It’s been 20 years since I was so excited about cash. You can build a simple T-Bill ladder these days that yields 5%. It’s state tax free and it beats virtually every money market fund or “high yield savings” accounts around. 5% on a risk free asset is about the best risk adjusted returns one can imagine. But how long will this free lunch last? That, my friends, is an interesting game of market timing. As I previously noted, cash is the most active instrument of them all given its overnight settlement nature. And while some people might think it’s a waste of time to obsess over the interest earned on cash I would vehemently take the other side of that view – I believe cash is one of the most egregiously mismanaged assets in retail investment accounts and especially bank deposit accounts. Heck, we even know that it’s egregiously mismanaged in corporate accounts following the SVB saga.

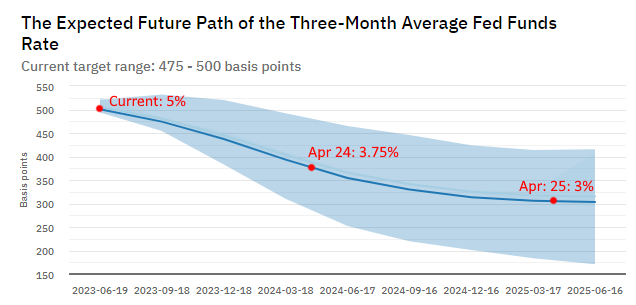

From an operational perspective the interest rate we can expect to earn on risk free assets is the overnight rate. The Fed establishes a target rate on overnight reserves and that rate will be roughly equivalent to what the Treasury sells short-term bills at. The market tries to front-run the Fed’s expectations and so the further you go out the curve the more you’ll see the future expected change in rates. For instance, at present the Fed is expected to be at 3.75% in a year and 3% in two years. The one year Treasury is yielding 4.7% and the two year Treasury is yielding 4%.

This is interesting from a strategic cash management position because the market is increasingly of the view that the Fed is done raising rates. And it’s increasingly moving to the view that the asymmetric risk in rates is DOWN instead of UP.

Our view is that inflation is a rear-view mirror story at this point and that the current rate structure creates more credit risk as inflation risk declines. Our target for the Fed Funds Rate is 2.5% by April 2025. Therefore, the free lunch of 5% rates is unlikely to last for long. While we believe the Fed is unlikely to pivot in a controlled manner we do think there’s a rising probability that they will be forced to backpedal. In other words, when they start to cut rates it will be swift and surprising. That said, we expect the Fed to maintain a restrictive 5% overnight rate for the remainder of this year. But as we move into the back half of the year investors will be wise to consider locking in these generous risk free returns. They’re unlikely to last and when they disappear they could disappear back to 2-3% in swift order.

Investors might position for this by initiating a curve flattening position across 3/6/9 month laddered T-Bills with the plan to move to a curve steepening longer duration ladder as the bills mature. Said differently, lock in the 5% rates across the 3/6/9 month structure (because the Fed is unlikely to have changed rates within 6 months) and as the 3 month bills mature every 3 months roll them into longer maturity 9/12/24 month to smooth the interest rate risk and lock in higher rates as we move into the latter portion of the year when reinvestment risk is likely to increase in the shorter duration bills. It’s counterintuitive but as the Fed cuts rates the interest rate curve is likely to steepen because this will be stimulative across much of the rest of the economy. And while that will likely be good news for risky assets it is bad news for risk free assets.

Anyone who tells you cash is boring probably has too much cash sitting in their bank account accruing fees that they don’t know are actually fees.1 It pays to be active with your cash and in an environment with 5% overnight rates it pays damn well. We hope this piece motivates you to take advantage of this unusual environment. And of course, if you want me to help don’t hesitate to reach out. After all, boring and disciplined is our bread and butter.

1 – It might look like “free checking”, but in a world with 5% overnight rates anything that isn’t paying you 5% is the equivalent of a large fee on a risk free instrument.