Defined Duration Investing FAQ

The traditional asset management approach is broken. The evidence shows that over 80% of active managers underperform a simple index fund. Even worse, this approach creates a conflict of interest for many shareholders where the strategy sells the hope of high returns in exchange for the guarantee of high fees. The result is investors take more risk to earn more return and chase returns without knowing that they're usually chasing higher risk. All of this is because our industry has failed to provide investors with an understanding of why they own certain assets and over what time periods they should own those assets. Defined Duration Investing was created to solve the problem of time within portfolios.

Defined Duration Investing is a holistic financial planning based strategy that’s designed to weather all environments across specific time horizons and help you stay the course. We've constructed a model that applies a specific time horizon to asset classes and strategies. After assessing your financial liabilities across specific time horizons we're then able to apply the proper assets to match those liabilities. This results in a portfolio that is not only diversified across asset classes, but more importantly, it's diversified across time. This is crucial in the process of meeting your financial goals so you can construct an asset allocation where you have greater certainty about the quantities of assets you'll have at specific times in the future. Additionally, this framework constructs a proper behavioral perspective of certain assets to help you generate better returns by behaving better.

Most asset allocation strategies use a mean variance optimization approach to portfolio construction. This means that the advisor or manager is designing an overall portfolio that is designed to optimize returns per unit of risk. The Defined Duration approach adds the element of time to the portfolio to help an investor segment their portfolio in specific blocks in order to optimize returns per unit of risk across specific time horizons. This helps the investor maintain a diversified portfolio that is consistent with their financial planning needs across time.

The Defined Duration portfolio is a highly diversified portfolio of global stocks, bonds, commodities, gold, cash and  other assets. We run a full financial plan to quantify your liabilities across specific time horizons. We then match those liabilities to specific assets in a customized portfolio. This provides you with a highly diversified "all weather" style portfolio that gives you greater certainty about your assets across specific time horizons while helping you behave better.

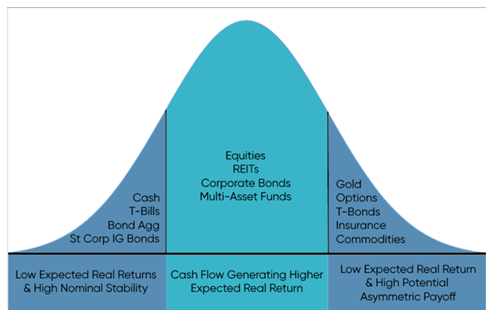

As a general framework the Defined Duration strategy can be thought of as existing on a bell curve with three specific buckets:

1) Stability bucket

2) Growth bucket

3) Insurance bucket

The specific portfolio will be implemented using low cost and tax efficient bonds and ETFs.

The nominal stability bucket is comprised of instruments that are designed to give you short-term principal stability and income. This could include money market funds, Treasury Bills and short-term bond ETFs.

The growth bucket is comprised of diversified stock ETFs, REITs, corporate bond ETFs and multi-asset ETFs.

The insurance bucket is dynamic and changes across time to meet your insurance needs. This could include gold, options, commodities and other instruments that have low expected real returns and high potential asymmetric payoffs to help protect you from inflation, market crashes and other uncertainties.

other assets. We run a full financial plan to quantify your liabilities across specific time horizons. We then match those liabilities to specific assets in a customized portfolio. This provides you with a highly diversified "all weather" style portfolio that gives you greater certainty about your assets across specific time horizons while helping you behave better.

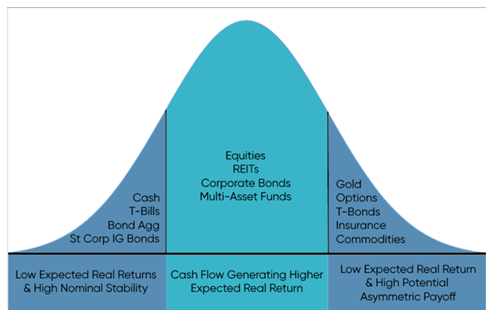

As a general framework the Defined Duration strategy can be thought of as existing on a bell curve with three specific buckets:

1) Stability bucket

2) Growth bucket

3) Insurance bucket

The specific portfolio will be implemented using low cost and tax efficient bonds and ETFs.

