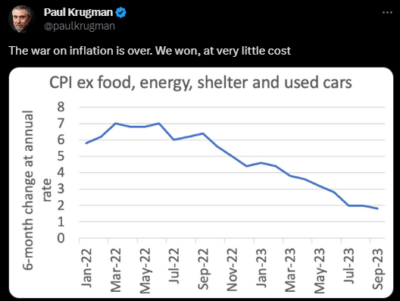

Here’s a Tweet (do we still call them Tweets?) from Paul Krugman which is getting a lot of flak. As I noted last month, he’s mostly right, but just explaining this in a bad way. After all, if you strip out most of the things people need in everyday life then yes, inflation is low. Heck, if we just stripped out everything from the index then inflation is 0%. I kid.

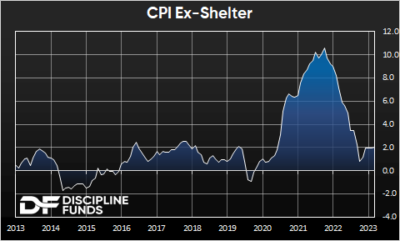

In all seriousness, the chart below is the one he should be showing. This chart shows CPI minus shelter. It shows the same general picture that Krugman is showing, but it doesn’t sound so ridiculous because we’re just stripping out one item. And yes, it makes sense to strip out this item because it has had such a disproportionate upside impact on inflation in recent years and has a very well known lagging effect. In fact, you could argue that the lag in shelter is why the Fed was so late to raise rates. They misinterpreted how much shelter would lag and by how much and so they ended up raising rates too late. And now they’re basically doing the same thing on the other side as CPI looks higher than it really is because of the lagging shelter component.

Headline CPI came in at 3.7% today, but it’s at 2%, right on target, when you exclude shelter alone. That’s pretty crucial in the broader context of what’s happening today because shelter is still running at 7.1% in the CPI when we know that real-time rent indices have fallen to 3.2%.

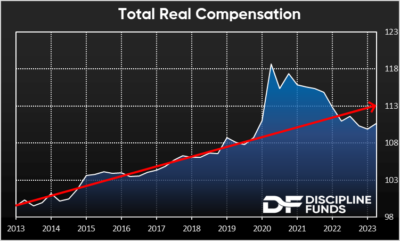

But that’s not even the interesting part of this Tweet, in my opinion. The more interesting opinion is “We won, at very little cost”. Was there really little cost to the Covid stimulus? I’d say absolutely not. And in fact, I think the high inflation of the last few years has had a very high cost.

This conversation is always difficult because the counterfactual to the stimulus probably would have involved a substantially longer recession and millions of lost jobs that would have remained lost for much longer. But we threw so much money at Covid that demand came back very fast. Much faster than it otherwise would have. So, on the one hand we erased a recession very quickly at the cost of high inflation. The counterfactual was likely a situation with much higher and more sustained unemployment similar to the post GFC years. Which scenario would have been worse?

It’s impossible to measure the counterfactual and its subsequent recovery, but we know, with certainty, that the economy has largely been running in place for the last few years. Or, at a minimum, most people don’t feel like life has gotten much better in the last few years, as evidenced by total real compensation. And based on pre-Covid trends, most people feel like they’re behind where they otherwise would be. And since we can’t measure the counterfactual scenario most people just look at the objective reality and conclude that there has been a big cost. Life is largely the same as it was before Covid, but our incomes don’t buy as much stuff as they did before Covid. So you probably feel like you’ve been running in place for a few years or perhaps losing a step.

And of course, none of this is equally distributed. For instance, if you were someone looking to buy a home or a car before Covid who prudently waited it out, you’re now even more frustrated as prices have surged. Or, if you’re a low income earner you had a big boost at the onset of the stimulus only to feel like you’re now falling behind quickly as prices have surged, incomes have stagnated and the difference is being made up with a consumer credit binge at higher interest rates. These people certainly feel like there’s been a big cost.

Perhaps more importantly, the stimulus has made people increasingly skeptical of fiscal policy. As I’ve discussed before, the big lesson from Covid and the GFC is that it’s not monetary policy that causes big inflation, but fiscal policy. And in the case of Covid we spent so much more than we needed to that we ended up getting very big inflation. So now people are looking around criticizing fiscal policy because we know it can cause dangerous inflation. That’s a potentially very important point as we near a Presidential election and an economy that looks increasingly close to a potential recession. After all, fiscal policy can be a very powerful countercyclical tool when it’s utilized in a prudent manner. And if we don’t have that tool in the toolkit during the next recession, it could end up being a much bigger recession than it otherwise would be. And that would be a very costly impact of the Covid stimulus.