Well, I had a great time earlier this year as I was able to mock certain people for thinking we’d get a rate cut in March or April. But now it’s my turn to be mocked as my prediction of a June cut goes up in smoke.1 Today’s hotter than expected CPI all but eliminates the odds of a June cut. And as I explained in our recent analysis the likelihood of cuts between July and October are slim because the election is too close and the pace of change is slower than can justify cuts by then. So. Now we might be looking at November for a cut. Or…no cut at all? What’s more likely?

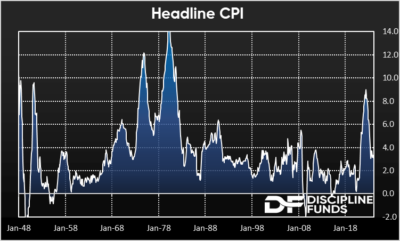

First, as everyone is having a panic attack over CPI let’s keep things in perspective. We’ve made TREMENDOUS progress in the fight against inflation. Headline CPI has come down from 9% to 3.5% in juist 18 months. We all knew the last mile was going to be difficult and that’s proving more than true, but let’s not overreact to all of this. Yes, “Team Transitory” was wrong and inflation has proven stickier than expected.2 But also keep in mind that we’ve made this progress with blowout budget deficits. Why the Congress and Treasury continues to run such huge deficits is perplexing, but it is what it is. Perhaps more importantly, we know that Monetary Policy has long and variable lags. Milton Friedman always stated that this lag could be as long as 30 months. The Fed has only been raising rates for 24 months and based on metrics like the Taylor Rule rates have only been “tight” for about 6-12 months. If the lags are a thing then rates should continue to bite as 2024 goes on (more on this below). Lastly, there will be lots of commentary about how inflation is accelerating, but that’s not really true. You have to squint super hard at the inflation data to find a meaningful change in the disinflationary trend.

Moving on. Why do I shift my thinking so sharply from June to November? Well, it’s all about politics and rate of change. Core PCE was 2.8% last month and is widely expected to moderate to 2.65% next month. We should see something in the 2.5%-2.6% range in May, but the pace of change there is now looking like it could be closer to 2.6%. We are very unlikely to be under 2.5% before June and so that takes July off the table because the rate of change is too slow to justify a cut. The next FOMC meeting is in September and I don’t think they’ll implement their first cut in September because it will look too political. And so that leaves us with November.

The election and sporadic FOMC meeting calendar creates a really interesting situation for the markets here. If my above assumptions are right then the earliest potential cut is November. And that means the economy has at least 6 more months of overnight rates at 5.3%.

What Does it All Mean for the Economy and Markets?

Higher rates for 2024 will mean that we’re about to find out how real those “long and variable lags” are. We’re right in the heart of what Friedman estimated to be the tightening portion of a rate hike cycle. So far the economy is spitting out mixed signals. Capital goods orders have slowed sharply, retail sales are slowing, housing activity is anemic, but real GDP is doing okay, real personal consumption is doing okay and job growth has been strong. It’s still a “create your own narrative” economy. But we’re going to see the rubber meet the road on these lags and whether they start to really bite. And that increases that asymmetric risk where credit markets slow enough to bring down consumption and growth and start eating into the employment data. And that, weirdly, is the Fed’s worst nightmare because so far they’ve been able to bring down inflation without hurting employment. Will the slowdown happen? So far there’s been little signs of it, but we’re going to find out before 2025. So, the potentially bad news is that this increases the likelihood of choppiness in the stock market and increases the potential for the Fed being too tight for too long.

All that said, I still think we get a cut or two in 2024 because inflation is still trending down and likely to be under 2.5% by the election. Further, higher rates during the next 6 months increases the risk that economic growth could slow more than expected in the next 6 months which would increase the odds of rate cuts. If things were to slow more than expected the Fed might be in the awkward position of considering a rate cut in September just weeks before the election.

The good news is that this means we’re going to be able to get 18-24 months of 5% money market and T-Bill rates. So savers are in hog heaven here as they can safely plan for up to 2 years of expenses with 5% expected returns. That’s glorious.

The bottom line is that we’re still digesting the Covid boom and the leftovers of the Covid inflation. Markets are notoriously overreactive and impatient about everything, but with a little patience and a properly matched asset liability strategy none of this should keep you up at night.

1 – Please send all hate mail to jpowell@federalreserve.gov

2 – Team “Transitory” was wrong mainly because they expected the inflation to be self correcting as the narrative claimed that fiscal policy didn’t cause any excess demand. That’s proving terribly wrong. But let’s not let “Team Hyperinflation” or “Team 1970s” off the hook either. They got inflation even more wrong.