One of the recurring themes I’ve focused on in recent years is the inherently long nature of a credit bust cycle like the one we’ve been experiencing since 2021. In short, economic booms lead to asset price booms which lead to overall consumer price booms. When consumer prices get out of line with the Fed’s target they adjust interest rates to bring prices back to some equilibrium. When the boom involves a lot of debt financed at low rates the Fed’s actions will, with a lag, hurt credit markets and this is what makes the bust drawn out – it takes time for these loans to actually bust because it takes time for the underlying contracts to roll and refinance.

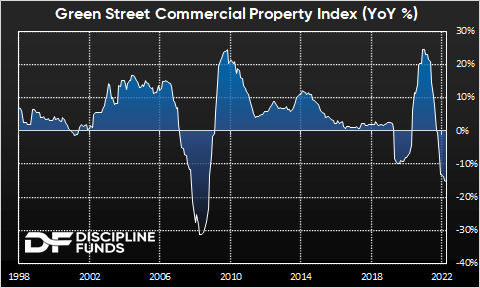

The important thing to focus on here is the price declines because the price declines are how we can measure the current levels of reinvestment risk. For instance, in the case of SVB their reinvestment risk was enormous because they held a huge amount of government bonds that, if marked to market, were underwater by a hefty margin. What we’re seeing in commercial real estate these days is starting to look similarly uncomfortable. According to the Green Street Commercial Property Price Index prices are now down by 15%. That’s the largest decline we’ve seen since the GFC.

The commercial real estate market is just one piece of a much larger overall real estate market, but it’s especially important in the context of the recent banking woes. The issues in the commercial space are very similar to the residential space in that it’s all predicated on prices that boomed too much that are now busting and any financed reinvestment or new purchase is rolling into a much higher interest rate. But unlike the residential space there is no supply shortage. In fact, COVID created the opposite effect where there’s now way too much supply of commercial space because of work from home.

According to Morgan Stanley there is $1.5T of CRE debt coming due in the next 3 years. They estimate that much of this won’t roll over and that that could cause prices to fall by 40%. That would be even worse than the financial crisis. And to add insult to injury, 67% of these loans are held by regional banks.

In recent weeks I’ve talked about how this is different from 2008 in that overall credit quality of the real estate market is much healthier than it was in 2008 and, importantly, the Fed is ready to act to stabilize the banking system. But the one thing the Fed won’t do until inflation is fully under control, is cut rates and that’s the linchpin in all of this. So we aren’t likely to get a full blown banking panic like 2008, but we are likely to see a “walk” on the regional banks as these issues cause impairments. But I don’t think we can really start to see improvement here until rates come back down to lower levels and that’s just going to take time because inflation isn’t coming down nearly as fast as the Fed would like.

In a recent CNBC interview I heard someone say “Stay alive until 25”. I don’t know if this is going to persist that long, but I think that’s a good way to think about navigating the next few years. Credit risk is high and rising and this is the kind of slow rolling problem that is inherently slow rolling specifically because the credit markets mature at a rolling pace. These are the sorts of environments where risks are unusually elevated. But at the same time it’s important not to fall into the doom loop narratives about how the world is ending. I’ve been saying this for years now, but “this too shall pass”.

Stay patient, don’t be greedy. At least not yet. Have a great weekend.