Here is the ONE thing I think I am thinking THREE times this week. If you prefer video you can also see my thoughts on the big rate cut from my interview on Schwab Network in which I discussed the relevant conclusions.

1) The Fed Goes 50!!!!!!

Last week I wrote about whether the Fed would go 25 or 50. I said I would personally go 50, but that the Fed would more likely lean to 25. But Jerome Powell continues to surprise and they went with the 50. This was the right call in my view. Inflation is down to 2.6% and unemployment is starting to trend in the wrong direction so the 5.33% effective Fed Funds Rate was starting to look too restrictive. This cut will bring the effective rate to 4.8% so we’re still in restrictive range, but less so.

When the August employment report came out the market began to price in rising odds of a hard landing. It became obvious that the Fed should have cut in July. So the way I view this situation is that they’re essentially acknowledging that they should have cut in July. In other words, the September 50 bps move isn’t best thought of as a single 50 bps cut, but better thought of as a make-up cut and two 25 bps cuts from July and September. The Fed made it clear that they’ll be shifting to a 25 bps schedule going forward with two more cuts this year in November and December and a target rate of 3% at some point in 2026.

My conclusion on 50 is that I am surprised and impressed. The Powell Fed was late to raise rates in 2021, but then quickly made up ground. And now that labor market data has softened and inflation has slowed materially they’re again acting more proactively. The argument that they’re now behind the curve is a lot less convincing since they’ve now established pretty clear expectations going forward, but without doing so in a manner that will cause a speculative credit binge and surge in inflation. So kudos to the Powell Fed.

2) What are the Risks of Going Big?

This move will spark all sorts of 1970s comparisons. Dollar Doomer newsletters are all scrambling today to pivot on narrative from the one where interest expenses on the national debt cause high inflation to the idea that cutting rates will spark a speculative boom and high inflation. I don’t see it. I’ve spent years saying a repeat of the 70s was never a risk and I still don’t see it. As I mentioned in the Schwab interview I still think policy is relatively restrictive and that the economy is still very much in the process of mean reverting to the pre-Covid norms in terms of GDP growth and inflation.

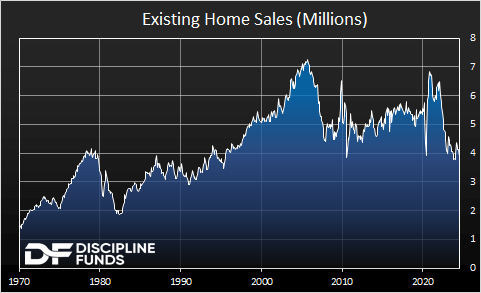

I think it’s important not to overreact to all of this. The Fed went big, but in the grand scheme of things they’re not really moving that big. A good way to assess the tightness of the credit markets and interest rates is to look at the most important benchmark interest rate in the economy – the 30 year mortgage. Mortgage rates are 6.15% as of today, down from the highs of 8% last year, but also significantly higher than the lows of 3% in 2020. There was a pretty distinct line in the sand when the Fed started hiking where existing home sales cratered after rates went over 5%. The combination of high prices and high rates made affordability difficult for tens of millions of households. That situation is still very much in place today. In fact, we’ve seen very little boost to existing home sales in recent months despite the decline in mortgage rates. So I think it’s safe to say that we’re still quite a ways from an environment where the Fed has to worry about a credit binge.

In that context I still think the bigger asymmetric risk is to the downside. The secular trend at work is that aforementioned mean reversion process to the pre-Covid levels. And if current rate policy is too tight and perhaps tighter than we think then there’s still a chance that the Fed is behind the curve here. So, even though neither case is my baseline outlook, I’d argue that a recession is the more likely risk here than a huge credit boom and inflation resurgence.

3) Pace of Trajectory is What Matters Most in the Future.

The Fed expects to cut two more times this year and then 5 times in 2025. That would bring us down to about 3% on the overnight rate, which is the level where I think policy is neutral. The question is, how will we get there and how fast? If the economy continues cruising along at the current pace and inflation moderates to the 2% target then the Fed can just bring rates down slowly and surely. This would be a true soft landing scenario. Remember, they can’t declare victory until they’ve normalized rates. Containing inflation isn’t mission accomplished. Mission accomplished is getting the economy back to a neutral interest rate with stable growth and employment.

It all looks good for now. As I noted earlier, the Fed is doing a much better job than most Fed watchers expected. But this is still a tricky environment in large part because the soft landing has become the baseline expectation for markets. And while growth is the higher probability outcome, recessions tend to be shocks to the system. And the reason the Fed often ends up being behind the curve is because they raise rates into a strong economy and recessions happen during strong economies. In other words, recessions tend to be shocks that happen in a seemingly good economic environment. So the baseline trajectory is that we’re very much in a new rate cut cycle on our way to 3%, but the path to getting there is either going to be a slow and methodical one or it’s going to occur very quickly because something shocks the system. Those are the only two outcomes and while the prior is the more likely scenario at this time I think it’s always wise to hedge your bets if you don’t have a long time horizon….