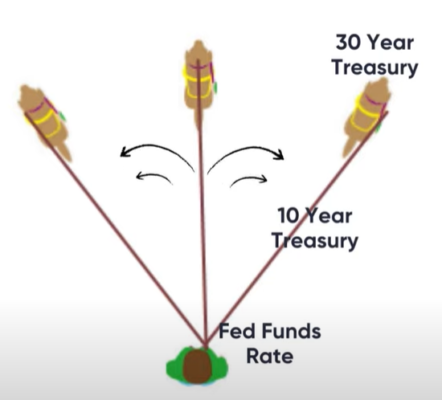

To understand the transmission mechanism of Monetary Policy it can be helpful to understand how interest rates are set and how this filters thru the economy.

My favorite analogy for understanding how interest rates are set is by thinking about the yield curve as a dog on a leash. The person walking the dog can best be thought of as the Federal Reserve and the dog is attached to a leash that reflects all the bonds from the overnight rate out to the 30 year government bond. The Federal Reserve sets interest rates in the Federal Reserve System where banks are required to maintain reserve deposits. This is a closed system for member banks and since the Fed is the monopolist on reserves they have absolute control over the price of reserves.

Banks can lend reserves and try to influence the rate, but the Fed ultimately sets the price as the monopolist. In today’s system the Fed does this by setting the interest rate on excess reserves. Therefore, if a bank has excess reserves they might try to lend them out, but because the Fed pays them interest on those reserves they are disincentivized to do so. This helps maintain the target rate where the Fed wants it.

In terms of our dog walking analogy the Fed has absolute control of the leash at the handle. And they let the dog wander the further out it goes. If the dog is reflected by the 30 year bond then you can think of the 30 year rate as an extension of the overnight rate. It might look like the dog is leading the man, but the dog is still ultimately on the leash controlled by the man. So the dog walker has a certain degree of control even over the long-term rate.1

I like to think of the long-term rate as an expected future path of the short-term rate. If the Fed were to signal, for instance, that overnight rates would move permanently to 0% then the 30 year bond would collapse closer to the handle and its variability in movements would be reduced. In theory the Fed could pull in the entire leash and control the entire curve. This has happened historically and is called “yield curve control”. This would be a form of Quantitative Easing where the Fed sets the price of reserves instead of the quantity of reserves (as they presently do under QE). In doing so they would be able to set the long-term rate at whatever they want and the market or “bond vigilantes” could do nothing about it because the Fed has a bottomless pit of money that no bank or bond vigilante could/would compete with.

In today’s system the Fed lets the long-term bond float and so bond traders are constantly sending signals and trying to front-run where they expect the Fed to go. It might look like the bond market is walking the Fed, but in reality the bond market is just trying to guess where the Fed is going in the future.

In terms of how this filters thru the financial markets – well, that’s complex because it’s very indirect. The Fed only controls the overnight rate with absolute power and the overnight rate has an indirect impact on other rates. For instance, if the Fed were to raise overnight interest rates to 5% then they are changing the overnight cost of funding for all banks. This sets a benchmark rate and banks would then try to lend at some premium to the overnight rate. A 1 year loan to a AAA rated entity might be set at the overnight rate plus some small premium. A 30 year mortgage rate would most likely be set at the overnight rate plus some higher premium to account for the term premium and inflation risk that the bank is exposed to. This creates more variability in the long rate and so longer rates will always appear less correlated to the overnight rate even though the overnight rate establishes the benchmark rate for these loans.

It’s all a bit more complex than that depending on the specific rate and loans, but I hope this overview helps.

1 – It could be helpful to think of the dog as being small when inflation is low and larger when inflation is high. In other words, even though the Fed has absolute control over the overnight rate the rate of inflation and market conditions could force the dog walker to change direction. Therefore, high inflation can be thought of as exerting a certain degree of control over the direction of the dog walker and long-term bonds should generally reflect the expectation that high inflation will force the Fed to impose higher interest rates.

Sources:

1 – The Channels of Monetary Transmission: Lessons for Monetary Policy – NBER

2 – Interest on Reserves and the Implementation of Monetary Policy. NY Fed