The nominal stability bucket is comprised of instruments that are designed to give you short-term principal stability and income. This could include money market funds, Treasury Bills and short-term bond ETFs.

The growth bucket is comprised of diversified stock ETFs, REITs, corporate bond ETFs and multi-asset ETFs.

The insurance bucket is dynamic and changes across time to meet your insurance needs. This could include gold, options, commodities and other instruments that have low expected real returns and high potential asymmetric payoffs to help protect you from inflation, market crashes and other uncertainties.

other assets. We run a full financial plan to quantify your liabilities across specific time horizons. We then match those liabilities to specific assets in a customized portfolio. This provides you with a highly diversified "all weather" style portfolio that gives you greater certainty about your assets across specific time horizons while helping you behave better.

As a general framework the Defined Duration strategy can be thought of as existing on a bell curve with three specific buckets:

1) Stability bucket

2) Growth bucket

3) Insurance bucket

The specific portfolio will be implemented using low cost and tax efficient bonds and ETFs.

The nominal stability bucket is comprised of instruments that are designed to give you short-term principal stability and income. This could include money market funds, Treasury Bills and short-term bond ETFs.

The growth bucket is comprised of diversified stock ETFs, REITs, corporate bond ETFs and multi-asset ETFs.

The insurance bucket is dynamic and changes across time to meet your insurance needs. This could include gold, options, commodities and other instruments that have low expected real returns and high potential asymmetric payoffs to help protect you from inflation, market crashes and other uncertainties.

other assets. We run a full financial plan to quantify your liabilities across specific time horizons. We then match those liabilities to specific assets in a customized portfolio. This provides you with a highly diversified "all weather" style portfolio that gives you greater certainty about your assets across specific time horizons while helping you behave better.

As a general framework the Defined Duration strategy can be thought of as existing on a bell curve with three specific buckets:

1) Stability bucket

2) Growth bucket

3) Insurance bucket

The specific portfolio will be implemented using low cost and tax efficient bonds and ETFs.

The nominal stability bucket is comprised of instruments that are designed to give you short-term principal stability and income. This could include money market funds, Treasury Bills and short-term bond ETFs.

The growth bucket is comprised of diversified stock ETFs, REITs, corporate bond ETFs and multi-asset ETFs.

The insurance bucket is dynamic and changes across time to meet your insurance needs. This could include gold, options, commodities and other instruments that have low expected real returns and high potential asymmetric payoffs to help protect you from inflation, market crashes and other uncertainties.

Everyone technically holds their assets as "buckets" within a portfolio. You probably hold a stock "bucket" and a bond "bucket" and a cash "bucket". Traditional bucketing strategies try to build a more structured time-based portfolio, but have three glaring flaws:

1) They do not formally quantify the time horizons of all assets in a portfolio.

2) They are overly simplified 2 or 3 bucket strategies using just stocks and bonds.

3) Often involve unnecessarily low return assets or high fee assets like annuities and options overlays.

4) They don't assign how the buckets directly interplay and help withdrawal rates.

Problem #1 - Investors who own stocks, commodities, gold, alternative assets or any multi-asset portfolio do not know the time horizon of these instruments and therefore have no foundation from which to judge the performance and purpose of the instrument in their portfolio. Traditional bucketing strategies don't quantify the time horizon of assets and therefore fail to provide investors with a reliable time horizon over which to judge instruments. We solve that issue by quantifying the duration of any instrument and then target a specific duration based on our underlying quant model.

Perhaps more problematic in the traditional bucketing approaches is the idea that duration is static and shouldn't be managed. The result is that your traditional bucketing strategy holds a bond aggregate or a bond ladder with a constant maturity that never evolves for interest rate changes. For instance, in a traditional bucketing strategy an Aggregate Bond Index yielding 1.5% in 2020 with a duration of 5 is viewed as having the same level of risk as an aggregate bond index yielding 4% in 2024 with a duration of 5. We know this is wrong and taking a quantified and dynamic approach to duration management helps clients stay the course while tailoring risks to their needs.

