebalanced to 30/70 stocks/bonds to maintain a more behaviorally tolerable asset allocation. When valuations normalized he rebalanced to 70/30.

We call it the "Discipline Fund ETF" because it is designed to help instill discipline in shareholders by rebalancing in a way that helps maintain confidence in a portfolio over the course of the potentially wild swings in financial markets.

As Ben Graham liked to say, the investor's worst enemy is most often him or herself. With that in mind, we created the Discipline Fund ETF to help instill discipline in our shareholders by creating a sophisticated product in a simple wrapper that offers:

- Algorithmic/systematic portfolio management.

- Countercyclical rebalancing.

- Global stock allocation.

- Broad domestic bond allocation.

- Low fees.

- Tax efficiency.

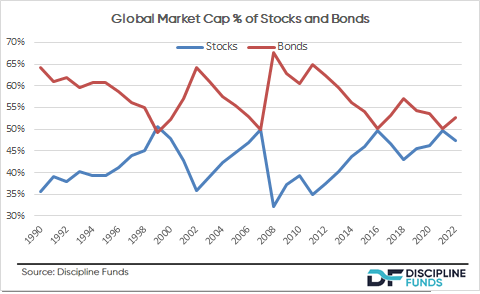

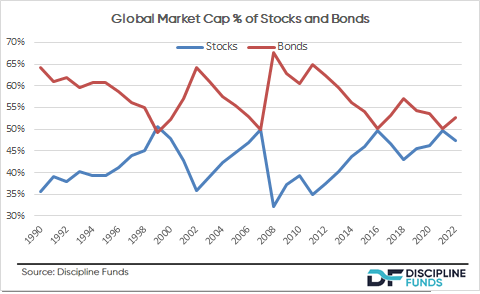

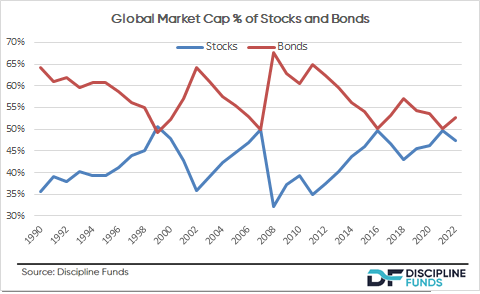

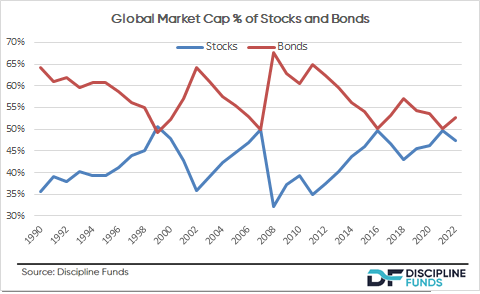

- The market capitalization of stocks and bonds is highly dynamic and changes every day and every year. But today's multi-asset index funds don't track the actual market cap. Instead, they actively rebalance away from market cap weighting back to a fixed weighting like 60/40 stocks/bonds. This means that when the underlying market cap booms you're often rebalancing back to a riskier 60% weighting. This creates a risk imbalance in the portfolio that can be reduced with a countercyclical rebalancing approach.

- Most modern multi-asset index funds distribute capital gains when they rebalance thereby resulting in an inefficient tax structure.

- Bond allocations contain substantial credit risk through high yield bond exposure at times in the market cycle when credit risk is highest. They therefore do not sufficiently hedge the stock market component.

Today's multi-asset index funds (like a 60/40 stock/bond index fund) rebalance back to fixed stock/bond weighting instead of tracking the actual passive market cap weighting. This means they're actively rebalancing back to a high fixed percentage of stocks despite the fact that the underlying market cap has changed. This  assumes the fixed weight exposes you to the same level of risk when, in fact, that 60% weight often becomes riskier when stocks boom. This means the index is rebalancing back to a riskier 60% weight at the most inopportune times in the market cycle. This doesn't make sense!

The Discipline Fund ETF doesn't apply a static weighting because we know that risk is dynamic. Instead, we apply a systematic, data-driven algorithm designed to calculate the current risk level of global stock and bond markets based on market capitalization, market valuations and macroeconomic data. The algorithm is constructed using a countercyclical rebalancing methodology which seeks to adjust the portfolio’s holdings to account for current market and macroeconomic risks.

In the event of a large stock market or macroeconomic decline (that is, the U.S. economy is performing poorly), the countercyclical rebalancing methodology may result in a higher stock allocation. For example, if the stock market declined and a typical passively-managed 50-50 portfolio became a 40-60 stock-bond allocation, it would again be reallocated back to its original 50-50 stock/bond allocation. Whereas, the Discipline Fund ETF may be reallocated to a 60-40 stock-bond allocation to account for the potential that equities often become less risky after they have declined in value.

When the stock market booms and the economy is doing well, the Discipline Fund ETF is likely to become less aggressively positioned with the understanding that higher valuations generally correlate with lower future returns. Likewise, when the economy and stock market become depressed, the Discipline Fund ETF is likely to become more aggressively positioned with the understanding that lower valuations generally correlate with higher future expected returns. When stock market risk is considered average, the Fund will generally allocate approximately 50 percent of its assets to the stock sleeve and 50 percent of its assets to the bond sleeve. The allocations may shift but will not exceed a 70-30 stock-bond allocation or a 30-70 stock-bond allocation.

