We're helping investors solve their most important problem - TIME.

The future of investing and financial planning is here.

Defined Duration, at a glance

Defined Duration Investing (DDI) is a rules-based framework that organizes assets around the timing and predictability of liabilities and expenses. We quantify and then match the defined duration (i.e. ‘how long your money is committed’) of your investments to your goals, rather than using guesswork or style boxes, thereby making financial planning more structured and easily understood.

1 · Plan

We build the financial plan based on a rigorous assessment of your balance sheet and income statement strength.

2 · Quantify

We use our custom software to quantitatively assess your risk score and financial strength based on empirical inputs, not subjective emotions.

3 · Match

We use our Defined Duration™ methodology to assess the right assets to match your financial goals and customize the right portfolio for you.

4 · Maintain

We maintain your plan over time—rebalancing and updating goals as life evolves.

How the Defined Duration™ method works

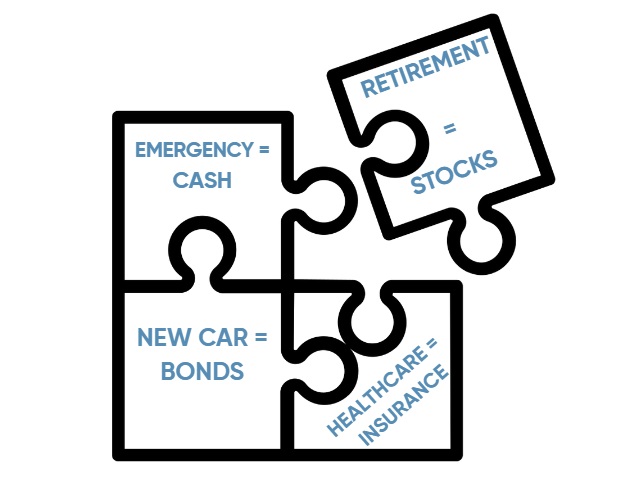

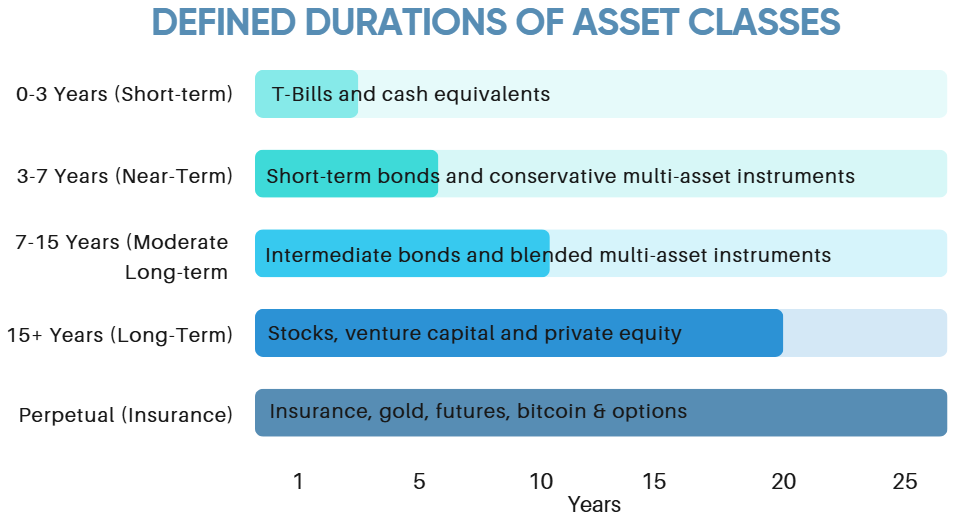

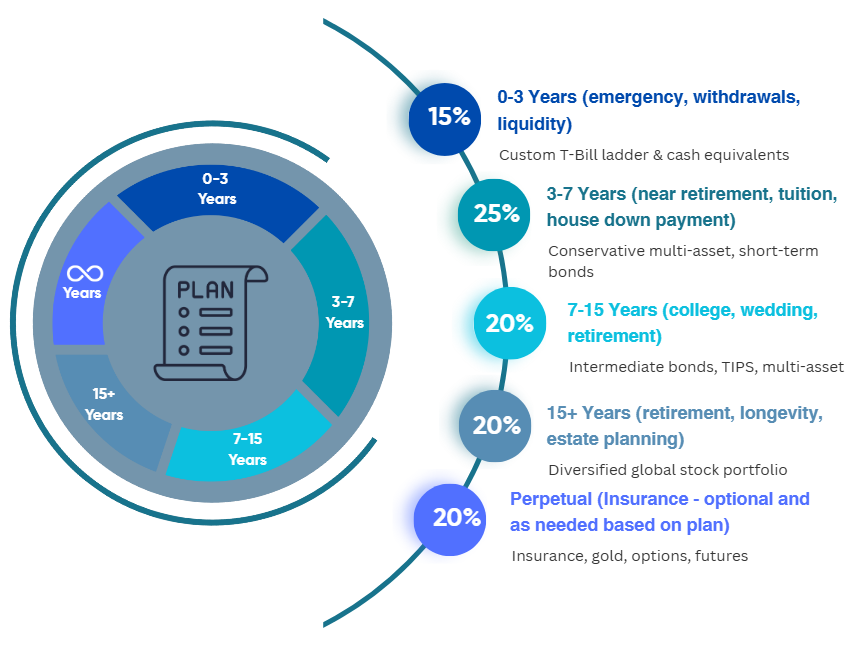

We map out your financial plan over 5 structured time zones to quantify your expenses and liabilities across your life. We then match them to assets using our quantitative Defined Duration methodology. For example, in the Defined Duration methodology cash is a 0 duration instrument. Bonds are ~5-year instruments. And stocks are 15-year instruments. This methodology allows us to build a temporally structured portfolio where the assets are matched to specific expenses and liabilities across time. The portfolio is customized based on your financial plan and structured using low cost, tax efficient and simple instruments designed to give you a clear understanding of how your assets correspond to your goals and financial plan.

Short-Term (0–3 Years)

Cash & short duration instruments for upcoming withdrawals and emergency needs.

Near-Term (3-7 Years)

Safer assets such as high quality bonds to match expenditures in the 3-7 year time horizon.

Intermediate-Term (7–15 Years)

A blend of growth and principal stabilizers (for example a multi-asset instrument like a 60/40 stock/bond fund) to match the uncertain period in the 7–15 year range.

Long-Term (15+ Years)

A blend of aggressive growth assets such as stocks to maximize growth and protect you from inflation.

