1) Why the high inflation reading is good news.

I was on Schwab Network earlier this week discussing why, despite a few upside surprises, inflation is still in a downtrend. This sounds a bit counterintuitive, but the upside surprises are still primarily due to the shelter component of CPI which is bad news in the short-term and good news in the long-term.

The reason this is weirdly good news is because we know that this component is headed to 3-4% over the coming year. It’s down from 8% and has fallen to just 5.8%. The reason why is that it lags by about 12-18 months and the current downtrend only started about 9 months ago. To put this in perspective, it took shelter 24 months to trough and peak from 2021 to 2023. We knew housing was booming in 2021 and 2022, but wasn’t bleeding into CPI data because the BLS measures shelter inflation on a biannual basis which causes this extreme lag. So now we’re seeing the opposite effect where rents are negative, house prices are up slightly and yet CPI is showing a high rate of shelter inflation. I think we’ve got another 9+ months of embedded shelter disinflation in the CPI’s biggest component. And as this component declines we should see CPI continue to decline.

The only way that doesn’t happen is if we get a huge boom in commodities or some other large component that offsets the shelter disinflation. Will that happen? I guess it certainly could, but so far we’re seeing no signs of commodity inflation or surging inflation in other components that could offset the largest part of CPI.

2) Short sellers are good people.

The CEO of Palantir was on CNBC this week ranting about evil short sellers. Now, I don’t know a damn thing about Palantir, but I always think it’s red flag when CEOs lose focus and complain about their stock price or short sellers. To me it’s like a horse jockey who complains about his slow horse because the gamblers were betting against him. It makes very little sense. Short sellers can’t destroy great companies. They can kind of help destroy companies that are destroying themselves, but selling a secondary market instrument short does not cause the underlying business to operate poorly. And in the long run well run businesses stampede over short sellers. So CEOs should focus on running their businesses well and let short sellers waste their money trying to time the market.

But this isn’t just conjecture. We know following the GFC that short sellers are good for markets. Many governments banned short selling in 2009 and the research following this period showed that the short sale bans reduced market liquidity, price discovery and increased investor costs. This isn’t surprising because short sellers didn’t cause the GFC. They merely helped expose who was swimming naked. And in the many cases where good firms were under pressure the short sellers became buyers when their bets went wrong. None of this is bad for markets. There are people who are overly zealous in their optimism and there are people who are overly zealous in their bearishness. Both get blown up when they’re wrong.

Speaking of which, this isn’t financial advice, but I strongly urge people not to short stocks. Picking individual stocks is very hard on its own. So imagine trying to pick the stocks that go down and doing so on borrowed time where you have to not only pick the right stock, but also get the timing dead right. That’s perhaps the hardest thing to do in finance.

3) Is the economy weaker than we think?

For two years my working thesis on the economy has been that we’re mean reverting from Covid and that the ride would be bumpy along the way. In short, the economy is still digesting the huge excesses from Covid. Over this period the stock market and economy have looked very weak at times (like 2022) and very strong (like 2023). But on average it’s all been a bit sluggish. It’s easy to fall victim to recency bias after a few good quarters of economic data, but the long-term sluggishness appears to be showing its face again.

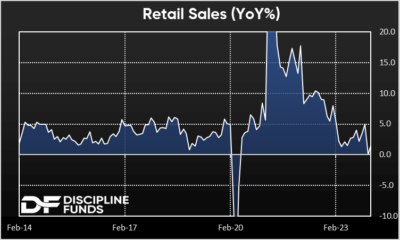

This week’s retail sales data came in at just 1.5% year over year which would put it near the bottom of the 10 year average. I suspect this is going to be the norm in the coming year. It’s not a recessionary indicator, but it’s a sign that things might not be quite as booming as many have made it out to be. It’s no reason to jump out of windows, but don’t be surprised if some of the recent optimism wanes a bit in the coming year.

I hope you have a better weekend than Julius Caesar did 2,000+ years ago!