Here are some things I think I am thinking about.

1) Another Frothy Bubblet Growing?

While this is not exactly like the Covid induced 2021 speculative market, there are signs that something similar is occurring in 2025. The biggie is valuations which have now surpassed their 2021 highs and rank only second to the late 1990s period. Then again, this is nothing like the 90s in my view and that’s because we have an actual technology boom that is supported by insane fundamentals. For instance, the firms that have amassed the market cap concentration (the Mag 7) are the most profitable firms that have ever existed. They dominate every aspect of what they do and so their valuations are high because they should be high.

Then again, there’s the problem of expectations. I am a big believer in the utility of AI. The current tech boom is real. But I have no idea how it will actually play out with time. For example, the technology is paradoxical in that it is massively deflationary and has the potential to be devastating for certain jobs (and therefore aggregate demand). It has the potential to create an excess of supply that we’ve never seen in human existence. But the technology itself is self replicating. That is, as it expands and grows it will become increasingly available and functional on its own. And if it becomes self replicating in a manner that makes it fully decentralized then these firms will have all sunk hundreds of billions of dollars into a technology that doesn’t have a single winner. In other words, what if there is no Google of the AI world? What if the technology becomes decentralized in a manner where we all have our own personalized version of an AI that evolves on our own tech stacks? In that world the technology eats itself in the sense that GPT or Gemini aren’t the winners, but instead morph into decentralized versions of AI where the technology is super low cost and controlled at the personal computer level instead of a centralized entity level. I don’t even know how realistic that is, but it’s a world where the technology itself destroys the very firms building it when it essentially wakes up and realizes it doesn’t need to be supported by a centralized entity. The thing is, no one knows where this is going and how it’s going to play out in the end even though expectations are very high at present.

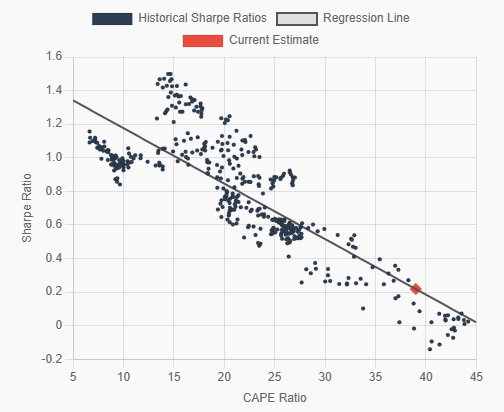

Getting back on point though – this is always the problem with crazy high valuations/expectations. It doesn’t necessarily mean returns will be lower across appropriate time horizons. For example, tech stocks have generated 8% per year since January 2000. But you had to be really patient to get that return because, even over 10 years, the average return was NEGATIVE 6.8%. So, what this means is that path of those returns will be more unpredictable when valuations are sky high. For example, here’s the expected 10 year Sharpe Ratio of US equities at today’s valuations. We could continue to see high returns, but they will come at the cost of higher than normal near-term volatility. And as you can imagine, this all creates a temporal problem for asset allocators. If we think of this inside the Defined Duration methodology then US stocks are longer duration instruments than normal.

And then you have the huge disparity in US vs foreign valuations. While the current US expected Sharpe is about 0.21 the foreign developed expected Sharpe is 0.81, which is about in-line with the historical average.

If you’re a US based investor owning only US stocks at present I’d argue you either have to be incredibly patient or try to reduce that excessive duration risk by adding lower duration instruments to your portfolio (like foreign stocks). Which, of course, is a very personal question. But the risks should be communicated so investors can build appropriately corresponding financial plans and portfolios. Temporal perspective sustains patience which creates behavioral robustness. That is, after all, why I’ve become so obsessed with time based investment strategies….

2) The Lower Rate Debate.

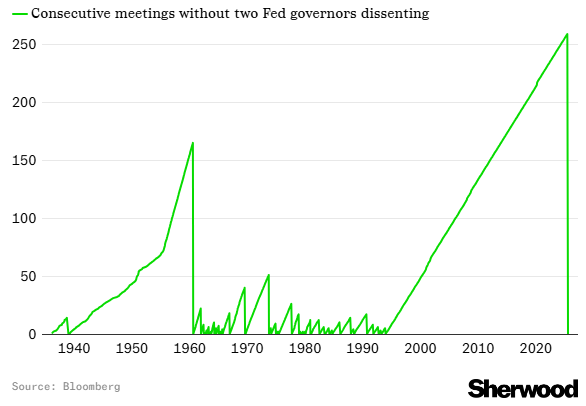

We got a really interesting Fed decision today, primarily because two Fed Governors dissented in favor of lower rates. Here’s a great chart from Luke Kawa showing how unusual this is. We just had the longest run in Fed history without two dissenting votes. So, you could argue there’s a real change in sentiment about where rates should be.

It’s important in the context of the next Fed Chair because the Chairperson alone can’t change rates. But if you start to see more and more governors in favor of cuts then you suddenly have an increasing potential for consensus. With today’s dissents we have what would be the potential for three rate cut advocates (assuming Waller, who dissented, isn’t the next Chief).

But another thing that’s interesting in the context of this is that my Real-Time Taylor Rule actually went UP after today’s data, from 5.1% to 5.25%. This tool is trying to predict where the next quarter’s Taylor Rule will be based on real-time economic data. It gives a window into where the rule is likely going and where overnight interest rates should currently be. And the fact that it is moving up certainly doesn’t support the idea that rates should be much lower.

Personally, I see both sides of the coin. I see a softening labor market, but not a collapsing one. And I see inflation below historical average and close enough to target that you could justify a marginally lower overnight rate. But I don’t think the data is convincing enough in either direction to sway me strongly at present.

3) Updating the Macro Dashboard with a Tariff Tracker.

I added a tariff tracker to the Macro Dashboard. I specifically constructed it to pull data since “Liberation Day” when the big tariff changes were imposed. This is where the rubber meets the road. While there’s been a lot of talk about huge tariffs all year the actual policy revenue has turned out to be significantly smaller than expected. Since April 2nd the US government has pulled in about $97B. That’s not nothing, but it’s also not remotely close to the income tax replacing policy that was being discussed in April. In total, this is on target to amount to about a $200B tax increase, which is not moving the needle a whole lot when you consider that the total US government receipts are $5 trillion.

Of course, this is still a fluid environment and appears to be changing every day with different deals and whatnot, but now that we’re tracking the actual daily tariff revenues you can see the real-world impact of the policy using the tariff tracker tool.