Perpetual (Unknown)

Insurance-like assets to help cover your financial plan in case of the unknown.

From the old way to the new way

Product-first, subjective, costly. Unclear goals, style boxes and factor tilts, frequent changes, and little linkage between assets and real-life spending.

Planning-first, quantified, disciplined. Clear goals, objective profiling, low fees, and time-mapped sleeves that align assets to liabilities.

Tools that make the process systematic and quantifiable.

Quantify, visualize, and communicate the plan with clear, repeatable outputs.

HourglassFP Pro

Our customized asset-liability matching, profiling and portfolio construction tool.

COMING SOON - the Defined Duration Tool Suite

Refine your plan with our customized retirement, estate and investing tools.

Plug and play products

Use the Discipline Funds product line to plug and play options in your plan.

Implementation options

Choose how to implement the strategy for yourself.

Do It Yourself

Work through the HourglassFP Tools yourself and plug and play the right pieces.

Work with your own advisor

Work with your own advisor to have them implement a Defined Duration™ portfolio.

Research & education

Research and ongoing insights to support planning-first fidelity.

Whitepaper: Defined Duration™ Investing

How Investors can Improve Financial Planning Needs and Portfolio Performance Using a Defined Duration Strategy.

Video: What is Defined Duration™ Investing?

COMING SOON - Learn how we apply the Defined Duration™ Method.

Audio: Implementing the Defined Duration Framework

Listen to our Morningstar interview about how we apply the Defined Duration Investing strategy.

Frequently asked questions

What is Defined Duration™ Investing & how does it differ from traditional portfolio management?

Traditional asset management processes are broken. Over 90% of active managers underperform their indices over 20+ year periods and yet the financial services industry still promotes style boxes, factor tilts and other performance-based portfolio strategies as planning solutions. Worse, this creates performance-based expectations instead of planning-based expectations which leads to performance chasing, higher turnover (higher taxes and fees) and behavioral biases. Defined Duration flips this all around and starts with your financial plan and ends by aligning specific assets to specific expenses and liabilities using a rigorously quantitative financial planning process.

