Here is a thing I think I am thinking about.

1) What is a Trade Deficit and is it Killing America?

This week’s video is about the trade deficit. I covered some basics about how this all works and why the trade deficit isn’t the worrisome thing some people claim it is. Then again, I also go into some of the risks it may pose and things to pay attention to as potential signs of risk. I hope it clarifies some of the misinformation around all this concern about trade deficits and current account deficits.1

2) The Hard Data Will Start to Hit Hard Soon.

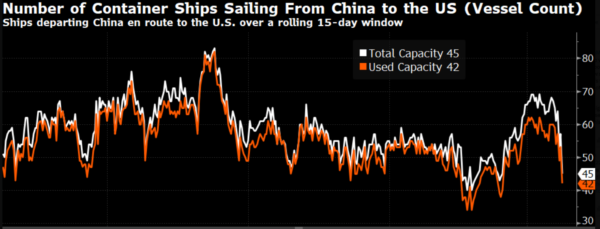

One of the strange elements of this whole tariff fiasco is that its actual effects on the economy have a huge lag. For example, the meaningful tariffs didn’t go into effect until just recently. And it takes 30 days for a container ship to get from China to LA. It takes about 45 days for the deliveries to get to Chicago. And 55 to NY. And although the tariffs have caused a good deal of uncertainty they haven’t yet started to impact the domestic economy in a big way. But the number of vessels currently in transit is already slowing rapidly as firms halt or delay new orders. Scheduled vessels for the first week of May are expected to be down 10.5% year over year and -33% for the week of May 4-10. This is also consistent with the new orders data from the recent NY and Philly Fed surveys. This means the real economic impacts are about to start being felt here, but they’re going to slowly lag into new data in the next month.

In my prior analysis on this situation I’d said that a significant reduction in tariffs was the most likely outcome here. And it looks like we’re moving somewhat in that direction, but the problem here is that even when there’s finality on this tariff stuff the factories in China still need to fire back up. And so we’re looking at the same lag there as it takes so long for the ships to get loaded and then arrive here for the work to be done. And that’s actually assuming that the administration wants to make a deal with China that brings rates down to a level that’s affordable again. And there’s no telling if that’s even going to happen because there’s still this outlier narrative going around about how we need to really stick it to China to establish this new world order for trade. And if that is indeed the strategy here then we need to prepare for a very long year because no one knows what the knock-on effects of that will be and whether it can be navigated in a way that avoids a recession. If the White House really wants to stop manufacturing things in China then we’re talking about a massively disruptive reorganizing of supply chains that will takes years, not months, to work itself out. If not, then they have a few weeks to put this whole thing to bed before the container recession starts to have a more serious impact here at home.

3) An Autopsy of American Exceptionalism

I wrote a piece from the future on the old Pragmatic Capitalism blog about the decline of American Exceptionalism. It made sense to write it over there because that’s where I spent so much time trying to debunk many of the bad narratives that got us to this point. I talk about what the world might look like in 25 years if we do actually pull back from global trade in a huge way and isolate ourselves. I am still hopeful that doesn’t happen, but I am fairly certain that if it does our relative standing in the world will fall quite significantly. I focus mainly on how I lost all the narrative wars of the last 20 years. You probably know most of the ones I’ve focused on – the USA isn’t bankrupt, our living standards aren’t in decline, fiat money didn’t ruin the financial system, etc. It’s been crazy for me to watch the wealthiest nation in human history somehow claim that the rest of the world has been taking advantage of us in a system we designed that has mostly benefited us. But here we are and I hope we’re not on the verge of going backwards.

It’s not the most optimistic thing I’ve ever written, but I can confirm that Paris and Kyoto are still nice in the future.

1 – A common response I’ve seen to this is Warren Buffett repeatedly expressing concern about the trade deficit. Buffett’s main concern has always been that we’re sending pieces of paper abroad that give foreigners claims on US assets. And this is true, but I’d argue it’s been a massive net positive on the whole. First, as a percentage of total ownership, foreign ownership of US securities is actually flat since 2008. So despite 20 years of a persistent current account deficit there hasn’t been a huge change in foreign ownership as a percentage of the total. But the current account deficit also reflects the way many firms in the USA outsource their comparative advantage. And that accrues to US firms (and households) as increases in net worth. This is a big reason why corporate profit margins have expanded so much in the last 30 years. Global competition has made US firms more efficient and that’s accrued to Americans as a huge gain in net worth. So this isn’t a situation where we’re just sending Dollars abroad for no good reason. We’re doing it in large part because that is investment in our businesses that has added value to those very firms and their owners. Could that all reverse? For sure. And weirdly, the thing that would cause it to reverse is ultra protectionist measures thereby reducing demand for US Dollar assets and reducing investment in US firms.