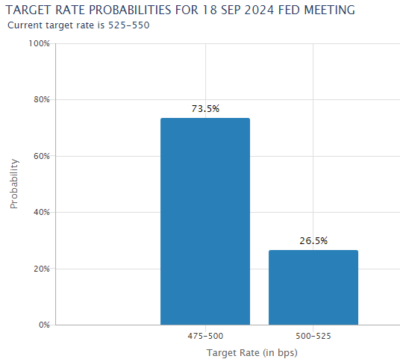

Just a week ago the market narrative was all about “soft landing”, but after Friday’s labor report the narrative is quickly shifting to “emergency landing”. Odds of a September rate cut are now 100% and odds of a 50 bps cut went up to 75%. JP Morgan is calling for 50 bps cuts in both September and November as the labor market softens.

None of this is terribly surprising to readers here. We’ve spent much of the last year explaining how higher rates were slowly putting the screws to the broader economy. Those of us looking under the hood could see the labor market softening for the last year. And that’s a big part of why I called for a July cut, which the Fed of course ignored and is now regretting. Now they’re going to get killed in the media as they cut just a few weeks before the election. And worse, it’s going to look like they’re behind the curve again. After all, the September meeting is SEVEN weeks from now and a lot can happen in that time. And as I’ve noted in the past, that will be just the first cut. The Fed will still be at 5% after they cut in September so policy is still going to be very restrictive even though markets are starting to price in many more cuts. It is indeed starting to look like they’re behind the curve and at risk of a policy mistake….

One point I’ve repeatedly made is that the soft landing narrative was always a bad metaphor. The economy doesn’t land like a plane. The economy is always flying, sometimes slowing and sometimes speeding up, but never “landing”. Raising interest rates was the equivalent of slowing the plane to fly below turbulence. But what the Fed really wants to do is get the plane back to cruising altitude with interest rates normalized. 5%+ interest rates are not a normalized economy and now looks far too restrictive. They’ve slowed the plane a lot but now they want to get the economy back to something like 3% interest rates where consumer demand for loans can normalize and the most interest rate sensitive parts of the economy (like auto and housing markets) can normalize. And that’s the ultimate measure of the Fed’s success – are they able to normalize interest rates or do they end up having to shift interest rates because they flew too low for too long and now they have to try to enact an emergency engine thrust to avoid an economic stall? I certainly don’t think we’re on the verge of crashing or that the plane is stalling, but the Fed can’t keep flying the plane at this speed or we will stall.

Let’s Dig Into the Data

Let’s take a step back here because this labor report wasn’t quite as bad as some people might be making it out to be. Some data:

- Private payrolls came in at +97K vs expectations of +148K.

- Unemployment rate ticked up to 4.3% vs expectations of 4.1%.

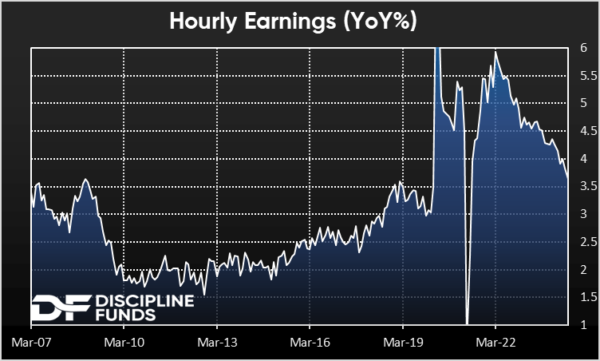

- Wages slowed to 3.6% vs expectations of 3.7%.

97K isn’t the end of the world. And even a 4.3% unemployment rate is still low by historical standards. But we should also be clear that this is all trending in the wrong direction. And it has been for quite some time now. It’s even worse when you look under the hood at metrics like long-term unemployment, quits rate, temporary employment and many of the other leading indicators of labor market tightness. And no, this labor market hasn’t been tight despite many commentators claiming otherwise. It’s been loosening quite obviously for this entire year.

So, to continue our aforementioned metaphor, the plane has slowed substantially and now looks like it’s at risk of stalling. We’re not stalling just yet so we don’t need to panic, but we should be on full alert.

What Does it Mean for the Fed?

The Fed is in a real bind now. They just missed an opportunity to start cutting rates. And now they have to wait 7 weeks to start cutting rates unless they implement an emergency cut. If I were Fed Chief and I’d made the mistake of not cutting this week I would come out next week and clearly communicate a September cut with the possibility of a 50 bps cut. Don’t leave it open-ended and wishy-washy like you’ve been doing. Make it 100% crystal clear that you’re cutting in September. You don’t need to panic and implement an emergency cut. But you do need to start getting in front of the narrative train here and stop waffling over this fictitious concern about another inflation flare up. All of those narratives were wrong and now look dead.

The most worrisome part of this data is the hourly earnings data. The Fed was worried that wages were proving sticky and could cause a second flare up. I’ve had the exact opposite view that wages were mean reverting to their pre-Covid levels and that wages were never sticky. Wages have come down meaningfully to 3.6%, but there’s still a lot of air under there and we could easily mean revert to 3% in 2025 as the labor market continues to soften and workers lose negotiating power. If that happens faster than the Fed believes then you’re going to see a much higher unemployment rate coinciding with it. This risk has been clear in recent quit rate data and especially this week’s reading which fell an alarmingly large amount. Workers do not have negotiating power in this economy, the labor market is not tight and there are rampant signs that it’s softening more. The Fed needs to clearly assess that risk and start to get in front of it.

