Tuesday’s CPI report was a huge relief for the Federal Reserve and their fight against inflation. Headline CPI came in at 3.2% and core inflation came in at 4%. Expectations were for modestly higher inflation. The details showed a broad slowdown in the positive rate of change in prices which is another sign that the Fed’s rate hikes are working to slow the economy. In fact, it’s working in an almost textbook fashion as housing activity and borrowing slow to multi-year and multi-decade lows. This is precisely the transmission mechanism you’d expect to see here as interest rates work primarily by making it harder to borrow and simultaneously increasing the demand for money.

Despite this, it’s still way too early to declare victory. Core inflation remains 2X over the Fed’s target rate of 2% and they can’t truly declare victory until they’ve eased rates back down to a more sustainable level. I suspect that level is somewhere in the 2-3% range because that would translate to a mortgage rate of about 4-6% and that’s a figure where the housing market can improve without sparking a speculative fervor and resurgence in inflation. And we’re likely a long way from rate cuts at this point. Historically speaking the Fed doesn’t cut interest rates until core PCE inflation is below 2.5% and we’re not there yet. So it’s all trending in the right direction, but the Fed won’t ease off their current rate positioning for some time. Which, paradoxically, will continue to put pressure on inflation, but will also increase the odds of a deflationary credit event and/or the Fed overshooting and driving unemployment higher than they’d like.

We have to give some credit where credit is due though. So far the Fed has managed to temper inflation without causing a big uptick in unemployment. Yes, it’s still too early to say they haven’t made a policy mistake, but it’s all going about as well as they could expect for now. And I expect that downward inflation trend to continue in large part because they’re staying aggressive for the same reason they were late to raise rates – housing.

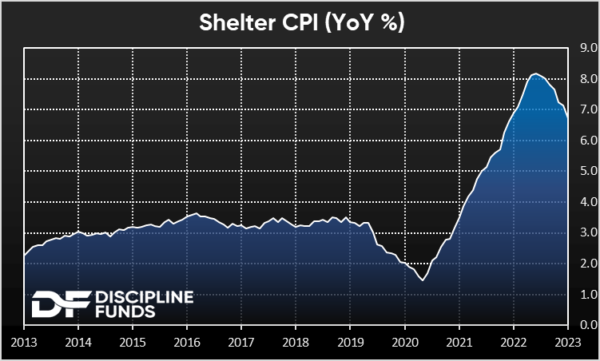

This has been the most important chart of the year and it will likely be the most important chart in 2024 as well. It shows the peaking of shelter inflation and the way it’s slowly filtering into CPI. This chart was one of the main reasons why we predicted that 2023 would be “the year of disinflation” and it’s why we think disinflation has become entrenched. As we’ve discussed many times in the past the shelter component lags by 9-12 months because of the way the BLS calculates it on a biannual basis. And at a 35% weighting shelter is one the most important pieces of the puzzle here. The wild thing is that it’s still reading 6.7% year over year even though we know shelter has declined at worst and crawled sideways at best in real-time measures. So expect that 6.7% figure to slowly creep back towards something in the 3-4% range in all likelihood and perhaps even overshooting to the downside. And that process is going to take another year which means that barring a commodity surge or another government spending spree the inflation data will continue to have a disinflationary tilt.

How Does it Impact Portfolios?

This is a tough one to decipher. On the fixed income side it’s probably smart to start extending durations a bit, as we noted previously. If the Fed is veering closer to a rate cut cycle then these high T-Bill rates aren’t likely to persist. That means fixed income investors will want to start locking in longer rates. On the equity side it’s messy because the lower inflation situation means the Fed could ease rates back down to a level where housing (and the economy) can really boom again. Then again, the higher for longer position means there’s the rising asymmetric risk of a credit event.

As you can likely predict, we’d focus on being disciplined about time horizons. If you have a long time horizon then increasing some equity risk is not a bad idea here. On the other hand, if you don’t have a longer time horizon the better way to get more return might be to increase your duration in fixed income over properly matched time horizons. So, the answer is it depends on personal needs!