You’re getting this on a Friday, but when we GAAP adjust the holiday week and Cullen writing this on a Thursday night it basically equals a midweek note.

1) What Deradicalized You?

I really liked this question from Joe Weisenthal on Twitter:

I began investing during the Nasdaq bubble and was immediately thrust into a brutal 3 year bear market. And then the housing bubble expanded and I became very bearish about the economy around 2006. Then the financial crisis happened and I became even more negative about everything. All of my early investing experience was trial by fire. The generally optimistic Cullen you might know by now did not exist. But some time around 2011/12 I got tired of living in fear and realized that very few people make money being pessimistic in the long-run. And it was also around this time where I realized that most of the bearish narratives were just flat out wrong. All that scaremongering about the national debt, QE, valuations, Capitalism, etc. It was mostly intelligent sounding narratives that were designed to scare people into buying a political narrative or someone’s newsletter.

And it was around this time that I was “deradicalized” in the sense that I made a concerted effort to look at the world through empirical evidence and not emotions. I wrote “Understanding the Modern Monetary System” and penned thousands of blog posts at Pragmatic Capitalism debunking nonsense narratives using a first principles based approach to understanding the financial world. I made a promise to myself to create empirical, evidence based understandings of the world that would serve as the foundation of every investment decision I made in the future.

I think the big takeaway from this is an important one: it’s okay to be skeptical of things. It’s healthy. But skepticism and pessimism should never dominate your investment thinking in the long-run. Optimism with a healthy dose of skepticism will generate far better results than living in fear or flip flopping from fear to hope.

2) The Yield Curve Un-inverts.

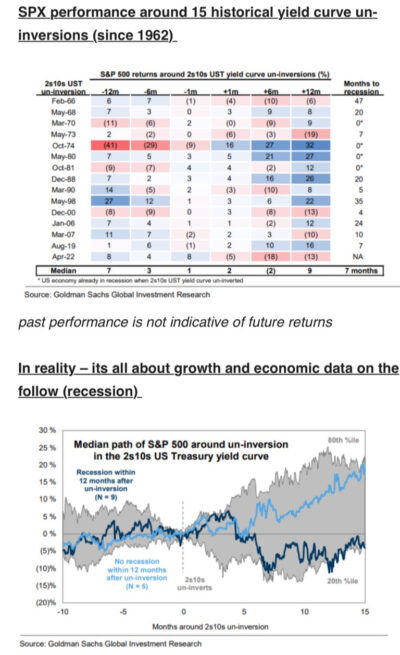

Here’s an interesting chart from Goldman Sachs showing the history of market returns after the yield curve un-inverts. The yield curve inversion has been a consistent worry for many investors in recent years, but it’s interesting to note that recessions typically occur 7 months after the curve normalizes. That makes sense when you think about it because the Fed usually starts cutting when things start softening. And as Goldman notes the difference in market returns between recessionary environments and non-recessionary environments is meaningful.

I never love datasets like this because 15 data points just isn’t enough to generate a statistically meaningful result. But I do think this is an interesting historical look at returns given the current environment. The Fed is currently in the make-or-break period for the so-called soft landing. As I’ve noted in recent pieces the next 9 months will decide whether the Fed is able to bring rates down on their own volition or whether the economy will force them into an emergency landing where they bring rates down to avoid a recession.

So, I guess the conclusion from this is the same as what I’d always say about short-term stock market investing – it’s always risky making bets on a long duration instrument in the short-term and I would also argue that this environment is riskier than average because the market is so optimistic about a soft landing.

3) The Less Efficient Market Hypothesis.

I love this new paper by Cliff Asness. Cliff argues that the market has become less efficient in the last 30 years due to three primary factors:

- Indexing Ruined the Market

- Low Interest Rates Ruined the Market

- Technology is Ruining the Market

Cliff puts #3 as the most important factor. I have argued numerous times that low rates were just a function of low inflation and the impact of indexing has been overblown because even indexing is more “active” than the binary depiction that is often portrayed. But #3 is really interesting and I think it could explain a lot of what’s happened in the last few decades as more retail investors and algorithms became prominent in the markets. Everything got a little more emotional and hyperactive. But the most interesting part for me was Cliff’s main conclusion:

- Having a long time horizon is the closest thing to an investor superpower.

I’m not a big advocate of factor investing in the sense that Cliff is, but I am absolutely an advocate of his conclusion. Stocks, in my Defined Duration methodology are 15+ year instruments. Picking the best factors, sectors or stocks inside of that time horizon is going to be difficult. And instead of holding specific parts of the market I generally prefer to just hold the entire haystack as John Bogle always said. There’s nothing wrong with tilts and certain levels of activity such as rebalancing, but being patient truly is the ultimate stock market superpower.

By the time you’re reading this the market will be overreacting to the short-term movements of an employment report that will be revised and then revised and then revised again in the coming months and year. But you can guarantee that I will have some thoughts on it over the weekend. Until then, stay disciplined!