Here are some things I think I am thinking about:

1) The Lifetime of Stocks is…Shrinking.

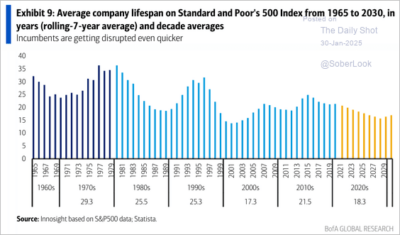

I loved this chart from Bank of America which shows the average lifespan of companies in the S&P 500 since 1960. The message from the bank is that incumbent firms are being disrupted much more rapidly. And it’s true. Many of the largest firms we all know of today did not even exist 20 years ago. This is good and bad.

Higher turnover means we have a faster pace of what Schumpeter called “creative destruction”. That means new entrants are innovating quickly and knocking off stale incumbents. It’s bad in the sense that this makes stock picking a lot harder because you can’t just buy and hold firms you expect to be around for decades.

But the thing I really like about this chart is that, despite the shrinking lifetime, that lifetime is still extremely long at 18.3 years. We spend so much time talking about the stock market on a daily, weekly and annual basis, but this data shows that stocks are, at a minimum, multi-decade instruments. This is what I try to communicate with the Defined Duration investing strategy. Stocks are inherently long-term instruments and they need to be utilized in a portfolio in a manner consistent with long-term thinking. That means thinking in truly long-term time horizons across decades and not years. This is why I always ignore short-term market narratives about the stock market. No one knows what stocks will do in the short-term because you cannot make a long-term instrument behave like a short-term instrument no matter how much you trade it.

2) Bitcoin Going to $0?

Gene Fama kicked the Bitcoin hornet’s nest this week when he appeared on a podcast and predicted that it would go to $0 within the next 10 years. I think this prediction is likely to be wrong and indicative of the academic sort of thinking that most traditional financial theorists utilize. The thing is, from an asset pricing perspective, an asset like Bitcoin is virtually impossible to value. In traditional finance we like to use things like discounted cash flows or similar cash flow based metrics to value an asset. We assign multiples of revenue, EBITDA, etc. But when an asset doesn’t generate cash flow it becomes difficult to value.

Bitcoin is more like a piece of fine art than a cash flow generating corporation. And to value something like a piece of art you need a more subjective asset pricing model. Personally, I don’t have a strong opinion on that as it pertains to Bitcoin’s specific price and the primary use case I consider with Bitcoin is fiat currency insurance. That is, if you live in a 3rd world country where the risk of currency collapse is high then owning something like Bitcoin makes a great deal of sense. If you’re an American using the world’s reserve currency I don’t think that argument is nearly as compelling. But I find it very compelling from the perspective of any 3rd world economy, especially those with unstable authoritarian economies. What is insurance worth to someone? That’s a super personal question and one that an asset pricing model isn’t going to help you quantify.

But $0 is an extreme sort of prediction. And it misunderstands the huge underlying infrastructure and network effect that has developed around Bitcoin. This isn’t merely something trading on pure speculation. There’s now a trillion dollar infrastructure in Bitcoin mining, embedded (incentivized wealth) and regulatory apparatus that utilizes this asset. None of that means it can’t fall significantly and given its history it wouldn’t be remotely surprising if it falls 80%+ at times, but for it to go to $0 you’re talking about the collapse of the entire global Bitcoin mining industry, the now billion dollar ETF structure and a complete and total collapse in the confidence that supports this asset. Could that happen? I guess it could in an environment where, for instance, the power grid went out forever, but the probability of that happening in the next ten years is extremely remote in my mind.

Of course, whether any American should own Bitcoin as fiat currency insurance is a whole other question….Fama would probably disagree with my framing of it as fiat currency insurance, or I supposed he’d prefer other assets to insure that risk, but I guess that’s why I don’t consider myself a disciple of Modern Portfolio Theory.

3) The Return of the 2010s?

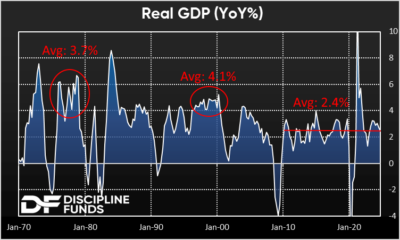

One of my dominant themes over the last few years was the theory that the post-Covid economy would eventually mean revert right back to the pre-Covid economy. In other words, once the dust settled on Covid and all that stimulus, I expected the economy to start looking a lot like it did in the period from 2015-2020 when inflation was low and growth was low, but stable. That was a perfectly good environment, despite the low growth. In fact, I’ve argued that low and stable growth is better for a big economy than experiencing high and unstable growth.

We got a pretty interesting piece of data this week in the GDP report which I believe is starting to confirm this. RGDP came in at 2.3% which was almost perfectly in-line with the average GDP we saw since 2010. So, we already know that inflation has moderated almost to the Fed’s target and now we’re seeing GDP readings that are more consistent with the pre-Covid period.

But the primary takeaway from this developing trend is that this environment isn’t the return of the 1970s. It’s actually looking like it’s not remotely close to the 1970s. And more recently we’ve heard comparisons to the late 90s. But that was a true economic boom with average RGDP of 4.1%. This also doesn’t look like that. So, in my view the return of the pre-Covid economy looks to be well on track. And that’s not necessarily a bad thing. Of course, the curveball in all of this could be Trump’s economic agenda. The tariffs combined with significant government spending cuts create some downside risk to this forecast. But we’ll have to wait and see how much of this is negotiating bluster and how much of it is real.