Trump’s new Treasury Secretary, Scott Bessent has famously promoted his so-called 3-3-3 policy. Did you really think I wouldn’t write a Three Things about three pronged policy agenda? In case you don’t know about this it’s his idea that the government should run deficits at 3% of GDP, target 3% real GDP growth and produce 3 million more barrels of oil daily. Let’s discuss.

1) 3% Deficit to GDP

The market is applauding the nomination of Scott Bessent to Treasury, but the market reaction is all a bit weird if you ask me. Bessent is a notorious budget hawk so it makes sense that bond yields are falling on this news. As I’ve recently outlined the potential for Trump’s second term to be disinflationary is higher than people seem to think. Especially if they enact all the cuts that are being discussed.

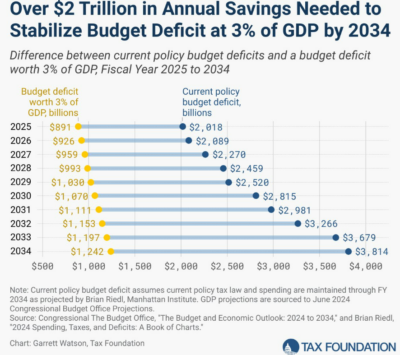

Of course, Bessent doesn’t control the budget. But the narrative around the Trump administration is certainly moving in a more austere direction. And in order to get the deficit as a % of GDP down to 3% you’re talking about nearly $1 trillion in spending cuts in the current deficit. And this makes the stock market’s response a bit odd. These cuts are not necessarily good for GDP in the years ahead.

Bessent has a 4 year target there so it won’t all happen at once, but we’re still talking about a deficit that will be meaningfully lower than the counterfactual. Here’s the differential between 3% and the current baseline estimates from the Tax Foundation. We’re talking about a $2T differential by 2034. We’re unlikely to see this level of cuts, but as I noted in the prior link the tailwind of big government deficits is going to shrink, at a minimum. And the risk of meaningful cuts is increasing.

2) 3% Real GDP Growth

This 3% doesn’t quite square with the last 3%. Or rather, this 3% would depend largely on how the prior 3% is achieved. The economy is only growing at about 2.5% RGDP with 6%+ deficits. If we were to cut the deficit to 3% of GDP over the coming 2 years I estimate that RGDP would fall to about 1.8%-2% over that period. But a lot of that depends on how quickly this is implemented. If Trump comes in and makes significant cuts in years 1-2 the economy probably can’t digest that as things stand and you end up with lower RGDP. If it’s more modest and spread out over time the labor market can probably digest it better and there’s a good chance the regulatory changes become more accretive to growth.

This is all too early to tell though. We really don’t know how big the spending cuts will be and whether Trump and company can even impact the budget in a meaningful way. But my baseline estimate here is that 3% RGDP would be the CEILING on growth even with the deficit where it presently is. And if we implement significant cuts then you probably end up with a larger deficit in the latter years of the Trump administration because…significant front-loaded cuts create recession risk which will kick automatic stabilizers into action and drive down tax receipts. How realistic is that? It’s too early to say, but as of now I’d argue that our baseline RGPD view should be for something in the ~2.5% range with downside risk if the budget cuts end up being much larger than expected.

3) Add 3 Million Barrels of Oil Daily

One item I’ve continually highlighted over the last few years, as inflation has come down, is that commodity prices have remained in a pretty consistent disinflationary trend. This is one of the very best real-time indicators of where inflation is headed. When people claim the 1970s are on the verge of coming back they are implicitly predicting a huge commodity price boom, especially since the surge in oil prices was the primary cause of the 70s inflation. I’ve said that narrative was dead, dead, dead. And if Bessent gets his way here then it’s more than dead as oil prices (and all tangentially impacted commodities) are likely to be lower in the years ahead.

JP Morgan released an analysis today concluding that oil prices are headed to $61 by 2026 if this plan is achieved. Oil prices were down 3% to $69 dollars on the Bessent news. Since oil impacts so many goods prices it’s safe to assume that there’s now marginally more downside risk in commodity prices instead of a 1970s style price boom. This would also be consistent with Trump’s first term (pre-Covid) during which oil production increased 40%+ and prices moved only modestly higher from $52 to $58 before Covid hit.

These three things reinforce the one thing I am becoming more convinced about – Trump is going to be more disinflationary than many people think.