In the Fund’s stock sleeve, the allocation between broad-based U.S. stock ETFs and broad-based foreign focused stock ETFs will generally align with the then-current market cap weighting of the U.S. and foreign stock markets.¹

The Fund’s bond sleeve also utilizes an algorithm designed to identify periods of above- or below-average economic and market risk with regard to the bond market. The Fund will adjust its bond positions depending on economic indicators. For example, during a late cycle economic boom the fund might alter its bond balance to higher quality bonds to reduce the level of credit risk in bonds whereas a traditional. total bond market fund will expose you to significant corporate bond and credit risk.

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

assumes the fixed weight exposes you to the same level of risk when, in fact, that 60% weight often becomes riskier when stocks boom. This means the index is rebalancing back to a riskier 60% weight at the most inopportune times in the market cycle. This doesn't make sense!

The Discipline Fund ETF doesn't apply a static weighting because we know that risk is dynamic. Instead, we apply a systematic, data-driven algorithm designed to calculate the current risk level of global stock and bond markets based on market capitalization, market valuations and macroeconomic data. The algorithm is constructed using a countercyclical rebalancing methodology which seeks to adjust the portfolio’s holdings to account for current market and macroeconomic risks.

In the event of a large stock market or macroeconomic decline (that is, the U.S. economy is performing poorly), the countercyclical rebalancing methodology may result in a higher stock allocation. For example, if the stock market declined and a typical passively-managed 50-50 portfolio became a 40-60 stock-bond allocation, it would again be reallocated back to its original 50-50 stock/bond allocation. Whereas, the Discipline Fund ETF may be reallocated to a 60-40 stock-bond allocation to account for the potential that equities often become less risky after they have declined in value.

When the stock market booms and the economy is doing well, the Discipline Fund ETF is likely to become less aggressively positioned with the understanding that higher valuations generally correlate with lower future returns. Likewise, when the economy and stock market become depressed, the Discipline Fund ETF is likely to become more aggressively positioned with the understanding that lower valuations generally correlate with higher future expected returns. When stock market risk is considered average, the Fund will generally allocate approximately 50 percent of its assets to the stock sleeve and 50 percent of its assets to the bond sleeve. The allocations may shift but will not exceed a 70-30 stock-bond allocation or a 30-70 stock-bond allocation.

In the Fund’s stock sleeve, the allocation between broad-based U.S. stock ETFs and broad-based foreign focused stock ETFs will generally align with the then-current market cap weighting of the U.S. and foreign stock markets.¹

The Fund’s bond sleeve also utilizes an algorithm designed to identify periods of above- or below-average economic and market risk with regard to the bond market. The Fund will adjust its bond positions depending on economic indicators. For example, during a late cycle economic boom the fund might alter its bond balance to higher quality bonds to reduce the level of credit risk in bonds whereas a traditional. total bond market fund will expose you to significant corporate bond and credit risk.

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

assumes the fixed weight exposes you to the same level of risk when, in fact, that 60% weight often becomes riskier when stocks boom. This means the index is rebalancing back to a riskier 60% weight at the most inopportune times in the market cycle. This doesn't make sense!

The Discipline Fund ETF doesn't apply a static weighting because we know that risk is dynamic. Instead, we apply a systematic, data-driven algorithm designed to calculate the current risk level of global stock and bond markets based on market capitalization, market valuations and macroeconomic data. The algorithm is constructed using a countercyclical rebalancing methodology which seeks to adjust the portfolio’s holdings to account for current market and macroeconomic risks.

In the event of a large stock market or macroeconomic decline (that is, the U.S. economy is performing poorly), the countercyclical rebalancing methodology may result in a higher stock allocation. For example, if the stock market declined and a typical passively-managed 50-50 portfolio became a 40-60 stock-bond allocation, it would again be reallocated back to its original 50-50 stock/bond allocation. Whereas, the Discipline Fund ETF may be reallocated to a 60-40 stock-bond allocation to account for the potential that equities often become less risky after they have declined in value.

When the stock market booms and the economy is doing well, the Discipline Fund ETF is likely to become less aggressively positioned with the understanding that higher valuations generally correlate with lower future returns. Likewise, when the economy and stock market become depressed, the Discipline Fund ETF is likely to become more aggressively positioned with the understanding that lower valuations generally correlate with higher future expected returns. When stock market risk is considered average, the Fund will generally allocate approximately 50 percent of its assets to the stock sleeve and 50 percent of its assets to the bond sleeve. The allocations may shift but will not exceed a 70-30 stock-bond allocation or a 30-70 stock-bond allocation.

In the Fund’s stock sleeve, the allocation between broad-based U.S. stock ETFs and broad-based foreign focused stock ETFs will generally align with the then-current market cap weighting of the U.S. and foreign stock markets.¹

The Fund’s bond sleeve also utilizes an algorithm designed to identify periods of above- or below-average economic and market risk with regard to the bond market. The Fund will adjust its bond positions depending on economic indicators. For example, during a late cycle economic boom the fund might alter its bond balance to higher quality bonds to reduce the level of credit risk in bonds whereas a traditional. total bond market fund will expose you to significant corporate bond and credit risk.

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

assumes the fixed weight exposes you to the same level of risk when, in fact, that 60% weight often becomes riskier when stocks boom. This means the index is rebalancing back to a riskier 60% weight at the most inopportune times in the market cycle. This doesn't make sense!

The Discipline Fund ETF doesn't apply a static weighting because we know that risk is dynamic. Instead, we apply a systematic, data-driven algorithm designed to calculate the current risk level of global stock and bond markets based on market capitalization, market valuations and macroeconomic data. The algorithm is constructed using a countercyclical rebalancing methodology which seeks to adjust the portfolio’s holdings to account for current market and macroeconomic risks.

