Here are some things I think I am thinking about.

1) The WalMart Warning.

Markets fell over -1.5% on Friday as global PMIs disappointed on the downside and WalMart warned about their earnings for the year. How worrisome is this? I think Chris Williams of S&P summed it up best when he said:

“The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices. Optimism about the year ahead has slumped from the near-three-year highs seen at the turn of the year to one of the gloomiest since the pandemic. Companies report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments. Sales are reportedly being hit by the uncertainty caused by the changing political landscape, and prices are rising amid tariff-related price hikes from suppliers.”

I’ve been pretty clear on this one so far. My baseline view is that Trump’s policies are more likely to be disinflationary than anything else with the risk of actual deflation if they cut too much, too fast. In total, the combination of reducing immigration, tariffs and government job cuts all end up with the potential to reduce aggregate demand in the short-run. And if they cut a lot more of the government than expected then we could start to see a very material impact to future labor reports.

The comments from S&P are especially interesting to me because suppliers are trying to front-run the tariffs, but consumer demand is softening which means firms are likely to have trouble passing on any price hikes. In other words, firms are trying to raise prices in anticipation of higher input prices, but there’s a good chance they aren’t going to be able to pass on those input costs if the demand isn’t there.

How worrisome is all of this for now? I don’t think we should be overreacting just yet. My recession rule isn’t showing any signs of increased recession risk just yet, but as I noted there is a good chance this all starts to impact future labor reports so we’ll be keeping a close eye on both weekly jobless claims reports and the monthly employment reports to assess the near-term risks to the economy.

2) Are Foreign Stocks Finally Beating Domestic Stocks?

I loved this comment from Meb Faber about international diversification. I am paraphrasing, but he says that international investing has worked for 98% of the 50 largest countries in the last 15 years. Of course, the one place where it hasn’t worked so great is…the USA. In other words, if you’d diversified out of domestic stocks you’d have benefitted from following global market cap allocations because the USA has trounced everything. If, on the other hand, you’d been a US based investor the story didn’t work out as well. You still did just fine as Vanguard Total World has generated 12.5% per year over that period, but Vanguard Total Domestic generated 16%. So, if you lived in any other country you wanted to own US stocks, but if you lived in the US you wish you’d been only allocated to the US.

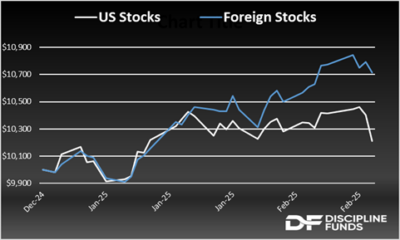

I always highlight that the main reason to own foreign stocks is to diversify domestic currency risk. The US Dollar has been on a 30% tear for the last 15 years, but it’s down 1.5% so far this year. And the result is that US stocks are up 2% while foreign stocks are up 7.2%. Is this finally the year? Is this finally the start of a period of Dollar decline and foreign stock outperformance? It’s only been 6 weeks so let’s not get ahead of ourselves, but it does highlight the benefit of owning foreign stocks when there’s domestic currency risk. And given the Dollar’s huge outperformance for the last 15 years I’d argue that this is certainly a period where some foreign diversification has the potential to add beneficial diversification over the next 15+ years.

3) The Future of Rates and Inflation.

One Trump policy idea that isn’t getting enough attention is his expectation of interest rates. In the last 6 weeks he has repeatedly stated that he will “demand” lower interest rates in the coming years. And I think he’s going to get what he wants because he’s going to install someone at the Fed in 2026 who gives him what he wants. I know a lot of people will say the President doesn’t control the Fed or that the Fed Chief doesn’t control interest rates, but they certainly can have a lot of influence. And so imagine scenario where interest rates are still at 4%+ in 2026 and Powell is on the verge of ending his term. Inflation is still in the 2-3% range and still looking slightly sticky while the economy is softening further. In that scenario I think we get a new Fed Chief who wants to aggressively give Trump a lower and more stimulative interest rate regime.

So the way I view it is that his policies probably create some downside interest rate risk because of the potentially disinflationary risks. And if we don’t get those lower rates this year (we have so far) then we’ll get them in 2026 when he installs a yes man at the Fed.

To summarize all of this I’d argue that Trump’s policies are likely to be marginally disinflationary, but even if they’re not you’re still going to end up with lower interest rates because the Fed Chief he installs will give him lower interest rates even if inflation isn’t as low as the Powell Fed would like it to be at that time.