Here are some things I think I am thinking about.

1) Fed Independence.

The biggest news of this past week was the potential for the President to fire employees of independent agencies. That would include Fed Chairman Powell. I have no idea how plausible this is, but it does appear like something that’s increasingly likely. And as I’ve been saying for a while now, I am not sure how much it matters anyhow because Powell is out in May of 2026 and Trump will replace him with a yes-man. But what if Trump does fire Powell before then and does it matter?

Trump clearly wants lower interest rates. He’s a real estate guy who knows that low interest rates are good for the economy and housing. And I suspect he’ll get his low interest rates. Either thru a recession this year or when he installs a new Fed Chief. So, I am not sure how much this matters in the short-run because there just isn’t that much time between now and next May. But this has huge ramifications in the long-run.

The main purpose of an independent Central Bank is that it can operate independent of political influence. Politicians are biased to stimulate the economy. And when they do so in an excessive manner the Fed can come in and offset that impact to some degree. In my view it’s pretty clear that the Fed had a meaningfully offsetting impact in 2022/23. While the federal government was running hugely procyclical deficits the Fed was able to come in, raise rates and crush borrowing. Had they not done this I suspect inflation would have been much higher because the shelter component would have been much stronger. We also would have seen stronger auto and goods demand in general. But rates snuffed that out because they made it virtually impossible for most consumers to borrow. This wasn’t ideal for politicians who might have liked to see even stronger economic data, but it was great for the broader economy and the sustainability of the recovery.

If we eliminate the independence of the Fed then we’re much more likely to see a more procyclical overall policy. That is, even when the government is running huge deficits the Fed might also get influenced to cut interest rates, which would exacerbate inflation and copy many of the things we’re seeing in places like Turkey where President Erdogan has implemented an MMT-like policy agenda that has contributed to a persistently procyclical high inflation. That’s a model we can learn from and Central Bank independence is essential to avoiding those kinds of outcomes.

2) More About Bonds.

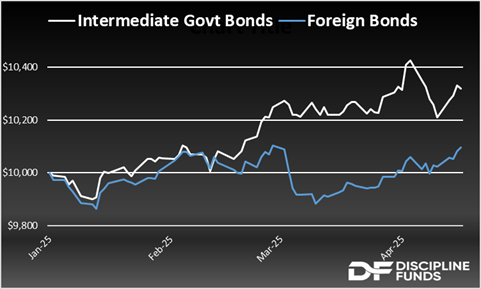

Boy, there’s been a lot of hyperbole about US government bonds in recent weeks. I’ve seen people saying that we’re trading like an emerging market economy and that we need to dump all bonds for foreign bonds and US bonds can’t be trusted any more. But here’s a little perspective for you on this great big bond “collapse”. The following chart shows US government intermediate bonds versus foreign bonds. Since the tariff concerns started in late February US government bonds have been a stellar performer. They’ve hedged equities in pretty much the exact way we’d expect. And while US government bonds are up 3.2% this year the foreign index is barely up 1%.

But the most interesting part of this chart is that we’re barely a smidge higher from where we were a few weeks ago. So, we had a big bump in bonds from late Feb to April. And then a pretty acute decline in yields in early April after “Liberation Day” and the stock market panic. And then yields pretty much recovered to where they were in the subsequent days. Bond prices are actually UP a bit since early March.

So, I just don’t see the big panic here. We’re looking at a few days of trading and then people are concluding that the US government bond market is now an emerging market economy because yields went up 0.5% in a few days right after they’d fallen 0.4% in a few days prior. If you’d slept thru the whole thing and looked at this data you wouldn’t even know anything meaningful happened because yields didn’t really move at all in the last month.

The long story short is that US government bonds are doing pretty much exactly what they always do in an environment where the economy starts to look jittery and they’re operating like much more of a safe haven than any foreign bonds. Which again is exactly what we’d expect from the world’s largest economy and safest bond market. And I don’t see this changing in any meaningful way if the economy were to worsen. So don’t read too much into a few days of trading.

3) What’s the Endgame here?

I keep trying to game this tariff thing out. Here are the scenarios I see being most plausible.

