The most interesting debate going on these days is about consumer sentiment. The US economy has outperformed expectations by most metrics. The stock market is booming, real GDP is at potential trend, wages are growing solidly, consumers are spending, etc. And yet consumer sentiment surveys remain very negative. What gives? I think I know what’s going on here.1

When we look at living standards it’s important to look at how people view “necessities”. For example, in 1900 many items that were considered necessities included clothing, food and shelter. In the year 1900 an American had to spend 80% of their income on just these items. And by 2015 Americans were spending just 45% of their income on these items. This is a tremendous change in living standards as you have the ability to spend 35% of your income on other items. This is a good thing because items that were previously viewed as luxuries will then become viewed as necessities.

For example, someone in 1900 could have only dreamed of decent medical care or going to college, but our improvement in living standards has given us the ability to add whole new categories to what we view as “necessities”. So, the consumer who complained about the high cost of food in 1900 can now convert their complaints to other items like medical care, college costs, etc. I don’t say “complain” disparagingly. We will always complain about the cost of something because, as our living standards evolve, there will always be new items added to our basket of consumption that we now view as “necessities” and we’ll complain about how those items aren’t attainable for all. This is, ironically, a good thing because it means new “necessities” are too expensive, but becoming more attainable to more people!

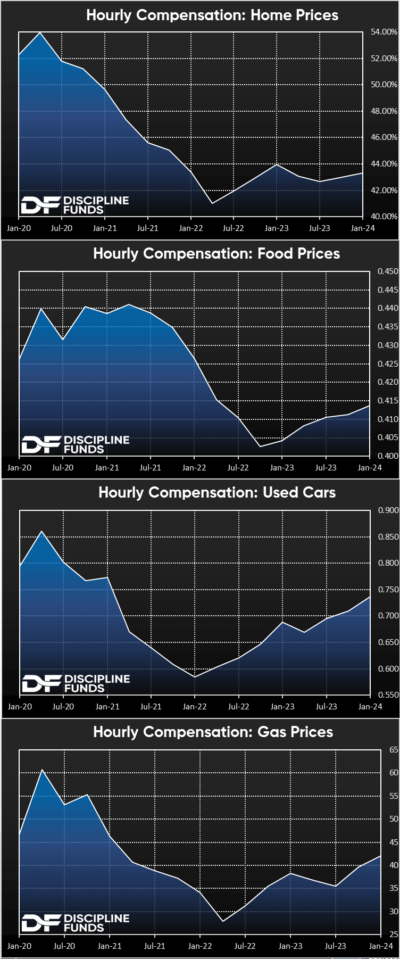

Anyhow, the Covid period was strange because it did all the wrong things to all the OLD items we care about the most. And that makes sense because a pandemic should boost demand for the things that matter most to us. But coming out of the pandemic has been tricky because those same items haven’t kept up with hourly earnings gains. Here is how hourly earnings have compared to price changes in some core necessities:

- House prices: -9%

- Food CPI: -1.5%

- Used cars CPI: -5.5%

- Gasoline prices: -4.6%

One good way to think about this is that there’s an old rule in financial planning that you should spend about 28% of your household income on a mortgage. But the average cost of a mortgage today is about 40% of household income because of the house price boom and mortgage cost increase. This means that homebuyers today have to be willing to redistribute 12% of their income to shelter alone. That’s 12% less for luxuries, entertainment, etc. Or 12% you have to borrow against to maintain your old living standard. This is a huge number. It’s a number so big that it’s made standardized financial planning rules void of value. Planners now have to completely reconsider what it means to “afford” a home because this necessity is now so expensive relative to household income gains.

Ironically, most of these items are things that economists and analysts like myself typically strip out of inflation analysis because they tend to be volatile. But they’re also very important items to everyday consumers. I often talk about “core inflation” here because that’s what matters to economists and the Fed, but “core necessities” are what matter most to everyday people. And you could argue that if you weighted the CPI by the things that people care about the most then they feel worse off in recent years for a very simple reason – the things we consider core necessities have become more expensive relative to our earnings. And that has made people feel like their living standards are declining.

None of this means that things aren’t good. It certainly doesn’t mean we’re not making progress in the right direction. In fact, all of these items are moving in the right direction now. But it also shows that people are frustrated for rational reasons.

NB – I always talk about how lucky we are to be where we are coming out of Covid. The pandemic could have been so much worse than it was. And had we not done any stimulus it’s very likely that the economy would be much worse than it is and unemployment would have ravaged the economy in a way that would have been much more damaging than a few years of high inflation. But I guess that’s a counterfactual none of us can really prove so we have to live with the objective reality we have.

1 – Most of this is heavily skewed by politics depending on which guy is your guy. But on the whole I think this is a case where both sides make very relevant arguments. The economy is better than expected AND people have rational reasons to be frustrated by what’s going on with a lot of prices.