Sorry for the brief hiatus. I’ve had my head down working on my new book which is due in a few weeks here. I am having a blast writing it which is either indicative of my own delusions or something readers will really enjoy. Perhaps both. Anyhow, here are some things I am thinking about in addition to my book:

1) The Strategic Bitcoin Reserve. There’s increasing chatter about the US government starting a “strategic Bitcoin reserve”. I will be blunt about this – I have no idea why any government would want to do this. When the world was on a true gold standard it made sense to have reserves of gold because you needed gold to support the money supply. Today’s system is not a fixed money supply system. The value of the money we create is only as good as the goods and services denominated in that currency. It has nothing to do with gold or any fixed monetary unit, not even central bank “reserves”! So governments don’t need to hold reserves of Bitcoin or gold. In fact, the government doesn’t need to save money at all because it has a printing press.

The government needs us to produce real resources, but it doesn’t need to save money to be able to spend money. And that’s my major problem with the idea of a strategic Bitcoin reserve. In theory, this reserve would protect us from potential currency devaluation, right? But you’re telling me that we should print fiat money to buy an asset that protects us from printing fiat money? That doesn’t even make sense. If we’re going to print money to protect the value of our currency then we should be strategically investing that money in endeavors that create real resources or are accretive to economic value in the future.

At times in the past I’ve expressed my interest in some sort of a strategic investment fund that would harness the printing press to create more venture capital style funding for entities that needed it. It’s controversial to have the government do that, but if we’re going to print money to protect the currency you want to do that in the process of innovation and mobilizing real resources, not buying rocks or digital rocks. Printing money to buy rocks makes no sense and should do nothing but create inflation and make the problem worse!

Anyhow, Bloomberg had a good editorial opinion on this. They call the idea a “scam” which is probably going a little too far, but I think it’s fair to say this is a very poor use of taxpayer dollars.

2) Exploding US Market Capitalization

I was updating a section of my new book and I was mind blown by this statistic – the USA is now 63.5% of all global market cap. Up from 60.5% at the start of the year. In fact, it should rebalance to almost 65% at some point in the next quarter since that’s where the FTSE All World Index now sits.

The US stock market has been the only game in town for years now. The last 3 years have been especially bad as global developed stocks have generated just 2.7% per year while US stocks have generated over 10.5%. If your benchmark is global financial assets well, the last 3 years have been pretty dreadful unless you’ve been massively overweight US.

The most amazing part of this data is that the next closest market is Japan at just 5.6%. No other country comes remotely close to competing with the US dominance in global market valuations. Sure, China is closer on a full cap basis, but over 55% of Chinese stocks aren’t investable so even China is small in comparison. And their market has been decimated in the last few years.

It’s wild stuff. The rah rah USA part of me is super happy about this. But the asset allocator in me looks at this and wonders “how is this not a huge potential risk for US investors”? It comes down to the old debate about momentum versus mean reversion. If you believe in mean reversion you think this trend has to reverse at some point. But if you’re the momentum investor you think the USA will just eat the world. Personally, I don’t think you have to pick one or the other and that’s kind of the beauty of holding the whole world allocation. But man it’s hard to look at those international allocations and not wonder if they’ll ever play catch up….

3) Invisible Independents

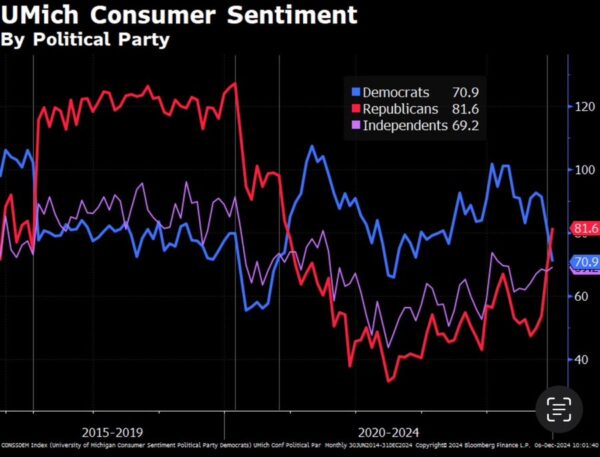

I was laughing at the online discourse last week after the U Michigan sentiment survey was updated and the figures predictably flipped after the election. Republicans are now optimistic and Democrats are now pessimistic. The data set that barely budged was Independents. And yet the discourse online was all about how the data is useless because the two extreme sides are so volatile. But what about those Independents? Why do they always get ignored?

It’s an interesting piece of the data because when you view the economy thru the lens of Independents things look just okay. Not bad, not great. Which I would say is pretty accurate. And my guess is that most people in this country, despite being forced to pick a side in most battles, probably overlap in numerous ways that make them more Independent than they are categorized as. But instead of the Independents dominating the narratives we tend to hear mostly from the two polar opposite parties.

Anyhow, nothing surprising there, but it drives me nuts how people don’t spend more time thinking about the many overlaps we have here and instead focus on the extremist ways in which our politics disagree. It seems to be getting worse as I get older. We’re all getting increasingly trapped in our little political silos and ignoring everyone else. The naively hopeful optimist in me still thinks it will get better before it gets worse, but I’m not so sure anymore….mean reversion isn’t a very popular thing these days, in markets or politics.