In the event of a large stock market or macroeconomic decline (that is, the U.S. economy is performing poorly), the countercyclical rebalancing methodology may result in a higher stock allocation. For example, if the stock market declined and a typical passively-managed 50-50 portfolio became a 40-60 stock-bond allocation, it would again be reallocated back to its original 50-50 stock/bond allocation. Whereas, the Discipline Fund ETF may be reallocated to a 60-40 stock-bond allocation to account for the potential that equities often become less risky after they have declined in value.

When the stock market booms and the economy is doing well, the Discipline Fund ETF is likely to become less aggressively positioned with the understanding that higher valuations generally correlate with lower future returns. Likewise, when the economy and stock market become depressed, the Discipline Fund ETF is likely to become more aggressively positioned with the understanding that lower valuations generally correlate with higher future expected returns. When stock market risk is considered average, the Fund will generally allocate approximately 50 percent of its assets to the stock sleeve and 50 percent of its assets to the bond sleeve. The allocations may shift but will not exceed a 70-30 stock-bond allocation or a 30-70 stock-bond allocation.

In the Fund’s stock sleeve, the allocation between broad-based U.S. stock ETFs and broad-based foreign focused stock ETFs will generally align with the then-current market cap weighting of the U.S. and foreign stock markets.¹

The Fund’s bond sleeve also utilizes an algorithm designed to identify periods of above- or below-average economic and market risk with regard to the bond market. The Fund will adjust its bond positions depending on economic indicators. For example, during a late cycle economic boom the fund might alter its bond balance to higher quality bonds to reduce the level of credit risk in bonds whereas a traditional. total bond market fund will expose you to significant corporate bond and credit risk.

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

Traditional index funds have fixed benchmarks of something like 60/40. But have you ever wondered where this arbitrary fixed weighting came from and why? We know the risks in the underlying assets change over time. We also know the actual market cap weights of the assets changes over time. Therefore a true "passive" index  fund would have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

In essence, Countercyclical Rebalancing is a strategy that rebalances its investments to reduce the pro-cyclical nature of the stock/bond weighting and help establish better balance across time. We achieve this by adjusting a portfolio’s holdings to account for the actual changes in market cap and macroeconomic conditions. In contrast, a standard passively-managed fund will generally hold stocks and bonds in the same percentage allocation (e.g., a standard 60/40 portfolio) regardless of market cap changes, market valuations and macroeconomic conditions. The problem with a fixed approach like this is that it assumes that the 60% stock allocation is always exposed to the same amount of risk, when, in reality, we know that can vary over time. For example, a portfolio with 60% stocks in 2008 faced very different risks than a portfolio with 60% stocks in 2010 and while this approach may be perfectly fine for many investors it may also pose significant behavioral risks to investors who think they're buying a "balanced" fund that actually has very unbalanced exposure to stock and bond risk.

The Discipline Fund ETF rebalances more dynamically than a static fund does which allows the fund to rebalance toward stocks when they appear more attractive and away from stocks when they appear less attractive. This helps better control for behavioral biases by aligning our asset allocation to the potential behavioral risks that the ups and downs of the market expose us to.

fund would have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

In essence, Countercyclical Rebalancing is a strategy that rebalances its investments to reduce the pro-cyclical nature of the stock/bond weighting and help establish better balance across time. We achieve this by adjusting a portfolio’s holdings to account for the actual changes in market cap and macroeconomic conditions. In contrast, a standard passively-managed fund will generally hold stocks and bonds in the same percentage allocation (e.g., a standard 60/40 portfolio) regardless of market cap changes, market valuations and macroeconomic conditions. The problem with a fixed approach like this is that it assumes that the 60% stock allocation is always exposed to the same amount of risk, when, in reality, we know that can vary over time. For example, a portfolio with 60% stocks in 2008 faced very different risks than a portfolio with 60% stocks in 2010 and while this approach may be perfectly fine for many investors it may also pose significant behavioral risks to investors who think they're buying a "balanced" fund that actually has very unbalanced exposure to stock and bond risk.

The Discipline Fund ETF rebalances more dynamically than a static fund does which allows the fund to rebalance toward stocks when they appear more attractive and away from stocks when they appear less attractive. This helps better control for behavioral biases by aligning our asset allocation to the potential behavioral risks that the ups and downs of the market expose us to.

fund would have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

In essence, Countercyclical Rebalancing is a strategy that rebalances its investments to reduce the pro-cyclical nature of the stock/bond weighting and help establish better balance across time. We achieve this by adjusting a portfolio’s holdings to account for the actual changes in market cap and macroeconomic conditions. In contrast, a standard passively-managed fund will generally hold stocks and bonds in the same percentage allocation (e.g., a standard 60/40 portfolio) regardless of market cap changes, market valuations and macroeconomic conditions. The problem with a fixed approach like this is that it assumes that the 60% stock allocation is always exposed to the same amount of risk, when, in reality, we know that can vary over time. For example, a portfolio with 60% stocks in 2008 faced very different risks than a portfolio with 60% stocks in 2010 and while this approach may be perfectly fine for many investors it may also pose significant behavioral risks to investors who think they're buying a "balanced" fund that actually has very unbalanced exposure to stock and bond risk.