Problem #2 - Overly simplified bucketing strategies can result in high correlations that don't sufficiently diversify a portfolio across all time horizons. Most bucketing strategies are informal and undiversified with just two or three buckets. Any investor who experienced 2022 knows that a two bucket strategy can be problematic when stocks and bonds become highly correlated. The Defined Duration strategy builds on traditional bucketing strategies and provides investors with a portfolio that diversifies across more asset classes AND more time horizons. The Defined Duration strategy uses as many assets and time horizons as the financial plan needs.

Problem #3 - Many bucketing strategies or "defined outcome" strategies are sold to investors with the premise that high costs are worth high degrees of certainty. This oftentimes results in very long bond ladders with low yielding and higher risk bonds or worse, expensive guarantees like annuities and options overlays. These strategies do give you a high degree of certainty, but do so in exchange for high costs. The Defined Duration strategy gives you the same degree of certainty over time, but does so using low cost ETFs in a diversified allocation of easily understood products.

Problem #4 - Most bucketing strategies have an inherent problem where they do not actually help you rebalance or understand how to refill the short-term buckets. But this shouldn't be a problem if you structure your buckets out properly and quantify the actual durations using multi-asset instruments. We solved this problem by combining some buckets into specific multi-asset buckets that help generate higher returns than lower duration buckets, but also solve the tax problem within rebalancing by doing rebalancing within themselves. For example, if you have a T-Bill bucket, 50/50 stock/bond bucket and a stock bucket then your stock bucket will outperform your multi-asset bucket which will outperform your T-Bill bucket over their specific durations. The multi-asset bucket should be wrapped in an ETF that can rebalance internally and tax efficiently thereby reducing asset allocation drift in the portfolio and the stock bucket should allow you to refill other buckets over time as it outperforms over sequential durations. This is superior to holding a portfolio like 60/40 stocks/bonds because it reduces your sequence of return risk by disaggregating the 40% bond slice. Anyone who invested in bonds in the 2021/2022 period knows that you cannot rely on a 40% bond aggregate slice to manage your withdrawals, even over short time horizons. Defined Duration investing solves that problem by giving you the ability to maintain an allocation that is similar to a 60/40 in totality, but broken out into its specific components so you don't have to worry about environments like extended bond bear markets.

The insurance bucket is optional and contingent on the investor's financial plan. But as a general overview, insurance should be viewed as a prudent part of any financial planning process including your asset allocation. When appropriate we use a 0-15% slice of the portfolio to hedge against unusual risks that aren't covered by the rest of your financial plan. For example, if you don't own a house you don't have significant real asset protection. This means it could make sense for this investor to own some gold or managed futures to give them more commodity and inflation protection. In most cases, however, we find that cash and T-Bills are sufficient insurance hedges, especially in environments when they are generating a real return (yield above the rate of inflation).

Interestingly, the super long duration instruments in the Defined Duration model are all long duration instruments such as commodities, gold, and other long duration hedges. These instruments all operate like insurance over the long-term in that they don't always generate consistent nominal returns, but often provide very high asymmetric returns during unusual financial conditions.

Although it's purely optional and contingent on the specifics of someone's financial plan insurance is always an important consideration in any asset allocation strategy.

No! The beauty of the Defined Duration strategy is that it's entirely customizable and personalized to the investor's needs. We start with a financial planning foundation and in certain environments and for certain investors, insurance is a prudent part of their financial plan.

We also know that some people do not like gold, commodities or tail risk hedges. And that's fine. We believe that stocks/bonds are the core of any good portfolio construction process and we often use cash and cash equivalents as behavioral insurance for investors who prefer not to use "alternative" investments like gold, commodities and tail risk hedges.

This can vary greatly depending on how the customized portfolio is constructed for you. But in general, we don't believe in the Wall Street mantra of trying to beat the market and get rich quick concepts.

The investment management business has mastered the art of selling high fees in exchange for the hope of high returns. But unfortunately, high fees in no way guarantee high performance. And ultimately, this financial model can lead to a portfolio manager taking additional risk to try to “beat the market.” This creates behavioral risk for the shareholders since they may be subject to big swings in their savings due to this increased risk.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

The Countercyclical Indexing and Defined Duration strategies are not "beat the market" strategies. They are strategies that are specifically structured to align with your financial goals and help you behave better. This will not only increase the odds of achieving your financial goals, but it will also help you sleep better and focus on the things that are most important in life.