Here are some things I think I am thinking about:

1) A Win for Assflation?

My greatest contribution to the field of economics is my General Theory of Assflation. No, that’s not a theory about the obesity epidemic and its causes. I am referring to my explanation of “asset price inflation” relative to QE. Perhaps the most common narrative in the last 15+ years has been the theory that the stock market was only going up because of the Fed and asset price inflation. One of the big conundrums in the post-GFC era was the low inflation despite QE and all that “money printing”. You know the theory by now – the Fed prints trillions via QE and the banks were supposed to loan out all that money and then the big inflation comes. But the big inflation never came and when I explained the causality of this (QE doesn’t create inflation because it just swaps safe assets for other safe assets and doesn’t actually change the quantity of outstanding safe assets) people would always respond by saying the money flowed into stocks and created asset inflation.

I jokingly referred to this as assflation because how else can you respond to things that seem obviously wrong, except with a joke? My argument for why stocks were going up was because there was real fundamental improvement in the economy. You didn’t need a conspiracy theory to explain it. You just needed to look at corporate earnings and profits. And there was no mechanism by which the Fed could be singlehandedly causing that.

Anyhow, the Theory of Assflation has been proven correct in my opinion. After all, stocks are now booming and the Fed has been raising interest rates and reducing their balance sheet all the while. If the Fed had been the primary cause of asset price inflation then we should have seen very significant asset price deflation since the Fed started raising rates. Instead, we’ve seen the opposite.

So, to the Nobel Prize Committee – I will be waiting at home for that phone call.

2) Assflation Everywhere?

I’m gonna lose some readership by overusing the word assflation here, but you’ve gotta whittle out the weak hands somehow, right?

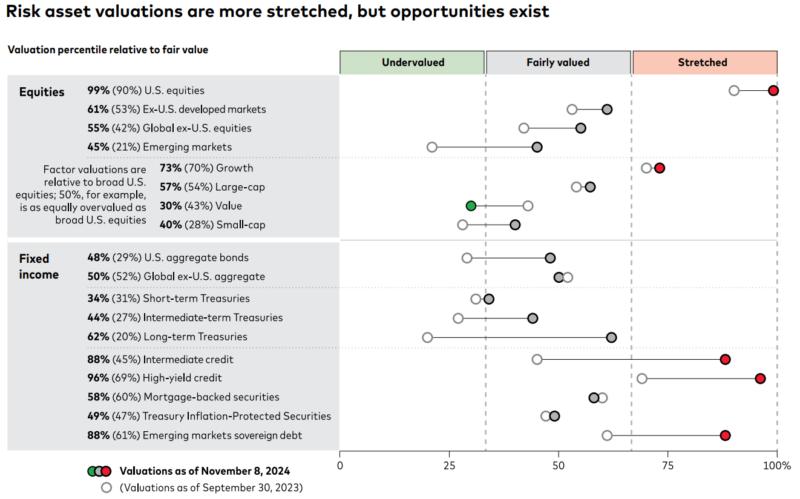

I loved this chart in Vanguard’s annual outlook. When the stock market rips like it’s currently doing people have a tendency to look at it and just broadly declare that stocks are overvalued and therefore uninvestable. But are they? And if not then where is the value? This chart is wonderful as it breaks down the assets by valuation in a more granular manner.

I won’t dive into too much detail here as the chart is self-explanatory, but I do find it interesting that emerging markets and government bonds in general are among the most fairly valued. If you held a gun to my head and forced me to pick two asset classes that I’d feel very comfortable owning for the next 10 years I think those two would be near the top of my list.

3) But Valuations Don’t Cause Assflation!

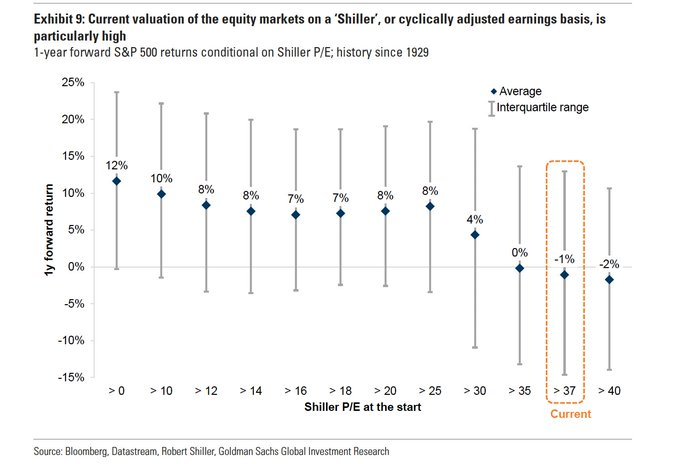

Of course, when you mention valuations we inevitably get into a discussion about timing the market with valuations. And then we have to have a discussion about how valuations aren’t a good short-term price predictor, but are often a good long-term predictor. But then Goldman Sachs comes in to ruin your Christmas with this unfortunate chart showing that current valuations are consistent with negative 1 year returns. Whoa, 1 year? That’s…awfully short.

Now, I have to admit that I hate using valuations to think about stocks 1 year out. In fact, I just generally hate thinking of stocks as being anything less than 10 year instruments. But valuations are extraordinarily stretched according to the Shiller CAPE. And while I wouldn’t make 1 year predictions using this data I think it’s perfectly reasonable to temper expectations about future 10 year stock market returns.