The Discipline Fund ETF rebalances more dynamically than a static fund does which allows the fund to rebalance toward stocks when they appear more attractive and away from stocks when they appear less attractive. This helps better control for behavioral biases by aligning our asset allocation to the potential behavioral risks that the ups and downs of the market expose us to.

fund would have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

In essence, Countercyclical Rebalancing is a strategy that rebalances its investments to reduce the pro-cyclical nature of the stock/bond weighting and help establish better balance across time. We achieve this by adjusting a portfolio’s holdings to account for the actual changes in market cap and macroeconomic conditions. In contrast, a standard passively-managed fund will generally hold stocks and bonds in the same percentage allocation (e.g., a standard 60/40 portfolio) regardless of market cap changes, market valuations and macroeconomic conditions. The problem with a fixed approach like this is that it assumes that the 60% stock allocation is always exposed to the same amount of risk, when, in reality, we know that can vary over time. For example, a portfolio with 60% stocks in 2008 faced very different risks than a portfolio with 60% stocks in 2010 and while this approach may be perfectly fine for many investors it may also pose significant behavioral risks to investors who think they're buying a "balanced" fund that actually has very unbalanced exposure to stock and bond risk.

The Discipline Fund ETF rebalances more dynamically than a static fund does which allows the fund to rebalance toward stocks when they appear more attractive and away from stocks when they appear less attractive. This helps better control for behavioral biases by aligning our asset allocation to the potential behavioral risks that the ups and downs of the market expose us to.

A traditional core and satellite approach takes a very diverse core holding and then builds satellites around it to meet other needs. The problem with this approach is that the satellites need to rebalance dynamically around the core and this incurs capital gains and risk profile skew along the way. DSCF fixes this issue because it rebalances internally and countercyclically.

For example, using DSCF as the core position, we can use a bond fund for a short-term liquidity satellite and an aggressive stock position as our other satellite. When your aggressive piece in a standard core and satellite grows you will need to rebalance to maintain your profile which will incur capital gains. Using the Discipline Fund ETF allows you to reduce this taxable event because as the aggressive piece grows DSCF's countercyclical rebalancing approach will offset some of the growth in the aggressive piece. This means less risk profile skew, less rebalancing and less taxes from capital gains.

By inverting the core and the satellites within a single tax efficient structure we create the same diverse and dynamic strategy, but with a more efficient overall approach.

A common question about the Discipline Fund ETF is "why can't I just buy the individual funds that the Discipline Fund ETF already owns?" You certainly could! But this would be a less efficient allocation for several reasons:

1) Taxes.

The ETF structure using other funds within a single ETF allows the Discipline Fund ETF to rebalance more efficiently than a portfolio of individual ETFs. When the Discipline Fund ETF rebalances it can reduce or avoid capital gains due to the ETFs use of in-kind redemptions and creations whereas the investor who rebalances their individual holdings has to incur capital gains every time they rebalance the same portfolio of individual funds.

2) Algorithmic Automation & Simplicity.

The Discipline Fund ETF is an extremely diverse fund that could serve as an entire portfolio. This simplicity creates greater efficiency because it reduces the need to actively rebalance and maintain the portfolio. Further, the underlying algorithm is fully automated and would require manual maintenance to replicate.

The Discipline Fund ETF could be appropriate for you for many reasons:

1) Extremely broad diversification.

The Discipline Fund ETF is highly diverse with exposure to over 7,500 underlying stocks and bonds.

2) Low fees and tax efficiency.

With a net expense ratio of 0.39% combined with the tax efficiency of the ETF wrapper, the Discipline Fund ETF is a very tax and fee-efficient way to get broad, dynamic diversification to the financial markets. 1

We are big fans of low-fee, tax-efficient ETFs and index funds. However, a drawback of most index funds and multi-asset mutual funds is that they distribute capital gains when they rebalance, something the Discipline Fund ETF is able to avoid.

3) Algorithmic countercyclical rebalancing.

While most index funds rebalance in a procyclical and/or discretionary manner, the Discipline Fund ETF is a systematic fund that rebalances to account for how risky the stock market is across time.

It's long been known that there is a "rebalancing bonus" when owning stocks and bonds, but most funds don't rebalance to fully account for stock market risk. This leaves them over exposed to stocks at the worst times. The Discipline Fund ETF takes advantage of the rebalancing bonus while also trying to optimize for behavioral alpha to help investors stay fully invested without the urges to make mistakes at the most inopportune times. 2

In a 2018 interview investment legend John Bogle mentioned that he would sometimes rebalance his portfolio in a countercyclical manner to control for his own behavioral risks. We are proponents of the entire John Bogle approach to investing and the Discipline Fund ETF is one of the only ways investors can now take advantage of the actual methodology that Bogle implemented in his own portfolio.

4) Behavioral alpha.

Investors spend most of their time chasing yesterday's best strategies rather than finding an appropriate strategy that they can stick with. In doing so, they generate lower returns by buying yesterday's best performing strategies and selling yesterday's worst performing strategies. We believe investors should work with financial planners to find the appropriate asset allocation combined with a behaviorally sustainable strategy so they can focus on what matters in life.

By rebalancing away from equities when stocks are perceived to be riskier, we are increasing potential behavioral alpha by reducing the risk of making psychological mistakes.

This reduces investors' urge to move all in or all out of certain asset classes. You can worry less about whether stocks are overvalued or if bonds might expose you to credit risk. By owning these assets in a countercyclical asset rebalancing portfolio, you can remain in the market without having to worry about whether you're in or out of one market by too much.

5) Simplicity.

We want to make it easier and simpler to manage your finances. The financial industry has mastered the art of selling complexity for a high fee with portfolios that consistently contain 10, 20 or even hundreds of positions. The Discipline Fund ETF is a sophisticated product in a simple wrapper that can help streamline financial planning and financial management by simplifying your portfolio.

6) Expert Bond Management.

Many investors are intimidated by the bond market and scared of low interest rates and/or high inflation. The Discipline Fund ETF is managed by Cullen Roche, a well known inflation and interest rate expert. Cullen constructed the Discipline Fund ETF to have a more dynamic bond portfolio when compared to simple Bond Aggregate funds, with the goal of targeting increased income and superior risk management over time by reducing credit risk in the bond allocation when the economy is in a late cycle credit risky period.