Again, there’s no need to panic and implement emergency measures or anything, but the Fed also needs to communicate to the market that they’re on high alert.

What Does it Mean for Your Portfolio?

As you might know, I am a big fan of asset/liability matching strategies and what I call Defined Duration investing. Asset allocation is really just a temporal problem and if you don’t have temporal clarity in your portfolio then you’ll find out that you have behavioral ambiguity in your portfolio. I believe investors should build a financial plan and then match specific assets to specific liabilities to create an asset allocation that is consistent with your financial planning needs AND your behavior. This is kind of similar to bucketing strategies, but is structured in a customized manner that specifically matches an investor’s financial plan and better disaggregates a bucketing strategy to create more clarity on goals. This creates a super robust and diversified portfolio that communicates, with greater certainty, how your portfolio matches your financial needs. This isn’t a high fee “beat the market” strategy where you end up with a big blob of diversified assets whose purpose you don’t understand. In a Defined Duration strategy each asset is serving a specific temporal purpose that gives you clarity over why you own it. For instance, I’ve discussed how you can do this by building 4 or 5 (insurance is optional/personalized) specific buckets:

0-2 Years: T-bills and Money market funds for emergency needs and short-term funding needs.

2-5 Years: Intermediate and Short-term bonds for uncertain short-term spending needs like weddings, a house down payment, etc.

5-15 Years: A diversified multi-asset holding and/or intermediate bonds to meet longer-term funding needs such as approaching retirement, children’s tuition, etc.1

15+ Years: Stocks and aggressive allocations for long-term funding needs like retirement, muti-generational needs, etc.

Insurance: Perpetual or specifically temporal assets such as gold, options, long duration bonds that have specific insurance-like characteristics.

The beauty of this structure is that you create a highly diversified portfolio that is serving very specific financial needs. It should help create a smoother glide path of returns because you’re diversifying more specifically across time horizons using specifically defined assets. So, for instance, when the economy is melting down and everyone else is panicking you are cool as a cucumber because you have a specific structure of assets set aside in short-term instruments that can meet any liquidity needs you might need for an economic emergency. You also know to ignore your aggressive holdings liks stocks because they are specifically long-term financial assets. You don’t panic because you have this crystal clear understanding of why you own certain assets and how they match your financial plan. The same basic fact is true during booms. You’re not playing the “beat the market” game, chasing returns and churning up taxes and fees. You’re invested in a portfolio consistent with your financial plan that helps you stay the course thru bull and bear markets.

The real beauty of this portfolio structure is that it’s systematically designed to insulate you from behavioral biases. Days like Friday do not scare me even the slightest bit because the most volatile long-term parts of my portfolio are segregated from the short-term principal protecting components. This wasn’t the way I used to manage portfolios. I used to build a big homogeneous blob of diversified assets and then when the stock market would get jittery I’d naturally get worried about the whole thing. There was no temporal structure even though there was diversification. If days like Friday scare you then it could mean your portfolio isn’t structured in a manner consistent with your financial needs/goals/behavior.

In today’s specific environment you can probably guess what this all means for this approach – we’ve been extending durations most of this year in short and intermediate duration bonds to front-run the Fed. At the same time we’ve been more conservatively positioned in our multi-asset 5-15 year bucket to account for elevated stock market risk and the potential for lower than expected returns over the coming 10 years. And in the long-term bucket you just set it and forget it. You can tinker with this for factor tilts or whatever, but this should be a largely inactive and long-term focused part of the portfolio.

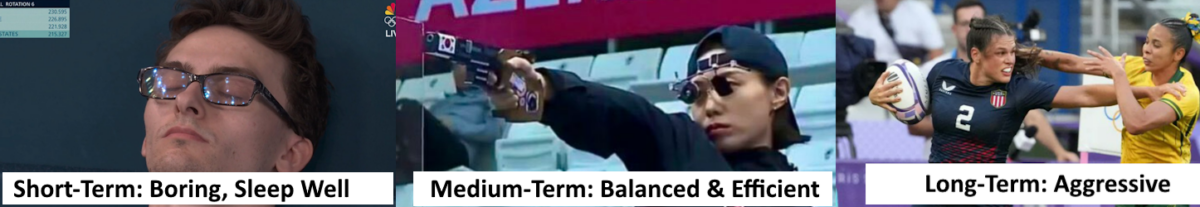

If you’ve been watching the Olympics you might appreciate these memes as they pertain to this investment strategy:

I hope you have a great weekend and as always, stay DISCIPLINED!

1 – People sometimes ask why we want to use a multi-asset instrument for the 5-15 year time horizon. The answer is that blending stocks with bonds arrives at a blended duration rate. For example, stocks are currently a 19 year duration instrument in my Defined Duration model and bonds are about a 5 year instrument. When you blend these instruments you get a 12 year instrument and if you do it in an ETF then you get the added benefit of being able to rebalance without capital gains. We add an extra twist on top to account for the skew from equity market volatility by rebalancing in a countercyclical way to help better reduce the duration and create more certainty over a shorter time horizon. But the main point is that the best way to get that target 10 year duration holding is by blending stocks and bonds in a multi-asset portfolio.