Here are some things I think I am thinking about:

1) Why Does the Stock Market Hate Tariffs?

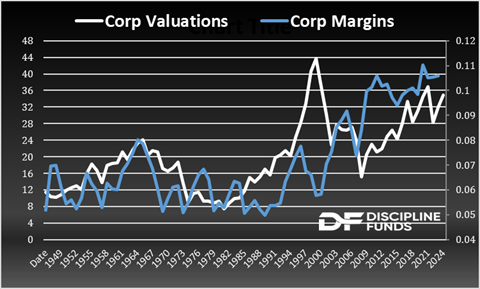

One of the predominant trends in Corporate America over the last 40 years has been an expansion in margins. It’s one of the primary drivers of the great valuation expansion over this time. As more of national income has flowed to corporations their valuations have expanded. And a big part of that was globalization and the ability to outsource labor and materials costs to less expensive regions of the world.

The recent stock market downturn reflects the concern that some of this is being unwound. And the reason for this is rather simple. Tariffs are a corporate fee paid by the importing company at the border. In order to maintain margins they have to pass that cost on OR eat it themselves. Here are the primary ways this occurs:

1) Raise prices for consumers.

2) Reduce investment and make labor eat the cost.

3) Increase investment in a timely and costly supply chain adjustment.

4) If none of the above then shareholders eat the cost via lower prices.

The problem today is US consumers are pulling back and firms aren’t ready to invest in a new supply chain. So firms want to pass on the cost to consumers, but consumers are looking like they’re not having it. And since firms aren’t ready to shift their supply chains just yet that means we’re looking at #2 and #4 with some mix of consumers eating higher prices. This hurts corporate margins, which feeds into lower valuations. So, it might not be the end of the world. Heck, this might not even cause a recession, but it definitely isn’t great for corporate margins and that’s why the stock market hates these tariffs.

2) Bear Markets Vs Bare Markets.

The S&P 500 officially entered “correction” territory today. That’s the arbitrary -10% level from its recent high. It’s the seventh fastest 10% decline since 1929. But let’s not overreact here. If the market moves down further and hits the -20% level then people will say we’re in an official “bear market”. But after 15+ years of mostly upwards markets it’s important to remember that there are bear markets and then there are BARE markets. A bear market is a scary market. But a bare market is when the tide goes out and we find out a bunch of people have been swimming naked. That usually involves some level of corporate fraud (think, Madoff, Enron), malinvest and excess leverage following a huge bull market and this isn’t just scary – it’s terrifying. The bare market is terrifying because it has a fundamental underlying driver where the excesses of the boom get exposed in a fundamentally driven bust. These are the really scary environments because we all look around at one another and say “holy cow, there’s a real fundamentally scary reason this is all happening and we don’t know if there are more shoes to drop”.

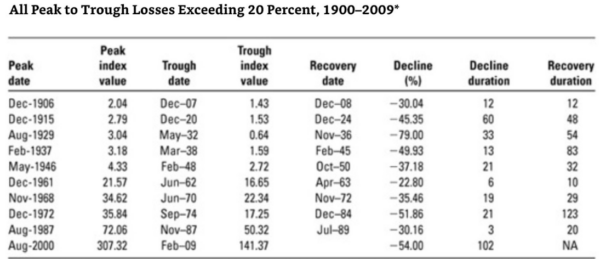

Anyhow, this obviously isn’t a bare market. Heck, it’s not even the -20% bear market yet. So let’s not get ahead of ourselves, but it’s always nice to remember that these things can and do happen. And here’s a nice overview from Jim O’Shaughnessy’s legendary book, “What Works on Wall Street” for the inflation adjusted drawdowns in the S&P 500:

The story is simple. -10% is nothing. Tis but a scratch as some might say. And while 30%+ declines are unlikely they can and do happen regularly throughout someone’s lifetime. So if this recent downturn has you frightened you might want to revisit that asset liability mismatch I talked about the other.

3) Big Drops in Inflation Coming?

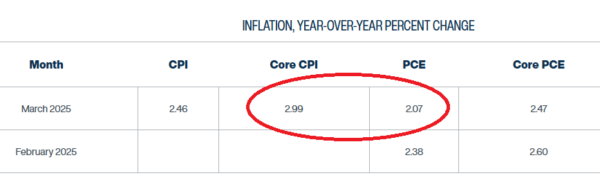

Here’s something interesting from the Atlanta Fed’s Inflation Nowcast – March might be the first time since 2021 that we had a 2 handle on core CPI. Perhaps more importantly, March is also going to be a near exact 2% reading on the headline PCE and a dip to 2.47% on the core. That is inching very close to the Fed’s 2% target. So, for all the the talk about tariffs and rising inflation expectations it still looks like inflation is very much entrenched to the downside. And if anything, all the economic uncertainty of the last few weeks probably means there’s downside to these readings. This means that by the time these readings come out next month we should expect the media to be talking endlessly about how inflation is now nearing target which could open the door for rate cuts later in the year if the economy softens….

So, it’s not all bad news out there. Heck even egg prices are crashing this week. Of course, that’s terrible for me because I’ve been farming my own chickens for 10+ years now and I thought I had finally made the greatest trade of my life, but now it looks like the great egg bubble might be imploding. That’s what I get for trying to corner the egg market.