Here are some things I think I am thinking about this week:

1) The China Deal is Actually a Big Deal

The White House announced the framework for a trade deal with China where the effective tariff rate with China will drop to 30%. Trump had mentioned that 80% “seemed right” as recently as last week so this is a big relief. 145% was insane and 80% would have been an effective embargo so 30%, while still high compared to where we were, is tolerable.

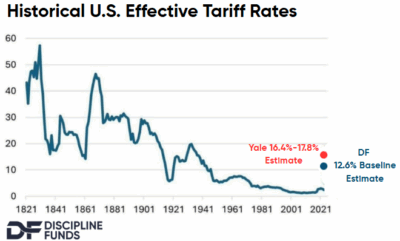

So, as I mentioned a few weeks back, this is all moving in a much better direction now. We’re still higher than the 5-10% total effective tariff rate I mentioned, but as I’ll note below, 12.6% is a heckuvalot better than the 25% we were at just a few weeks ago.

That final rate is important because we’re finally getting a better grasp of the endgame here and what the global effective tariff rate will look like. For perspective, we came into the year with a 2.5% effective rate. It seems safe to assume that the White House will maintain a minimum 10% rate across the board. So, using some very general figures we can use the 30% China rate and the 10% baseline global rate to assume we’ll get to about 12.6% baseline. This is a baseline estimate though and other researchers like the Yale Budget Lab have the figure closer to 17%, although they’re assuming the other countries remain at current levels. So the endgame is probably somewhere in the middle here if I had to guess, but no matter how you slice this up it’s up from the 2.5% rate at the start of the year.

To put this in perspective – with the 12.6% estimate we’re talking about extra tax revenue of about $380B and with the 17% rate we’re talking about tax revenue of $550B. These are still significant tax increases, but they’re a far cry from the rhetoric of just a month ago when it looked like the USA was going full blown isolationist.

This is bad news in the sense that the tariffs are a pretty significant regressive tax hike on consumers who will ultimately pay most of the tariffs as firms pass along costs. But it’s great news in that it now reduces or eliminates the uncertainty for firms trying to invest. So, while the net effect of the last few months was slightly negative (prices are up a bit, Q1 GDP was negative, US stocks are getting crushed by foreign stocks, etc) we can now definitively remove the worst case scenario and hope that the net effect of the higher effective tariff rate is modest. More importantly, with a rough estimate of the tariff endgame we can now move on to considering the net effect of all the other more important stuff going on in the economy and start to move past this tariff noise.

In retrospect I have to say that the last 6 weeks seem like a bad dream. There will be a lot of noise from both sides about who won or lost all this and who caved. But I don’t think anyone won or showered themselves in glory. The USA didn’t really get anything meaningful from China or the UK in these first few agreements and the effective tariff rate is meaningfully higher so US consumers are worse off in the end. Many countries (rightly or wrongly) responded to the US tariffs the exact wrong way by retaliating. Milton Friedman taught us decades ago not to retaliate to tariffs. So, as tariffs typically do, it just resulted in us all throwing rocks in our own ports and then portraying it as a win for rock throwing. Nobody won anything here in the end.

Anyhow, I for one am glad that there’s light at the end of the tunnel here because this topic is inherently political and I absolutely hate talking about politics even though I view this as a much more economic debate than political one.

2) Is the Deficit Finally Shrinking?

We got a monthly treasury statement on Monday and it was one of the more interesting ones I’ve seen in a while because the deficit is actually shrinking. In the first full three months of Trump’s Presidency the deficit is down $112B versus the same period last year. That’s due to a 9.7% increase in tax receipts and 1.2% increase in spending. So while we have a tax hike from the tariffs for the next few years we also have deficit reduction from a real slowdown in government spending.

The way I think of economic growth is that some sector always needs to be expanding their balance sheet. The most important balance sheet is the private sector balance sheet because that’s the balance sheet that does most investing and it’s impacted by the way those investments play out over time. This is part of why the tariffs were worrisome. If we’d continued the path we were on then it was a double whammy because the government was tightening their balance sheet AND we were seeing a big slowdown in investment due to tariff uncertainty. When that happens at the same time it doesn’t end well. But we should see a resurgence in investment spending now that the tariff uncertainty is waning.

So, even though the government is tightening the deficit there is still a net deficit. And while that might mean we’re still on the path to slow growth it doesn’t necessarily signal something very negative. And most importantly, it might help offset some of the short-term inflation impact from tariffs and help bring inflation and ultimately interest rates, down.

3) How to Respond to Persistent US Outperformance?

Here’s a wonderful new paper from AQR’s Antti Ilmanen and Thomas Maloney. They discuss the drivers of US outperformance and conclude that the main driver was rising valuations. Not surprising. And when expectations are high it doesn’t take much to underperform simply because expectations were…too high. As Keynes liked to say, the markets are a beauty contest and if you expect the most beautiful person in the world to walk on stage and you get a Cullen Roche, who, for the record, is quite handsome, but not nearly the most beautiful man in the world, you’ll be disappointed.

But the key finding for me was that their conclusions were true in both hedged and unhedged currency. That’s especially interesting to me because, as you might know, I primarily view foreign diversification as a Dollar hedge. That is, you own foreign stocks knowing that periods like April 2025 happen. And when those periods do happen the Dollar falls a lot, domestic assets become unstable and on a relative basis all that foreign stuff ends up looking much better. It’s just such an easy way to hedge your domestic currency risk that I see it as a no-brainer sort of diversifier. But what it really communicates is that no matter what’s going on with currencies high expectations still make those assets risky because expectations are so high.

Anyhow, go have a read. It’s a good one.

Well, that’s all I got for now. Hopefully this is the beginning of the end of the silliest trade war in economic history and we can all move on to talking about more important things like the huge rally in Fartcoin.