Someone emailed me the other day asking about my “muddle through” prediction of the last few years. They were pushing back on this idea that the US economy is just muddling along. I actually love conversations like this because they make me question my own views and consider countering positions. I’ve mentioned in the past that I do this a lot now. I go out of my way to understand the other side of arguments and it’s turned me into the most annoying person because I can “both sides” any argument now to the point where my own wife doesn’t even know what I believe anymore. Don’t worry, I know exactly what I believe, but I am just trying to keep her on her toes so she’ll stick around for a few more years.

Anyhow, this emailer, who was very kind (hello there), was arguing that we’re experiencing a huge boom. But when I started digging into the data I couldn’t bring myself to believe their position. And here’s the big thing – I think the Great Financial Crisis did something nasty to our perceptions of the world. It reset our expectations permanently lower. And here’s the data:

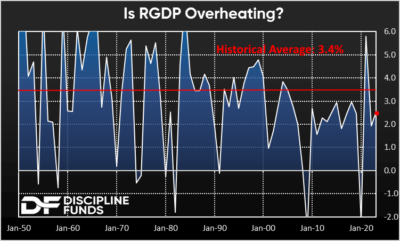

- From 1950 to 2010 Real GDP averaged 3.4%. That was the average! An economy that was “hot” or potentially “overheating” was typically something in the 5%+ growth range.

- From 2010 to the present RGDP has averaged just 2.3%.

In the last few years RGDP has averaged just 2.2%. More recently, GDP Now is expected to come in at 2.8% based on latest estimates. So, is this overheating? Is this even hot? I wouldn’t say so. If anything it looks pretty average, probably a tad on the low side. Depending on when we measure it it’s been very low.

Now, the arguments for why this has happened are many and interesting (population slowing, financial adjustments, labor force adjustments, etc), but the main point is that our expectations have been reduced since the GFC for better or for worse.