1The Fund's gross expense ratio is 0.43% (including underlying fund costs), however, the Fund’s investment adviser has contractually agreed to waive all or a portion of its management fee for the Fund until at least one year from the date of the Fund’s commencement of operations to the extent necessary to offset all Acquired Fund Fees and Expenses. This waiver agreement will continue in effect for the life of the fund or until terminated sooner only by agreement of the investment adviser and the Fund's Board of Trustees.

2Alpha: A measure of the difference between a portfolio's actual returns and its expected performance, given its level of risk as measured by beta.

The Discipline Fund ETF is listed on the CBOE and can be purchased through any brokerage account using the ticker DSCF.

Please remember to always use limit orders when placing trades in newly issued or thinly traded ETFs. If you need help implementing a trade please don't hesitate to reach out to us. If you're a large retail or institutional investor we can help put you in touch directly with market makers and trade desks to help implement block trades seamlessly.

ETF and mutual fund fees can be confusing with references to "waivers," "gross expense ratios" and "net expense ratios." We are proponents of transparency and simplicity and our fees reflect that. The Discipline Fund ETF costs just 0.39% per year. We pay for the underlying fund costs so 0.39% is the all-in cost to the shareholder. This fee is substantially lower than the average broad world allocation fund which has a fee of 0.81% according to Morningstar.1

Existing or new clients of our Separately Managed Account service get a full fee waiver for any balance held in the Discipline Fund ETF. In most cases this results in a net fee reduction relative to our existing management fee since we pay the cost of the underlying funds in the Discipline Fund ETF.

1The Fund's gross expense ratio is 0.43%, however, the Fund’s investment adviser has contractually agreed to waive all or a portion of its management fee for the Fund until at least one year from the date of the Fund’s commencement of operations to the extent necessary to offset all Acquired Fund Fees and Expenses.

The investment management business has mastered the art of selling high fees in exchange for the hope of high returns. But unfortunately, high fees in no way guarantee high performance. And ultimately, this financial model can lead to a portfolio manager taking additional risk to try to “beat the market.” This creates behavioral risk for the shareholders since they may be subject to big swings in their savings due to this increased risk.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

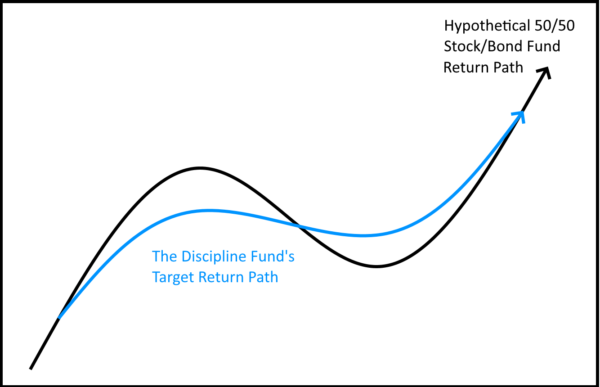

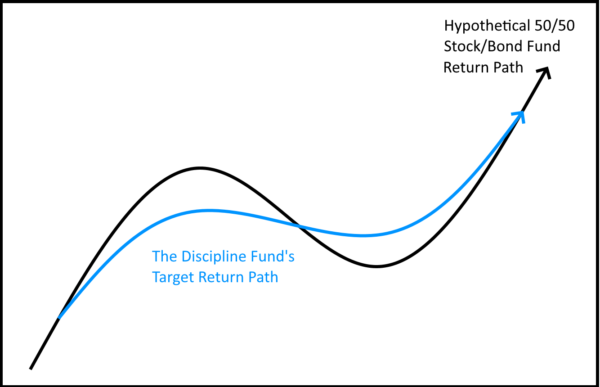

The Discipline Fund ETF is not a "beat the market" fund. It is structured as a diversified core holding and will always maintain some relative stock/bond weighting. Therefore, when the stock market booms it is likely to underperform the broad stock market and when the stock market undergoes a prolonged bear market it is likely to outperform the broad stock market (despite falling in value). The goal of the fund is to create smoother and more predictable relative returns across time to help investors remain more comfortable with their portfolio and remain fully invested through all the behavioral risks we encounter across time.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

The Discipline Fund ETF is not a "beat the market" fund. It is structured as a diversified core holding and will always maintain some relative stock/bond weighting. Therefore, when the stock market booms it is likely to underperform the broad stock market and when the stock market undergoes a prolonged bear market it is likely to outperform the broad stock market (despite falling in value). The goal of the fund is to create smoother and more predictable relative returns across time to help investors remain more comfortable with their portfolio and remain fully invested through all the behavioral risks we encounter across time.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

The Discipline Fund ETF is not a "beat the market" fund. It is structured as a diversified core holding and will always maintain some relative stock/bond weighting. Therefore, when the stock market booms it is likely to underperform the broad stock market and when the stock market undergoes a prolonged bear market it is likely to outperform the broad stock market (despite falling in value). The goal of the fund is to create smoother and more predictable relative returns across time to help investors remain more comfortable with their portfolio and remain fully invested through all the behavioral risks we encounter across time.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

The Discipline Fund ETF is not a "beat the market" fund. It is structured as a diversified core holding and will always maintain some relative stock/bond weighting. Therefore, when the stock market booms it is likely to underperform the broad stock market and when the stock market undergoes a prolonged bear market it is likely to outperform the broad stock market (despite falling in value). The goal of the fund is to create smoother and more predictable relative returns across time to help investors remain more comfortable with their portfolio and remain fully invested through all the behavioral risks we encounter across time.