In the traditional portfolio construction process the advisor does subjective risk profiling and implements a portfolio that tries to optimize for style boxed risk/return to meet client needs. Defined Duration quantifies the risk profile based on quantitative balance sheet and income statement inputs and then applies an asset allocation based on the underlying financial plan and needs, not a subjective risk optimization process. This gives the client greater clarity of why they own certain assets and the way those assets are actually helping them achieve their financial goals. Best of all, it can be implemented in a low fee, tax efficient, globally diversified and highly personalized manner.

We've created a unique process by which we can quantify a reasonable time horizon for different asset classes. This allows us to quantifiably match specific assets to a specific financial plan. For example, in the Defined Duration methodology cash and T-Bills are 0 duration instruments, the bond market is a 5 year instrument and the global stock market is a 15 year instrument. We use this method to match and blend different instruments or alternatives to different liabilities and needs in the financial plan.

What instruments do you use?

We are huge fans of low cost indexing style strategies. We always try to use the lowest cost and most appropriate instruments to meet someone's needs. But we also know that one size doesn't fit all. On average, a Defined Duration portfolio will hold a custom T-Bill ladder and 5-10 stock and bond ETFs. Where appropriate we apply an insurance sleeve to insulate the investor from excess inflation and other risks, but the insurance allocation is 100% optional. But in all cases, diversification, low costs and tax efficiency are essential aspects of the products we utilize.

What does the portfolio look like?

In theory, our portfolios can be as simple as 3 funds across 3 time horizons, but our experience is that investors need more customization and greater diversification to meet life's varying time horizons. On average, the Defined Duration process will output 4-5 customized allocation blocks across the 0-3 year, 3-7 year, 7-15 year, 15+ year and perpetual time horizons. The instruments utilized within each bucket can be structured and customized to meet the granular goals of the underlying investor. While we tend to defer towards "simple is better" we also know that our financial lives are anything but simple and some level of customization is always required.

At a minimum you can expect to see a portfolio where the 0-3 year time horizon matches a personalized T-Bill ladder, 3-7 year time horizon matches intermediate bonds and safe multi-asset instruments, 7-15 year time horizon matches a balanced allocation of stocks/bonds, the 15+ year time horizon matches a more aggressive stock tilted allocation and the perpetual time horizon is matched to instruments that exhibit insurance like features (gold, managed futures, options, etc). It's all customized to match the client needs and so every portfolio is different.

How are risk tolerance and capacity incorporated?

We built customized software based on our methodology to help us implement a quantiative planning process. We anchor risk to balance-sheet strength and cash-flow needs, not emotional and subjective questionnaires or a portfolio manager's guesstimates about the best stocks. Everything about the Defined Duration method is rigorously quantitative to reduce subjective and emotional inputs. This helps us create a portfolio based on your balance sheet robustness, not your emotional fragility thereby helping us build a portfolio that can ride out any storm knowing that we all become fragile when markets get volatile.

How often are allocations reviewed or rebalanced?

Reviews are tied to plan changes and horizon shifts, with disciplined rebalancing policies to keep durations aligned. Every Defined Duration portfolio is different because every client is different. These customized plans require as much upkeep as the client needs. So the answer is, it depends! But we try to minimize rebalancing knowing that more activity can result in more taxes and fees. That's why we built our own set of products and software to help implement the Defined Duration strategy. These products are specifically designed to reduce activity and enhance customization by maintaining an asset allocation and process that better aligns with our goals.

How Does DDI Compare to Traditional ALM Strategies?

Traditional bucketing strategies and asset-liability matching strategies are often overly simplified or single asset class. For example, most liability driven investing strategies incorporate fixed income only because bonds can be quantifiably matched across specific maturities. Our approach is unique in that the Defined Duration approach quantifies an implied equity duration which allows us to then blend multi-asset portfolios and create customized instruments that can be matched to any time horizon. By using multi-asset instruments we can enhance the overall diversification of a portfolio while still maintaining a targeted time horizon.

Are you fiduciaries?

While we have our own customized products and software we also truly believe that this form of asset allocation is a better way to do financial planning and asset management. We didn't build this process with the goal of getting rich. We built this process with the goal of solving an obvious problem in finance - the problem of time. So yes, when we make recommendations we always try to do what's in the best interest of the people we are privileged to work with.

Ready to align portfolios to real-world plans?

Speak with our team or request an overview you can share with stakeholders.

Contact Us