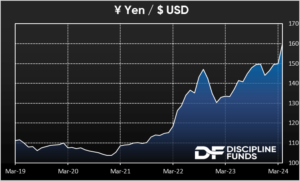

The Japanese Yen has been undergoing quite the roller-coaster ride in recent weeks and is now down over 45% vs the USD since 2020. With their large government debt load many investors are wondering if this is the beginning of the end for the country whose currency has appeared impervious to large debt loads. Here are three different views on the current situation and where I think this might all be headed.

1) This is a full blown collapse.

If you take the 100 foot view of this situation you’d certainly be uncomfortable with what’s happening. The Yen/USD was as high as 160 on Monday, up from 110 at the beginning of 2020. This is a big move for the world’s third major reserve currency. And it’s largely due to the fact that inflation has jumped from 0% for much of the last 20 years to as high as 4.3% in 2023. Despite this jump in inflation the Bank of Japan left interest rates largely unchanged at 0% while every other Central Bank raised rates.

This is quite a different world from the one that Japan has been living in for the last 30-40 years where deflation and ZIRP (Zero Interest Rate Policy) was the dominant theme. Inflation has moderated from 4.3% to 2.7% , but with the current rate of inflation remaining stickier than expected some are wondering if Japan is moving into a new era of higher inflation where ZIRP is no longer the right policy approach. And so the natural relief valve for the economy is via the exchange rate. And the stickier inflation has been the more buoyant the exchange rate has remained.

If inflation is indeed on the verge of remaining higher or moving higher then the situation here is more concerning. But let’s zoom out a little because this is by no means new.

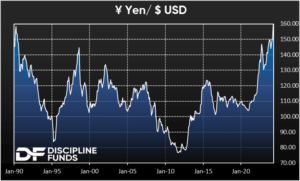

2) This is just typical FX volatility.

Back in 2011-2015 the Yen/USD jumped from 75 to 120. There were numerous calls from prominent investors declaring the Yen dead. The famous Widowmaker trade had supposedly run its course and interest rates and inflation were on the verge of exploding.

It was the same argument people are making today – the large government debt load will collapse the currency and cause a crisis. But the crisis never came. In fact, if you look at the FX rate over the course of the last 45 years the current move to 160 doesn’t look like much as the Yen has been mostly range-bound for the entire period. You could have gone to sleep in 1990 and woken up today and thought nothing even happened. And despite brief bouts of higher inflation the lowflation remained entrenched.

From this perspective this all looks rather benign. Inflation is uncomfortably high, but it’s nothing to jump out of windows over.

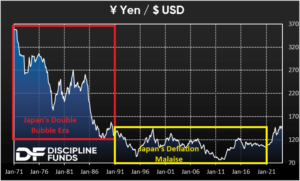

3) Japan is normalizing from the double bubble deflation.

The 30,000 foot view provides us with a very different picture. This view covers the incredibly complex and traumatic events that unfolded over the 50 year period since the infamous asset price bubble. Japan had the biggest combined real estate and stock market bubble in history which was followed by a huge balance sheet recession and deleveraging. And then they had 30 years of deflation and ZIRP. Then Covid hit and we finally got a bit of inflation.

What really stands out over this period is the extraordinary collapse of the USD vs the Yen during the double bubble boom of the 80s and 90s with the exchange rate going from 350 to just 120 over a 20 year period. The Yen then moved largely sideways for the next 30 years before finally moving to the current rate of 160.

When viewed thru this lens it doesn’t look like a currency collapse so much but just a normalization of sorts. In other words, Japan is experiencing a more normalized rate of inflation, but with the BOJ leaving rates at 0% the release valve for a higher relative inflation rate is the FX rate. And of course, the Japanese aren’t stupid. They own over a trillion dollars of USD and have always been prepared to defend the Yen if needed. So, ironically, the more the USD appreciates the stronger the Japanese Government’s FX position becomes. When you combine this with the relatively low rate of inflation the situation looks very manageable rather than being the sort of emerging market currency collapse where a country has low reserves and a high rate of inflation during a currency collapse. This is very different.

So far this doesn’t appear to be a panicky situation. And in the context of a much longer history this appears like some much needed normalization for an economy that has undergone some very abnormal events in the last 40 years. All that said, we would want to keep an eye on the inflation trend. After all, a falling exchange rate isn’t a problem in and of itself. But when it’s accompanied by a very high rate of inflation that is typically a signal that a true FX crisis is unfolding. With inflation at just 2.7% that doesn’t appear to be the case here, but it’s worth keeping a close eye on because a meaningful collapse in the world’s third reserve currency would not be an isolated global economic event.