John Bogle used to say "stay the course.... resist the urge to move all in or all out of the market." We couldn't agree more. But we also know how difficult it is to actually implement that approach and then stick with it. Everyone knows the right things to do abstractly - "buy low, sell high." But investing is just like dieting - it's simple in theory, but difficult in practice because the emotional urges are so strong. So, we too often sell low and buy high. The Discipline Fund ETF tries to correct for these emotional biases.

- If you're a retiree or someone with an inherently conservative risk profile then the Discipline Fund ETF might help you become more comfortable with your portfolio due to its countercyclical rebalancing methodology.

- If you're someone who's frozen in cash because you're worried about stock and bond valuations, the Discipline Fund ETF might be a good solution to getting some exposure without going "all in" on one market.

- If you're someone who struggles with investment discipline, then the Discipline Fund ETF might be right for you.

- If you’re looking for an allocation in your portfolio that provides some stock market exposure, while trying to limit volatility, then the Discipline Fund ETF might be right for you.

- If you're someone who just wants to automate your investments in one simple, tax efficient and globally diversified portfolio that helps you sleep well at night, then the Discipline Fund ETF might be right for you.

- If you're someone who wants income and bond exposure, but feels overwhelmed by the complexity of the bond market and the potential risks in a low interest rate environment then the Discipline Fund ETF might be a good way to achieve some bond exposure from professional bond investors without going "all in" on bonds.

- If you're very tax sensitive, but also need an efficient rebalancing vehicle then the Discipline Fund ETF might be right for you.

Rebalancing is one of the most important and underrated tools in portfolio management because it helps us maintain a certain risk profile consistency, but also provides us with the potential for a "rebalancing bonus."¹²³ While the Discipline Fund ETF is not designed to "beat the market" or target "alpha" (excess return), we are specifically trying to target behavioral alpha (generating a return that is better than a counterfactual investment where you lose confidence and sell low or buy high). To us, this is the true "rebalancing bonus" - the behavioral control that it systematically instills in an investor over time.

Risk profile consistency is important because it is a behavioral control mechanism. Over long periods of time we can expect that your portfolio will experience "allocation drift" - that is, the stock component will outperform the bonds and grow into a larger part of your portfolio. This outperformance is good for your returns, but bad for your future risk levels as it increases exposure to stock market risk. If your portfolio exposes you to more or less risk than you are comfortable with then you risk making behavioral mistakes (selling into downturns, chasing returns, etc.). Therefore, rebalancing is an important element in achieving behavioral alpha (superior performance through disciplined investing) and good behavior is a crucial piece of any good financial plan.

We rebalance for a simple reason – the empirical and behavioral evidence shows that it is an essential and beneficial element in any portfolio. We have found this to be particularly true over the course of our research and professional management – rebalancing works because it is a behavioral tool that helps us maintain more suitable and sustainable portfolios as opposed to constantly wasting high fees chasing the ever-elusive, optimal portfolio.

The Fund relies on proprietary algorithms to help rebalance its investments. These algorithms are updated monthly, and depending on the algorithms’ outputs the Fund’s portfolio is reallocated accordingly. Since the algorithms are data dependent, there could be long periods of time where the fund is very passive and periods of time where the fund is more active.

¹ – Andre F. Perold and William F. Sharpe, “Dynamic Strategies for Asset Allocation” Financial Analysts Journal (January/February 1988):16-27.

² – Robert D. Arnott and Robert M. Lovell, “Rebalancing: Why? When? How Often?” The Journal of Investing 2, no. 1 (Spring 1993): 5.

³ – Bernstein, William. The Rebalancing Bonus: Theory and Practice.

The Discipline Fund ETF always defers towards "simple is better". With this in mind, we built a "Fund of Funds" that holds low fee and very diverse global stock ETFs as well as domestic bond ETFs. On average the Discipline Fund ETF will hold between 4-8 liquid and diversified ETFs roughly split between stock and bond ETFs. The ETFs that the fund will hold will be deeply liquid and well established funds from established investment firms. This means that the Discipline Fund ETF will always hold a globally diversified portfolio comprised of thousands of highly liquid global stocks and U.S.-based bonds. It will be one of the most diverse yet simple ETFs available.

We chose to be a Fund of Funds (i.e., an ETF that holds other ETFs) because it allows us to obtain a low fee and broader diversification than if we owned the underlying securities individually. This is also a highly efficient structure since the ETF wrapper provides us with an efficient tax vehicle that allows us to rebalance the underlying ETFs without having to distribute capital gains to our shareholders. This gives us broader diversification and the ability to rebalance without the same tax inefficiency that an investor would be exposed to by owning each of the underlying ETFs in a brokerage account.

We do not use leveraged ETFs, individual stocks/bonds, or alternative assets. These types of assets increase risks, costs and tax inefficiency. In keeping with our theme of simplicity, we use bond funds to provide us with safe income and principal protection and stock market exposure to provide us with growth and inflation protection. Both of these instruments have tested long-term track records of achieving these goals.

As we described above, the stock allocation is constructed to rebalance in a "countercyclical" manner. This is done by quantifying the relative risk of the stock and bond markets across time using a macroeconomic and financial algorithm. For instance, when the economy is booming and the stocks are in a bull market, the Discipline Fund ETF is likely to rebalance away from the stock market over time. Similarly, when the economy is performing poorly and the stock market is declining, the Discipline Fund ETF is likely to rebalance heavier into the stock market.

