John Bogle famously said that a US based investor doesn’t need to own foreign stocks because US stocks get so much revenue from abroad. I rarely disagree with Bogle about anything, but this is one of the few things I think he got wrong. Late last year I explained that global diversification was still working. And in this brief piece I’ll show you why international investing isn’t just sound financial planning, but is also likely to continue working.

International investing is mostly a currency story.1 If you have all your assets denominated in Dollars then you need to be keenly aware of currency risk. You can hedge this in lots of different ways and the most popular ways typically include owning things like real estate, gold, Bitcoin or other assets that operate like a direct inflation and currency hedge. But this is also true of stocks. While US stocks are typically a good inflation hedge in the long-run they will go through periods of underperformance, typically when the Dollar depreciates. Owning US stocks with foreign revenues doesn’t hedge this risk sufficiently because these entities are users of Dollars and you ultimately have to consume their profits in Dollars. So, if the Dollar is crashing for some reason then those firms will typically have some pricing power in the domestic economy, but in a relative sense they’re still taking a bath on their foreign exchange conversions and you’re still consuming at a relatively weaker exchange rate. This feeds into the relative asset performance.

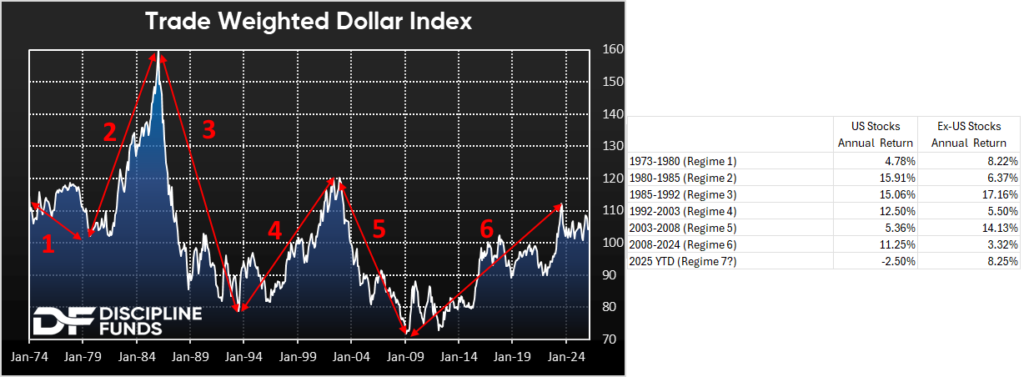

The data resoundingly confirms this. If we look at the trade weighted Dollar Index going back to the 1970s I would highlight 6 major regime changes with the potential that a 7th major regime change is just starting now. In each of these regimes the currency performance plays an important role in the relative performance of US versus foreign stocks. And in each period of Dollar weakness foreign stocks outperform, oftentimes by a significant margin.

The reason I am a big advocate of global diversification is because it’s such an easy way to hedge the inevitable ups and downs of the domestic currency. It’s by no means a perfect currency hedge, but it strikes me as a sensible financial planning tool because we all have domestic currency risk whether we want it or not. Of course, when the Dollar is strong this will feel relatively stupid, but if the Dollar were ever to take a bath that’s the time when currency diversification would play an outsized role in helping to stabilize your financial plan. After all, you need certainty the most when things become uncertain and that often coincides with domestic currency devaluation.

The more interesting and timely discussion is whether we’re on the verge of a new regime at present. Timing a huge secular macro shift is impossible, but one thing we know is that Donald Trump wants to make the US more competitive on the global trading stage. And a weaker dollar would be an obvious part of that. So it makes sense that the Dollar is down 3% since inauguration day. Trump’s foreign trade agenda should make the Dollar weaker if it’s successful. This is consistent with his first term as well, but he’s clearly leaning into the tariff policies more aggressively this time around.

So, how will it all play out? Who knows? But at a minimum we know that these things tend to ebb and flow across time. And given the Dollar’s huge run in the last 15 years we’re probably due for a period of Dollar softness. Especially if Trump gets what he wants. And all of this strengthens the rationale for owning a portfolio of globally diversified stocks.

1 – There are other factors in play here, of course, but I am just highlighting one of the primary drivers of relative performance.