Here are three bad ideas I think I am thinking about:

1) The Reserve Currency Issuer Doesn’t Need a Strategic Currency Reserve.

The Trump administration announced a Cryptocurrency Reserve Fund that would hold Bitcoin, Cardano, Solana and Ripple. They seem to think the US needs this fund to help support crypto innovation and potentially hedge against currency risks. I don’t know how else to say this so I’ll just be blunt about it – this has the potential to be one of the most extraordinary misuses of taxpayer funds based on some of the most extraordinary misunderstandings I have ever seen. Let me explain.

First, the USA is the global reserve currency issuer by a huge margin. Foreign reserves of USD are 54%. The Euro is a distant second at 19% and the Yen is just 5%. There is no currency that even comes close to the USD. Importantly, people seem to get the causality of this wrong. There’s a lot of half-truth narratives about Bretton Woods, the Petro-Dollar or other myths about how the Dollar is only a reserve currency because the USA somehow strong-armed everyone into using the USD. There might be shreds of truth to these stories, but it’s really much simpler in my view – foreign economies use Dollars because the US economy is the largest, wealthiest and most trustworthy economy in the world. So, when China does business with the richest consumers in the world they get Dollars. They’re not using Dollars because they got fooled into some agreement. They’re using Dollars because they like getting revenue from the largest and wealthiest consumers on the planet. So, as a result of this foreign governments end up stockpiling Dollars.1 That’s it. It’s really that simple. And that isn’t changing any time soon. In fact, the US economy appears increasingly robust compared to every foreign economy.

This crypto reserve fund idea is based on the idea that we need a reserve of other assets to help bolster the Dollar and maintain its status. But such a fund does nothing to help the Dollar and very likely undermines it. After all, we’re the issuer of the reserve currency. We don’t need to stockpile Dollars or other assets because we create the Dollars.2 But it gets worse. The reason the USD is so dominant is because our output is so dominant. The US economy is the wealthiest, most innovative and productive economy in the world. That’s why the Dollar is in such high demand and it’s the main reason why we’ve had low inflation for most of the last 40 years. So, if you want to bolster the Dollar you need to incentivize output. Instead, this idea would require us to either tax hardworking Americans so we can stockpile meme coins that don’t add anything to the productive capacity of the economy or worse, we’d have to run larger deficits to fund these purchases. This is madness.

I can understand some argument where you want to invest in the infrastructure of the crypto space to incentivize us to be the leading innovator in the industry. But a reserve fund doesn’t achieve this any more so than stockpiling gold at Fort Knox helps us achieve dominance in the gold industry. So I don’t know what this fund would achieve other than creating artificial demand for assets that have minimal underlying intrinsic economic value.

Of course, there are reasonable arguments for strategic reserves of assets with intrinsic value. We stockpile oil because it has an intrinsic value and obvious economic utility and the reserve allows us to manage the supply of an asset that is essential to the economy. But why in the world would we use taxpayer Dollars or borrow money to buy something like Cardano, which is an asset with a virtually meaningless $30B market cap? I think you could maybe, maybe make an argument that a Bitcoin reserve fund makes sense based on its larger network and broader global adoption as a gold like alternative. But even that is a stretch in my view.

2) The Tariffs are Starting to Look Like a Very Bad Idea.

I probably need to file this in the “way too early to declare” pile, but the early reads on the tariffs look really bad. Monday’s ISM report was filled with commentary about how the tariffs are hurting corporations. And then we got another big downward revision in the GDP Now because of it. And it’s the exact thing I was worried about in my last note – big downward revisions to consumption. The revision to -2.8% GDP included an upward revision in the trade data, but big downward revisions in consumption after new orders tanked.

This one’s hard to interpret because we’re likely to get upward revisions from inventories and consumption later in March when the data updates. GDP Now doesn’t update other metrics until they come out so we’ll get some uptick in this reading before the end of this month. But Monday’s downward revision in consumption was a pure downgrade and based on my reading of the data we’re now looking at a very anemic +1.5% GDP reading after this data updates. And while the import data is making this look worse than it is the realistic worry here is that corporations are getting hit with these big tariffs, they’re stockpiling inventories and they’re going to try to pass on the added costs to consumers. But if consumption is softening then that’s not going to happen and that means labor and shareholders are going to eat any price increase that consumers don’t eat.

All of this is causing a lot of turbulence in the financial markets as they grapple with the reality that this tax on corporations might end up being more of a tax on corporations than the consumers they hope to pass these tariffs on to.

As I said, it’s way too early to start jumping out of windows over this, but it doesn’t look great for now.

3) Dalio Predicts a US Debt Crisis.

I enjoyed the most recent episode of the Odd Lots podcast in which Ray Dalio predicts an impending US debt crisis within three years if something isn’t done to reduce the deficit. I am a 20 year broken record on this topic as I’ve been hearing this “same “USA is bankrupt” narrative for literally my entire career. I love Ray Dalio and I wrote an entire chapter in my forthcoming book about his investment approach. And while Dalio is a wonderful macro thinker I just don’t find his argument all that convincing on this particular topic. Or rather, I should say that I think he made the fatal mistake of predicting a dire outcome with a specific time horizon. Let me explain why I think his view is wrong over this specific time horizon.

