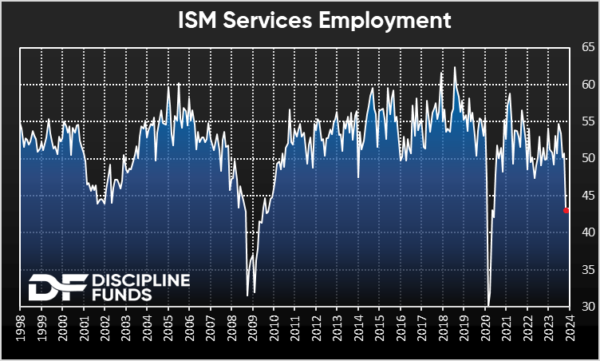

This is a chart that people will be talking about for a long time now. This shows the ISM Services Employment Index. Services have been extremely strong for the last few years and it’s been a consistent bright spot in the economy. It’s been so strong that it’s forced the Fed to reconsider their position at times in the last few years as services inflation has remained stickier than the Fed is comfortable with. But we may be seeing the tide change and there’s a chance here that it’s changing in a big way. Now to the data.

ISM Services Employment fell to 43.4 in December. This was especially interesting in the context of Friday’s data because the employment report for December came in stronger than expected albeit with big revisions down to previous months. But this services report caused interest rates to tank and it’s no wonder why – this is a level that you ONLY see in a recession. Yes, in the last 30 years readings this low have only been experienced when the economy was softening very materially.

It’s impossible to say whether this is a seasonal blip or something more meaningful. I’d argue that the current environment remains pretty clear – everything is softening, but nothing is softening so substantially that it’s worrisome. It’s what I’ve called a muddle thru environment where the economy is muddling back to slow, but trend growth of the pre-Covid period. But then there’s the outlier risk that credit markets are so tight that you get a hard landing due to some outlier effect where the economy slows very sharply because the Fed hit the brakes for longer than they should have. This data certainly looks closer to the latter than the muddle thru environment, but one month of data isn’t a trend.

In the end I’d argue that this data marginally increases the odds of a rate cut in Q1. It raises the odds of an emergency rate cut from virtually 0% to something now materially higher. So, it’s not a sign to panic by any means, but it’s also a reason to be skeptical of what’s happening at a broader macro level because the digestion of the Covid excesses isn’t over just yet and we shouldn’t be surprised by…surprises.