Here are some things I think I am thinking about this weekend:

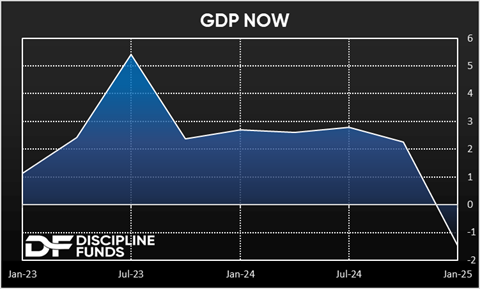

1) A Negative GDP NOW Print!?!

It was a wild week in the markets, but the biggest news of the week dropped on Friday when the Atlanta Fed revised their GDP Now estimate from +2.3% to -1.5%. Yes, you read that correctly. NEGATIVE 1.5%. That’s a reduction of 3.8%. What in the world just happened?

It’s impossible to know the exact cause here, but the obvious guess is the tariffs since the latest revision revolves primarily around import data and updated consumption data. My best guess about this big revision is we’re seeing firms front-run the tariffs which resulted in a -3.7% contribution from net imports. There was also a meaningful decline in the consumption item from 1.53% down to 0.87%. It sounds bad and some people were having a panic attack about this, but I wouldn’t go jumping to conclusions just yet.

First, this sort of change is a one-off effect or a short-term effect due to the sheer size of the tariff threats that were recently initiated. Second, the decline is very likely to show up as an offset in some future dataset when we get clearer reads on inventories and consumption. That likely means that firms will show up with a large inventory build or consumption will jump by a larger than expected margin. And when that data shows up we should see an upward revision to this reading. It might even be very strongly positive.

Either way, it’s way too early to start getting worried about a recession based on this. The NBER would need to see much broader weakness to declare a recession. For example, you’d need a prolonged increase in unemployment to trigger an official recession. And we’re not even close to something like that just yet. At the same time, if the consumption bump doesn’t materialize then there’s a real chance that firms are building inventories that are going to sit on shelves for now. So, if consumption is softening (and I wouldn’t be shocked if that’s true) then a very low rate of GDP change would not be surprising. But I wouldn’t expect this -1.5% reading to stick unless the broader economy really starts to devolve in the coming months. That’s not at all out of the realm of possibility and I fully expect low growth this year, but I wouldn’t panic over a recession just yet.

Check out our Macro Dashboard for more fun and nerdy data.

2) Is This a Stagflation?

Speaking of recessions – one piece of confusion that I am seeing in many places is the idea that we’re currently undergoing or at risk of undergoing a stagflationary environment. Stagflation is when the economy has stagnant growth with high inflation. Periods in the 1970s and early 80s were the classic sort of stagflation where growth was low and even negative at times and yet inflation remained well above average.

To put this in perspective consider the 1974 recession, 1980 and 1982 recessions. During these recessions real GDP turned negative, but PCE inflation remained well above 5% the entire time. During the 1974 recession PCE inflation averaged 10%. During the 1980 recession inflation averaged 10.9%. And during the ’82 recession inflation averaged 6.5%. That’s not remotely close to what’s happening today. For example, PCE inflation is currently at 2.5%. It’s averaged 3.5% over the last 50 years. So we’re actually below average now!

I suspect that people have PTSD from the Covid inflation. And rightfully so. The price level surged and now it’s remained sticky for longer than most of us expected it would. But make no mistake – the rate of change has slowed very meaningfully from just a few years ago. And so the “return of the 1970s” mantra has been wrong. And yet that narrative is still sticking around. Is it possible that inflation could surge again? Sure. But it would have to surge by quite a lot from its current levels for this to qualify as anything remotely close to a stagflationary environment. As of now we don’t have stagflation. We just have low growth with low inflation even though inflation is still very modestly above the Fed’s 2% target.

3) Buffett’s Cash Hoard.

There has been a lot of talk about Buffett’s huge cash hoard that was presented in the recent Berkshire annual report. Buffett said:

“Having loads of liquidity lets us sleep well … during episodes of financial chaos that occasionally erupt in our economy, we will be equipped both financially and emotionally to play offense while others scramble for survival.”

One of the investment strategies I wrote about in detail in my forthcoming new book was Buffett’s 90/10 stock/T-Bill portfolio. It’s a very aggressive portfolio and he likes to utilize the T-Bill allocation as an insurance hedge of sorts. It’s there to keep him calm, but it also gives him a certain degree of optionality where he can unleash cash when the time is right. But most of us can’t stomach a 90/10 because the 90% part of the portfolio is too volatile. And on average the global financial markets are 45/55 stocks/bonds so most of us prefer a much safer component of our portfolios to complement the stock allocation. But why is Buffett able to remain so persistently aggressive?

The first element here is that Buffett is always playing the long game. He correctly thinks of stocks as super long duration instruments and he’s always patient to allow stocks to perform. Even though he’s using cash as dry powder he does not time the market in the way that many traders try to do by trading in and out of the market. He’s just using cash to buy and then patiently hold. He can be aggressive because he’s patient enough to allow his stocks to accrue value over very long periods of time.

But the second, and arguably more important element here is that Buffett has very low expenses and financial needs. He famously lives in the same house he bought in 1958. And so he has very low expenses and liabilities relative to his assets. This means he has a huge asset-liability mismatch, except in the opposite way that most of us do. Most of us have significant short-term expenses relative to our incomes and assets. And so we need more safe assets or income to help us fund those expenses. But Buffett has such low expenses and liabilities that his assets can be incredibly aggressive. Of course, getting the assets and income is the hard part, but we can all control our liabilities to some degree and while Buffett is commonly thought of as someone who has mastered asset management we don’t often talk about how he has also mastered the art of managing his liabilities by having very low financial needs.

That’s all from me for now. It feels like things are starting to get more interesting in the global economy and financial market so I hope you get some rest this weekend. And as always, stay disciplined!