First, Dalio makes the old Bond Vigilante argument when talking about demand for government bonds. He likens government debt to corporate debt and says that interest rates could shoot higher and cause a debt spiral if there’s a lack of demand for debt. I think this misunderstands the driver of interest rates. Interest rates are determined by the Fed based on inflation. The demand for government liabilities can influence interest rates, but there’s absolutely nothing stopping the Fed from setting interest rates at 0% in perpetuity if it really wants to. The Fed can always smash the so-called “bond vigilantes” if they want to because they have a bottomless pit of money. Smart bond traders know this and that’s why they incessantly focus on Fed policy. The result of this is that it often looks like the market sets interest rates, but the market is mostly just front-running where they think the Fed will go in the future. And yes, the Fed often follows those market signals, but don’t confuse the cart for the horse here. The driver of the cart is the Fed and they are very much in control of the horse even if the horse might appear to be pulling the cart around.

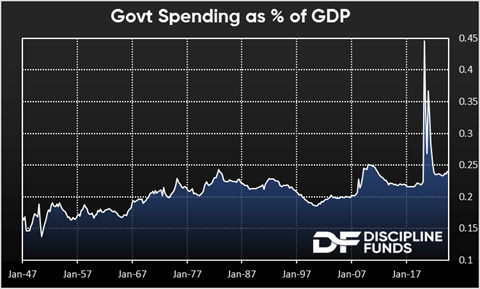

Second, he’s arguing that inflation (and higher rates) stems mostly from government deficits. The government cannot run out of money in any meaningful sense. It can run out of demand for its money which results in high inflation. But inflation has many causes and government spending is only one factor here. On average, we know that government spending is not the dominant driver of inflation. After all, government spending as a % of GDP has been rising modestly for 70 years. But interest rates and inflation collapsed lower for most of the last 50 years. The cause, in my view, is simple – we’ve had slowing overall growth due to slowing population growth and technology and innovations have resulted in an explosion in supply of goods and services. And when you combine slowing demand with exploding supply you get lower rates of inflation. The government has tried, desperately at times, to get inflation higher. But even large interventions like 2008 had little impact on inflation. It took something truly gigantic like 2020 to get inflation up. And to achieve that the government had to spend 45% of GDP. In other words, it had to DOUBLE its current level of spending per year to get inflation up.

So, we know that government spending can cause inflation. Covid proved that. But we also know that government spending as a % of GDP is 24% and has averaged 20% for the last 70 years. And it takes something in the realm 30-45% to cause high inflation. But as it stands now, government spending as a % of GDP is more or less in-line with where it’s been for the last 15 years and so I would argue that given current levels, other factors will play the more important role in inflation in the years to come.

Third, he doesn’t differentiate the types of QE being implemented. Dalio consistently says that the signal for this event is the Central Bank buying bonds. He cites the QE experience as evidence of this and a creeping level of government intervention. But we didn’t implement QE because there was a lack of demand for government bonds. We did it for the exact opposite reason! The Fed was very specifically trying to get investors to move OUT OF bonds because inflation was too low. I agree with Ray that if the Fed had been buying bonds during a super high inflation then that would be an indication that there’s not enough demand for the bonds. But that’s not what the 2008 and 2020 QE experiences entailed. They were buying bonds to suppress interest rates and try to get investors to rebalance their portfolios OUT OF bonds and into stocks and other assets. So the causation for QE matters enormously in this context. If we were Zimbabwe with sky high inflation and the Fed stepped in then I’d agree. But the recent versions of QE have been implemented because inflation was too low, not because inflation was too high.

Lastly, this all ties into the first point about reserve currency status. The USA has the best fiat currency in the world, by a large margin. The demand for the Dollar is unmatched and that helps keep inflation low. So, if the USA experiences a hyperinflation and debt spiral then that means the entire system is collapsing since the US financial system underpins the entire system. Do you know how dramatic that is? We’re talking about an armageddon-like collapse of the fiat system. And I just don’t see it. There are so many other countries that will collapse before the US financial system ever does. You’ll see the dominoes go as the UK, Japan and many other collapse long before the USA does. So I guess it’s possible that the US system will one day collapse, but it’s the best house in a bad neighborhood of fiat currencies and you’ll see many other houses burn before the fire gets to the US house.

All that said, I do think Dalio is directionally correct on the deficit. If we were to keep running deficits of 6-10% of GDP per year then there’s a legitimate risk that my second point becomes increasingly wrong as the deficit and government spending become a larger and larger part of overall annual economic spending. Government spending as a % of GDP is currently about 24% and if it were to consistently grow to 30%+ then I think government spending would become an increasing driver of inflation that could slowly spiral. But we’re not there now. And I don’t see a scenario in which we’ll get there in the next 3 years unless Trump really explodes the deficit. That’s not totally implausible, but Treasury Secretary Bessent appears to be very much onboard with Dalio’s 3% target so I’d be surprised if government spending as a % of GDP explodes in the coming years.

Well, sorry for all the negative banter. But things are pretty negative right now so it seems appropriate. I’ll try to be more upbeat next time. Until then, stay disciplined.

1 – I sometimes get a good chuckle about stories saying “China is dumping Dollars!” or things like that. No, they got those Dollars doing business with America and now they’re choosing to give them to someone else. They might be dumping them, but someone else is buying them after they previously bought them….Whether that is hurting the actual value of the asset is contingent on many other factors.

2 – A useful analogy for this is to consider corporate stock. Apple is the issuer of Apple stock. They do not need to stockpile Apple stock or other company stocks to enhance the value of Apple stock. What they need to do is optimize their own output so that the value of Apple stock increases with time. Yes, they could theoretically buy other companies or make bets on other corporate stocks (like Berkshire Hathaway does), but this isn’t the core driver of their stock value and they absolutely don’t need to stockpile other stocks to enhance the demand for their own stock. The government operates in much the same capacity where, if they are going to spend money in an effort to enhance demand for the USD, it should be focused on optimizing output or achieving public needs that Capitalists won’t engage in (like fighting wars, putting out fires, etc).