At a fund specific level, the stock allocation is comprised of 3-4 underlying market-cap weighted ETFs that give us exposure to the global stock market. For instance, if the equity market is seen as a neutral risk and the Discipline Fund ETF holds 50% stocks and 50% bonds at a given time, then the Discipline Fund ETF will hold an underlying stock allocation across 3-4 ETFs that closely reflects the global market cap of stocks (as of 2021, that is roughly 45% U.S. stocks and 55% foreign stocks, leading to an overall allocation within the Discipline Fund ETF of roughly 21% U.S. stocks and 24% foreign stocks).¹

The fund may tilt to certain research supported equity factors depending on certain market environments, but will always maintain an overall allocation that is closely aligned with the global market cap of stocks. For example, in a very high valuation environment like the Nasdaq Bubble the equity allocation of the global stock market was 50% US stocks and 50% foreign, however, the growth in US stocks was driven largely by the tech boom. As a result of this the Discipline Fund ETF might underweight exposure to US technology within the stock sleeve in order to reduce volatility in the stock component of the portfolio and maintain a more countercyclical asset exposure.

We hold a global allocation because of the significant academic research showing the benefits of it.² Further, we don't try to pick the best countries because we don't want excessive single country/political risk. Historically, the relative size of US vs foreign stocks has changed significantly and we don't know if the U.S. economy and U.S. corporations will continue to outperform foreign stocks. In fact, we specifically want to hedge against the potential outcome where the U.S. doesn't do as well against other economies. With that in mind we allocate globally knowing that this allocation gives us exposure to the best performing markets without having to guess which specific market that will be.

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

² - See "Global equity investing: The benefits of diversification and sizing your allocation" - Vanguard, 2021

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

² - See "Global equity investing: The benefits of diversification and sizing your allocation" - Vanguard, 2021

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

² - See "Global equity investing: The benefits of diversification and sizing your allocation" - Vanguard, 2021

¹ - We quantify "global market cap" using the full cap as quantified by the World Federation of Exchanges. Many publicly traded funds (such as Vanguard Total World) use free float or the "investable" universe of stocks. We believe this results in a larger US position than accurately reflects both economic size and actual outstanding market cap.

² - See "Global equity investing: The benefits of diversification and sizing your allocation" - Vanguard, 2021

The Discipline Fund ETF is really two strategies in one. The stock piece is rebalanced to account for potential stock market risk relative to the bond piece. But the bond allocation is also rebalanced across time to account for interest rate risk and credit market risk. We manage bond risk by maintaining exposure only to high quality investment grade U.S. bonds when credit risk is high. We manage bond risk within the bond component by quantifying the relative risk of bonds to other components of the bond market. This helps us try to maintain exposure to safe haven assets at times when they are most likely to provide us with principal protection relative to other lower quality instruments.

For example, if the Discipline Fund ETF algorithm perceives the macroeconomy to be riskier than average, then the Fund might rebalance to an underweight stock market position of 40% stocks and 60% bonds. Within the bond piece, the Fund might shift entirely to US Treasury bonds to reduce the credit risk in the portfolio. This boosts the credit quality of the bond piece and gives us better protection in the case of an economic or stock market downturn.

All bonds aren't created equal. We know that investment grade U.S. bonds and Treasury bonds are the safe haven assets when the stock market declines substantially. More importantly, we view bonds as a stabilizer in your portfolio relative to stocks. When the stock market falls substantially, a bond hedge is an important behavioral hedge that helps investor mentality. However, certain debt instruments such as high yield bonds and many foreign government bonds may act similar to stocks when the economy becomes unstable. Because of this, we know it's important to own the right kinds of bonds at the right time.

Every portfolio and investor is different, but as a general guide, we believe that the Discipline Fund ETF operates best as a core holding in a multi bucket portfolio. For example, if a moderate risk profile investor who wants to allocate to a 60/40 stock/bond allocation might consider the following allocation:

- 20% Short-term and intermediate bonds for liquidity needs

- 40% Discipline Fund ETF for growth and stability

- 40% Diversified stocks for aggressive growth

- It creates a highly diverse allocation, with over 7,500 underlying holdings attributable to the Discipline Fund ETF alone.

- It simplifies the management of the entire portfolio into just a handful of ETFs.

- It compartmentalizes risks across specific behavioral buckets and time horizons.

- It rebalances dynamically to help maintain your profile due to the internal mechanism of the Discipline Fund ETF.

- It improves tax efficiency due to the fund of funds aspect of the Discipline Fund ETF and its rebalancing mechanism.

- The core holding of the Discipline Fund ETF frees up behavioral bandwidth enabling one to more freely take risks in the 40% aggressive bucket.

We've spent decades navigating the institutional investment space and helping retail investors achieve their financial goals. We know how hard it can be to coach investors through bull and bear markets and we created the Discipline Fund ETF to help make this process even easier.

The Discipline Fund ETF is designed to help investors maintain good behavior over time. At the same time, it's a low fee, diversified and tax efficient vehicle. If you are an institution or 401k provider, then this fund could be a good option for helping investors stay the course in a product that helps them obtain broad diversification with low fees.

If you're a financial advisor or financial planner who wants to spend less time managing investments and more time doing real planning, then the Discipline Fund ETF could be a good option to help your clients make optimal investment decisions and reduce the risk of overreacting across time. This reduces the amount of time you need to spend coaching worried investors so you can spend more time doing what you do best - planning and real advisory work.

If you are interested in offering the Discipline Fund ETF as part of your product offerings or to your clients, please reach out to us through the contact us page for information and resources.

