Here are some things I think I am thinking about this weekend:

1) Updating the Macro Dashboard.

I am working on a huge software update for the Defined Duration strategy, but in the meantime I’ve also updated the Macro Dashboard for those interested. I created a real-time Taylor Rule tool as well as an updating Leading Inflation Index. This is the Index I use to track inflation across time and it was enormously helpful in navigating the Covid inflation. It’s a big reason why I was worried about inflation in 2021 and also why I said inflation would moderate in 2023. By the time CPI peaked in the middle of 2022 my Leading Inflation Index had already fallen from 11% to 6.5%. At present it’s reading about 2.35% and doesn’t have a strong directional bias, which, to me says that inflation is just kind of bouncing sideways. But most importantly, inflation is now well contained.

The Taylor Rule tool is kind of cool because I was able to integrate GDP Now into it to create a more real-time metric. Yes, it’s imperfect, but all these tools require perspective and guesswork so be gentle with your critiques. It currently says the Fed is a little too loose, but given where inflation is I can’t say that’s especially meaningful at present.

Anyhow, the Dashboard also has some useful links that I monitor and I embedded the charts natively instead of scraping FRED. If you have critiques or other things you’d like to see there please let me know.

2) The Teeny Tiny Tariffs.

Back in April I laid out 3 likely scenarios for how the tariffs would play out. The most likely scenario I laid out, at 70% odds, was one where Trump had to backpedal on most of the tariffs and the economy basically reverted back to where it was before, but with minor damage. The key to this was the deal with China because we had a near trade embargo in place until that happened. Thankfully it was short-lived. I’d say my scenario 2 has more or less played out and the best evidence of this is that there has been very little meaningful change from the actual tariff implementations so far.

It’s interesting because, despite all the constant noise about tariffs, we’re seeing very little actual economic impact. This is clearly seen in actual tariff tax receipts. For example, through the first 6 months of this year we’ve incurred $86B in total customs duties. In 2024 we incurred $82B. So we’re on track to more than double customs duties. But $86B just isn’t that much in the grand scheme of things. For example, back in April when the tariff banter was at its peak the administration was saying they could replace the income tax with tariffs. We’re talking about a $3 TRILLION line item there so markets panicked because that would have been a colossal tax increase. But we’re nowhere close to that occurring and the math never made sense to begin with because you can’t collapse global trade and also expect global trade to generate trillions in revenue. For reference, we’ve incurred $1.5T in individual income tax receipts through the first 6 months of the year. $86B might sound like a lot of money, but for an entity that accrues $5T of annual receipts that $86B just doesn’t move the needle that much. You’re talking about 1-2% of total tax receipts.

So, I think that’s a big part of why markets have surged back, inflation remains tame and the economy hasn’t slowed significantly. Despite all the bigly talk about tariffs they’ve turned out to be teeny tiny tariffs so far. That could change in the coming year if the administration gets more aggressive implementing them, but for now this has turned out to be a much smaller actual policy lever than it was presented as in April.

3) Mean Reversion in Inflation Expectations.

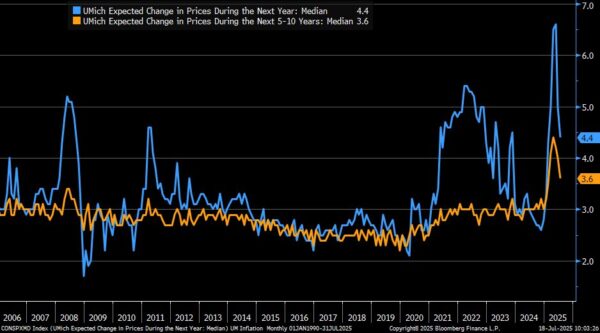

We had a huge surge in inflation expectations when the tariffs were first announced, but there has been very little flow through from the tariffs to actual price changes. That’s mostly due to the prior point – corporations haven’t had to boost prices materially because they haven’t incurred significant actual tariff costs. And so now we’re seeing bigly mean reversion in inflation expectations.

On Friday we got the U Michigan Consumer Sentiment data and it shows a big decline in inflation expectations (chart via Liz Ann Sonders, Schwab’s wonderful Chief Strategist). I suspect this is going to collapse right back to where it was before long. I never thought the tariffs would be inflationary to begin with, but that median reading got wildly out of whack in my view.

In short, it’s been a weird 6 months of 2025. In some ways it feels like nothing has happened and in other ways it feels like everything has happened. I don’t know what to make of it. All I know is that all this market volatility resulted in me doing a whole lot of leg days and so my cycling FTP has exploded higher and my max squat is at an all-time high (I have a lame recurring joke on Twitter where you have to do leg day when the market is down 1% or more). I used to joke about my theory of “assflation” (that’s asset price inflation if you’re new around here), but now it’s coming back to haunt me as my glutes grow. For some reason the beer belly doesn’t go away despite all this exercise. Inflation, man. You just can’t defeat it no matter how hard you try.

I hope you’re having a great weekend and as always, stay disciplined.