Here are some things I think I am thinking about over the holiday weekend:

1) Core PCE is STILL trending in the right direction.

Core PCE came in at 2.78% on Friday. This was the lowest rate of inflation we’ve seen since March of 2021 right before the big spike. This should ease some concerns going forward as there were concerns that this reading might come in at 2.9% or even higher. But now we can begin to safely assume that the seasonal quirks are behind us. Atlanta Fed’s Nowcast says the March reading will come in at 2.67%. So this is all trending in the right direction and I continue to see it trending that way for the remainder of the year unless something causes a huge commodity spike. Until then there’s just too much pressure in the housing component to overcome it.

The bigger picture here is that even though disinflation has moderated in its downward pace it’s still trending in the right direction. So, I think we can now safely assume that all the 1970s & 1940s narratives were wrong.

The question still remains though – is this enough progress to cut in June or July? We only have two more inflation readings before the June meeting and we’re likely to be at or close to 2.5% by that point. So, is that enough? I’d say yes, but I could also see the scenario where there are some members of the FOMC who are still hesitant and want to wait until July (or even later). That will almost certainly be the case if the next few inflation prints surprise to the upside. But as of now I still think it’s safe to assume that June is the month we get a cut. But it’s looking more like a coin flip between June and July at this point. Not that it matters a huge amount though because the difference between getting two or three cuts this year isn’t going to cause some seismic economic shift….

2) Why cut now?

Speaking of 2 vs 3 cuts – the increasingly common question I am seeing is “why cut now?” I answered this in my previous Fed FAQ, but it’s worth reiterating because I think it’s a confusing chain of thought. We’re now at a point that I’d argue looks somewhat similar to early 2021 when rates were still 0%, but inflation was starting to shoot higher. The Taylor Rule was absolutely skyrocketing and ended up being very right about what was coming down the pike. What we’re seeing now is indications of softening inflation and softening demand, a clear downward trend in inflation, a crashing Taylor Rule and the potential that the Fed will be too tight for too long.

But the other key element of this is that the Fed wants to bring the economy back to a normal altitude now that the turbulence is dying down. And while cutting rates from 5.33% to 4.75% this year will be viewed as stimulative I don’t think it’s moving the economic needle a whole bunch. It’s just starting to normalize things. I mean, this isn’t like they’re going from 5% to 0%. The rate cuts that might occur this year are going to be pretty modest. Mortgage rates, for instance, might drop to 6% by year end. I don’t think we’re going to see a housing boom and credit reflation with mortgage rates at 6%. After all, we know that the mortgage market collapsed as soon as rates went over about 4.5%-5%. That was the rate where the cost of a mortgage was just too much for most people. And so I think we’d have to see much lower rates than 4.75% to cause a real credit boom. Add in the fact that house prices haven’t budged much and the math on 6% mortgages still remains ugly. So I don’t think consumer sare going to climb over one another to borrow at 6% when most of them are locked in at 3-4%.

The bottomline is that the Fed is trying to manage the risks now. And I think they’re on the right path because the odds of a 1970s double bump look very low now, but the odds of overshooting on the downside look increasingly high. They don’t want to repeat the mistake of 2021 where they were slow to act and so some modest easing of rates here seems like a prudent decision in my view.

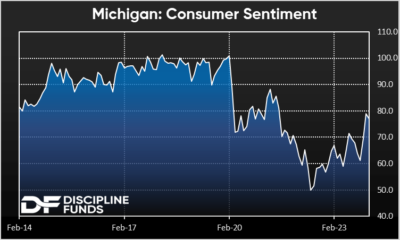

3) Why are consumers still so grumpy?

Consumer sentiment surveys keep coming in low. Which is confusing a lot of people because if you just looked at the stock market and the economic data it seems like everything keeps surprising on the upside. Some people attribute this to politics and say that Republicans are down in the dumps because their guy isn’t in office. But I think you could also argue that Democrats are a little too rosy about things.

I do this thing now that really annoys my wife where I play devil’s advocate about virtually everything by trying to view things from the perspective of people I think are wrong. For instance, I think inflation has moderated to a relatively sustainable level, but I get a lot of emails and messages online about how inflation is still ravaging consumers. And yes, they’re right! Because you have to put yourself in the shoes of someone who rents, doesn’t own a lot of stock and has a median wage. Imagine being the person who earns $100K a year, prudently saves and now feels like they’re going to rent forever because housing prices surged 50% and interest rates are sky high. That person is extremely pissed off and there are tens of millions of them out there. I 100% get it and I try my best not to be the Ivory Tower economist telling people they are wrong to feel a certain way because “core inflation” has moderated a lot.

And I think that pretty much sums it up. The last 3 years have not been super fun. We got locked down, the economy cratered, then we all got sick, then we printed a ton of money, then the stock market surged, then the stock market fell 20% in 2022, then it came back and now some people only want you to remember the happy 2023 part of the story. Sure, we dodged a bullet and Covid could have been a lot worse. But in the grand scheme of things I still think many people feel like they’re running in place and that the trillions we spent during Covid was basically shoveled to rich people or dumped down the drain. So no, I don’t think the sentiment readings are all that wrong. I think a lot of consumers are still really frustrated and rightfully so.