Cullen Roche is the portfolio manager and creator of the Discipline Fund ETF and its underlying algorithm, which he has developed over the past ten years. The systematic algorithm at the heart of the Discipline Fund ETF is designed to be non-discretionary, with data-based inputs that result in allocation outputs that are implemented with minimal adjustment. Cullen has been managing money for almost two decades and has become well known for his top-down macro thinking. He's a strong advocate of low cost, diversified and tax efficient investing.

Discipline Funds has partnered with Wes Gray and ETF Architect to operate all aspects of the ETF. We've also partnered with CBOE as the stock exchange partner for fund operations. We couldn't be happier about these world-class partners.

We built the Discipline Fund ETF primarily because we encountered all the same behavioral problems that the Discipline Fund ETF is designed to fix. The founders of the company will always maintain a significant portion of their personal financial assets in the Discipline Fund ETF to take advantage of the tax efficiency, simplicity, and systematic diversification of the Fund. This not only gives us exposure to a fund that we fully believe in, but it aligns our interests with those of our shareholders.

One risk with a countercyclical rebalancing strategy is that it could overbalance at times. For instance, if the stock market fell 50% during a recession and the fund rebalanced to a 100% stock position it might actually expose the investor to unreasonable risk if the stock market were to decline another 50% as it did in 1930. The Discipline Fund ETF controls for this risk by establishing bands within which the Fund can rebalance. Specifically, the Discipline Fund ETF can never hold more than 70% stocks and 30% bonds or 70% bonds and 30% stocks. This means that even if the fund were to rebalance during a substantial market decline it would still maintain a meaningful allocation to stocks or bonds.

We love low fee, tax efficient, diversified and systematic portfolios. A 60/40 stock/bond fund is a fantastic way to achieve this. However, we believe there are many potential "active" flaws in a 60/40. Primarily:

- 60/40 typically holds US stocks and bonds thereby choosing not to hold 50% of all global stocks and bonds. This exposes the investor to a significant amount of home bias.

- 60/40 actively rebalances back to 60% equities when it grows. For instance, when the stock market booms the 60/40 grows into 70/30 and the fund actively rebalances back to 60% equities. But why does it do this? Why not rebalance back to 50% stocks at times if it's appropriate? This static rebalancing approach exposes the investor to significant declines such as the 35% decline of 2008/9.

- 60/40 holds a bond allocation that yields just 1.3% as of 2021. This portfolio has become so dominated by cash and cash like equivalents that it will struggle to generate sufficient income going forward.

The Discipline Fund ETF has similarities to popular strategies like Risk Parity (all weather) and Harry Browne's Permanent Portfolio. The major difference is that the Discipline Fund ETF is simpler. For instance, a true Risk Parity fund holds dozens of uncorrelated asset classes while the Permanent Portfolio holds 25% cash and 25% gold. We believe that this can result in excessive complexity, exorbitant costs and tax efficiencies that detract more from the portfolio than they contribute. While we are also trying to create a portfolio that measures asset class risk parity and helps investors remain permanently invested, we believe that simplicity is a crucial ingredient to achieving this.

The famed Boglehead, Rick Ferri, has explained that no one is a true passive investor. We all actively choose to deviate from global market cap weighting and we all have to make active decisions about rebalancing, reinvesting, divesting, etc. Some level of activity is fine and we are adherents of low cost indexing strategies regardless of whether we call them "active" or "passive". But the term "passive investing" has also become muddled in the era of low cost indexing. For instance, a common myth is that a domestic 60/40 stock/bond portfolio is "passive". In reality, this portfolio is very active since:

- It actively chooses not to hold 50% of global stocks.

- It actively chooses not to hold global bonds.

- It actively chooses to rebalance annually back to an arbitrary weighting of 60% stocks, which is a full 15% higher than the market cap weighting of global stocks versus bonds as of 2021.

We believe all asset allocation should start with a sound financial planning based foundation so please reach out to us if you'd like to know the best way to fit the Discipline Fund ETF into your portfolio.

If you're a DIY investor looking for a second opinion, the Discipline Portfolio Review service might be appropriate for you. This includes a comprehensive review of your current portfolio to help streamline tax efficiency, fees and overall allocation. We can also explore whether the Discipline Fund ETF might be a good fit for your current portfolio.

Discipline Funds is part of Orcam Financial Group, an SEC registered investment advisory firm. We provide separately managed accounts, portfolio reviews and the Discipline Fund ETF. If you would like to contact us about more personalized help, we would love to talk to you. Feel free to reach out to us using the contact us page. We're here to help.

ETFs are highly tax efficient vehicles primarily because of their operational structure. For instance, if we owned all of the funds or underlying stocks and bonds in the Discipline Fund ETF individually, we'd have to incur a taxable event every time the portfolio rebalanced because we'd necessarily have to buy and sell these underlying holdings to achieve our new allocation. The same basic fact is true of a mutual fund - it is required by law to distribute virtually all capital gains to its shareholders (along with a tax bill).

ETFs operate under a different dynamic. When you buy new shares of an ETF it will be because a market maker went into the market, purchased the underlying basket of assets and delivered them to the ETF issuer in exchange. This is called a creation unit. When you sell those shares the market maker will operate in the opposite fashion - they will buy up ETF shares and deliver them to the issuer and receive a basket of the underlying securities in an in-kind exchange (not a sale). The benefit of this structure is that the ETF issuer is not required to distribute any capital gains as a result of its operations, allowing the issuer to rebalance a portfolio more efficiently and better control the tax liability of the underlying holdings.

This is a fairer and more efficient process than what commonly occurs with mutual funds where you can get hit with cap gains through no fault of your own. Instead, with the ETF you better control your capital gain tax liability by controlling when you sell the ETF and incur taxable events.