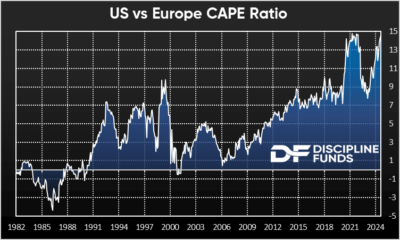

The US economy has been on a tear versus every other G20 economy over the last 10 years and especially in the last few years. While high interest rates are slowing most other developed economies the US has stayed relatively robust. This is especially true in the pricing of the US stock market. When looking at global CAPE ratios (cyclically adjusted price earnings) we see US stocks at a new all-time high versus European stocks. The outperformance of US stocks over European stocks is nothing new, but it’s become increasingly exaggerated in the last few years, especially as the mega tech growth boom exposes Europe for being a major laggard in the most important industry in the global economy.

There’s two ways to look at something like this. On the one hand you might assume that high valuations are bad because “expensive” usually implies bad. On the other hand, you could argue that high valuations simply reflect a price premium. Expensive things are expensive because they’re better things. Of course, this whole conversation is silly if we don’t talk about time horizons. And here’s where things get interesting.

The way I like to think about valuations is that they’re reflective of long-term price premiums. In other words, the ridiculous valuations of the internet in 1999 were not wrong over a proper time horizon of 20 years. But they were dramatically wrong over a time horizon of say, 20 months. In my Defined Duration model the global stock market is about a 16 year instrument and the US stock market is currently about an 18 year instrument. Will the US premium prove correct over an 18 year time horizon? I would confidently assume yes. Will they prove right over the next 18 months? That’s a coin flip. So high valuations are evidence of long-term certainty, but can also create huge amounts of near-term uncertainty.

The big conclusion from a chart like this is that it probably doesn’t matter too much if your time horizon in stocks is a very long time. But if you’re playing the short game with an inherently long-term instrument then the stock market, and especially the US stock market, is likely to introduce a lot of uncertainty into your financial plan in the coming 5 or so years. And that’s just one more reason why I think every investor should hold a slice of assets outside of their domestic economy. Not just to insulate yourself from domestic economic and currency risk, but also to protect yourself from the danger of very optimistic long-term expectations that might not pan out over the short-term.

1 – It’s kind of crazy to think of how much stronger the US economy would be without the rate hikes. If housing and autos were still broadly affordable we’d likely have much higher growth and much higher inflation.