Here are some things I think I am thinking about:

1) Inflation is dead?!?

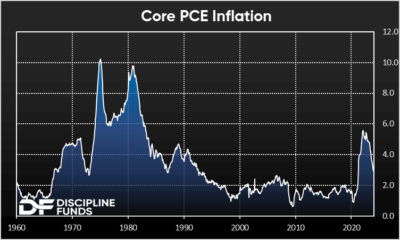

This week’s data confirmed what we’ve long been predicting here – disinflation is well entrenched and the risk of a big resurgence in inflation is very low. We got a slew of data from the GDP report and personal spending that confirms the falling trend in the rate of inflation. Core PCE, the Fed’s preferred metric, fell to a rate of 2.9%. That’s the lowest inflation reading since March of 2021.

There was more good news in this week’s data though. GDP came in higher than expected in large part due to higher consumption and we saw a decent jump in jobless claims. So demand remains relatively robust, but not robust enough to cause a big bump in prices. And we’re getting continued softening in the labor market that is consistent with growth, but not a boom. One might even call it a…dare I say…soft landing?

All of this got analysts in a tizzy over the expected rate cuts this year. The big debate is whether the cuts will come in March, May, June or later? I’ve been guessing that they would wait until the Summer, but Goldman Sachs came out with a new report reiterating their view that they’ll cut at ALL THREE meetings. I still think they’ll wait until the June meeting because historically, they don’t cut until rates are under 2.5% core PCE, but maybe it’s different this time?

2) How do we define a “soft landing”?

Speaking of “soft landings” – I do hate that analogy. If the Fed is piloting our plane then they’re not trying to land the plane. The economy doesn’t land and stop. It is always flying. Sometimes the plane slows, hits turbulence or speeds up, but it never actually lands. And while this might just sound like Cullen whining about semantics I actually think it’s important because this analogy misconstrues our understanding of what the Fed is actually doing.

What really happened here is that plane was flying too fast in 2021. Then we hit a rough patch of air and the Fed kept flying us right through it. When they finally recognized the danger in 2022 they lifted the nose (interest rates) which caused the plane to slow and avert some of the turbulence. As of today the turbulence has moderated quite a lot, but the Fed still has the nose pitched at a suboptimal angle. They would like to bring the nose back down so we can continue along at the altitude and rate of speed we were traveling before this mess started.

This analogy is better because it highlights what success will actually entail here. Avoiding the turbulence isn’t “mission accomplished”. We want to bring the plane back to a more sustainable altitude and speed. And the only way we’ll know that that’s been accomplished is when the Fed brings the nose back down to its normal position. For the Fed that would mean bringing interest rates back down to a more sustainable level. I’ve been saying that a sustainable overnight rate is probably something in the 3-4% range. So, with the rate at 5.5% we’re still quite a ways from being able to say that the mission has been accomplished.

Don’t get me wrong. The pilots here are doing a good job. Better than I expected them to do. But we don’t want to be complacent here and declare victory when we’re still flying low and slow through a turbulent environment.

3) Interest expenses don’t threaten the national debt.

The national debt is always a fun topic to discuss because you can pretty much guarantee that you’ll anger somebody.1 For instance, I sometimes sound like I am dismissing the risks of the national debt and people always email me calling me an idiotic Socialist. But after my interview the other day on the national debt I got a message saying that I was doing a disservice even talking about this topic because I was helping bring attention to a topic that people shouldn’t be scared about. That was a new one for me. I guess I am sorry? But I actually think that’s a big part of my job. I talk about things that are relatively complex/controversial and try to bring some clarity to issues so people don’t overreact and do stupid things with their money. And that often involves debunking or discussing topics that are political or scary.

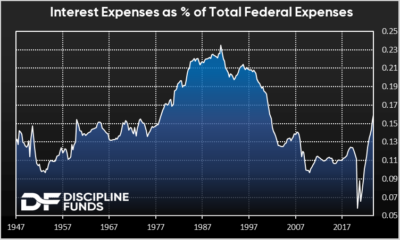

Anyhow, I got another email about my interview in which someone explained to me that I was ignoring the interest burden on the national debt and that this line item was going to spiral out of control in the coming years. I’ve actually written entire research pieces on this specific topic in the past, but I’ll reiterate my view here just to be sure I anger someone.

The interest burden is a policy choice that can be controlled with a dial. For instance, if the Fed does indeed choose to reduce rates this year that interest burden will start to slow materially because the vast majority of government debt is short-term notes more directly to the overnight rate. In theory the Fed could just pin the rate at 0% and reduce hundreds of billions of annual interest burden. I don’t think they should go to 0%, but you get the point hopefully. In either case, the Fed will very likely reduce rates in the coming years and that will ease this burden.

But more importantly, here’s a little historical perspective on this matter. Current interest expenses aren’t even that high in a historical sense. In fact, they were much scarier throughout the entire 1980s and that just so happened to be the very best time in history to do the opposite of what Treasury Bond bears wanted you to do. Which makes sense because this is basically just a chart of high interest rates and when interest rates rise that’s often a signal to buy T-Bonds because higher rates mean lower prices and a potential for better future risk adjusted returns. In my view today’s environment is the most attractive T-Bond environment in a very very long time. So don’t let the scaremongering over the national debt make you second guess the viability of the US Treasury market.

I hope you have a great weekend.

1 – I kid. I would never intentionally anger the readers of this website. Speaking of anger, does anyone want an adorable, angry two year old?

2 – I may be an idiot, but I am definitely not a Socialist so please, if you’re going to email me and insult me at least get your facts straight.