Scenario 1 – Trump Caves Completely, but “Makes a Deal”. In this scenario Trump will probably start getting increasingly pressured by the business community to abandon the tariffs as the economy slows and markets remain volatile. He’d probably throw his advisors under the bus and blame them for giving him bad advice while also declaring that he made a great deal that got us to a similarly free trade world as we had coming into the year. He’ll point to lots of small wins in these deals, but in reality they will be meaningless in the grand scheme of things and he will have most just caved under economic pressure as he realizes all of this is silly.

In this case the effective tariff rate drops to what it was at the beginning of the year and this was all for nothing. This would be a hard one for him to stomach in my view because they seem wedded to this notion that we need to change the world order and stop letting the world take advantage of us via trade (they’re not, by the way, but that’s a different matter). So I just can’t imagine they’d completely cave on the tariff agenda because it would be absurd to spend months talking about how we’re going to revitalize manufacturing and balance trade to benefit Main Street only to end up at a conclusion where we have the same old free trade system that they claimed made everything so terrible.

This outcome is the best one for markets and the economy, but the worst outcome for Trump. So I just don’t see this one playing out in all likelihood. This looks like a very low probability outcome to me. Let’s call it 5%.

Scenario 2 – Trump Caves Mostly, but “Makes a Deal”. This is a less extreme version of scenario 1 where Trump caves on most of the tariffs, but leaves many of them in place. In this scenario he can claim wins with certain negotiations and also maintain some tariffs so he can still claim to be altering the world order. This would likely involve a sweeping deal with China and a few other big players like Europe while maintaining other less important tariffs. Tariffs with China get reduced, but probably remain in place to a far lesser degree.

In this case the effective tariff rate drops to 5-10% overall and there is minor economic damage and lots of cheerleading that exaggerates the greatness of the deal. This is a mostly good outcome for the economy and the markets as it significantly reduces the uncertainty here. But it’s also a strange one to consider because it means that we’re more or less moving back to the status quo on trade. So again, this goes against the whole narrative that we need to create greater balance of trade as it takes us to an endgame where we’re still maintaining a broadly free trade world with our most important trading partners, albeit marginally less free trade than before.

The overall impact of this scenario depends on how long we leave the current tariffs in place. The longer they remain in place the greater the uncertainty will be and the less business investment we see in the meantime. But I think Trump is impatient about virtually everything so if this scenario does play out it’s likely to play out in the next month or two. Which would be generally good news even though we might have done enough damage here to cause a technical recession this year. On the whole it will achieve very little, but a few small wins while having caused a huge amount of unnecessary carnage in the last few months. But it will be paraded about as a great win and being able to maintain small-ish tariffs will allow him to still claim he’s changing the whole world order of the monetary system to help Main Street. 5-10% effective tariffs won’t do anything of the sort, but narratives are what counts in the end here.

I’ll place this one at 70% probability.

Scenario 3 – Trump sticks to his guns and Congress or the public forces him to cave.

This is the worst possible outcome as it means that Trump is deadly serious about this “new world order” narrative and the need to maintain large tariffs as a revenue and trade balancing tool. This outcome would get very messy in my view. We probably get a moderately deep and prolonged recession in which Trump is unable to back down because he’s too invested in the theory that we need to endure some short-term pain for long-term gain. But short-term pain will soon start to look like long-term pain. The Fed will step in to cut rates sharply as unemployment climbs and the deficit will start blowing out as tax receipts slow and automatic spending stabilizers kick in. It will become obvious with time that the tariffs are having the opposite impact of what was intended and that they’re hurting Main Street the most. Economists who rejected all this will be massively vindicated and grow increasingly vocal in their criticism, which will be increasingly supported by the business community. Trump won’t be able to back down from this position as he’d become the longest lame duck President in the history of Presidents. He’d demand we ride it out until we recover as he awaits the long-term gain that isn’t coming. But Congress and the business community won’t let him. If unemployment jumped to 7% Congress would step in and pass a veto proof tariff bill that strips him of the Executive Order authority over tariffs. And by then the damage will have been done. The economy will then start to heal, but that’s going to be a long drawn out process.

This is the very worst case scenario as we get high unemployment, deep recession and much lower stock prices. I don’t see it as the most probable one, but it’s one that is increasing in probability as Trump becomes increasingly emboldened with time and people embrace bad narratives like the idea that tariffs can be used to eliminate taxes for everyone earning less than $150,000. So, I’d place this one at 25%, but rising.

Well, that’s all I got for now. I hope you’re touching some grass this weekend. We all need it after the last few weeks. As always, be well and stay disciplined!