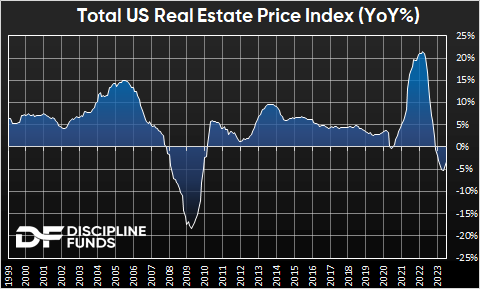

Mortgage rates officially hit 8% today. It’s amazing considering mortgage rates were as low as 2.5% back in just 2020. But it isn’t the high rate that is so alarming – it’s the rate of change. And this is what separates this period from any period in the past. The Fed has made an unprecedented change in the pace of rate hikes. But the fun part about the Everyone Gets a Narrative Economy is that depending on where you look the real estate market is or isn’t broken.

For instance, let’s look at just how bifurcated the real estate market has become. The commercial side is in a death spiral. Commercial prices are down 16% and financing for commercial deals has evaporated. Work from home has created huge excess inventory and there’s $2T+ of debt that’s going to be rolling in the coming few years.

Meanwhile, residential has also frozen, but work from home made our homes more valuable and rising interest rates locked most existing home owners in their “Golden Handcuffs”. So there’s no forced selling, low inventories and high unaffordability. And prices are now…UP 1% from a year ago.

When you dig into the data it’s a disaster. Existing home sales are down 40%+. The NAHB Home Builder Sentiment Index is plumbing its recent lows. Mortgage applications are at a 25 year low. And the buy:rent index is just sitting at levels that we last saw before the Housing Bubble. It’s hard to frame real estate data as anything other than bad.

It’s also amazing because you can both argue that the real estate market is totally broken, but you can also argue that the housing market is holding up remarkably well in face of some very strong headwinds.

What’s Coming Next?

We’ve long been saying that this issue cannot resolve itself without one or two things happening:

- The Fed needs to cut rates back to about 2-3% to bring mortgage rates below 5%.

- Real estate prices need to experience a lot more pain.

Given the bifurcation in commercial and residential it’s hard to see the super bearish case for residential unless the employment situation gets a lot worse. That’s the lynchpin holding a lot of this together. And if it worsens then we might all need to buckle up. But so far that hasn’t been the case. Commercial remains a ticking time bomb, but is vastly smaller than residential so it plays a less important role in the broader economy. And since the Fed is holding up the Golden Guillotine of bond losses in bank balance sheets that hasn’t been as worrisome as expected earlier this year. So it’s all holding together even if it feels like the “this is fine” meme. But as I’ve been saying for the last few years, this ain’t over. Not by a long shot. One or both of the above conditions will happen with absolute certainty in the coming years. The question is whether we get there in a panicky way or if we get there in a controlled way.