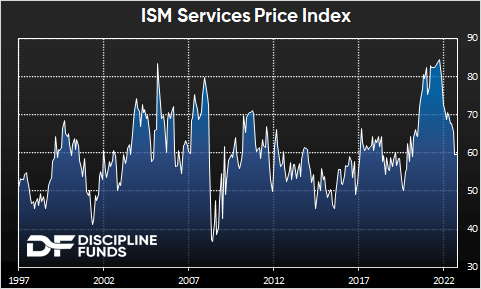

One of the stickier components of recent inflation data has been services inflation. In the CPI data this has been primarily driven by rents, but services in general have remained much stickier than other prices. But this morning’s ISM Services Prices Paid Index showed a surprisingly large decline to levels not seen since 2020.

As we noted in our 2023 outlook this was very likely to be a year of disinflation and this data only solidifies this view. If anything, this is a worrisome piece of data for the Fed as they’re at risk of getting caught flat footed once again. We’ve been very vocal in recent months about how inflation risk is morphing into credit risk. The SVB saga vindicated that view, but we don’t think the credit risk is entirely behind us.

Inflation was a 2021 and 2022 story, but the Fed has been so aggressive with their rate hikes that they’ve now created a tremendous amount of credit risk. In short, investors became overleveraged during the COVID boom and they’ll spend the next few years deleveraging and rolling over debt at much higher rates. Consumers will also find themselves under pressure as the Fed has hammered bank balance sheets and contributed to tightening lending standards. All of this is a messy mixture of macro dynamics that exacerbates credit risk in the years ahead.

The Fed doesn’t have the luxury of being as forward looking as we can be, however. They are so data dependent that they have to be able to justify what they’re doing. At present the trends in the data have the appearance of a persistent inflation risk and the Fed’s primary tool to fight that is to reduce demand through rising unemployment. The policy risk, however, is that they’re now making the same potential mistake that they made in 2021. In 2021 the Fed justified their 0% rate position by looking at unemployment data which was still quite high. Through this lens it appeared as though demand was too low to generate sustained inflation because unemployment was still too high. That turned out to be disastrously wrong in large part because employment data lags prices. And the same thing is happening now except in the opposite direction. The Fed has tightened the economy substantially, unemployment is at risk of rising more than the Fed is comfortable with and yet they won’t react until the proof is in the pudding. And by the time the Fed starts eating that pudding it will have already been too late as the disinflation will only become obvious after the Fed has destroyed millions of jobs.

The Fed remains overly worried about a 1970s style price spiral. In our view that story is all but dead and the services prices only confirm that view. The Fed is playing a very risky game of chicken here, but they’ve painted themselves into a corner where they have no choice but to stick to the path they’ve chosen. Our view is that they overtightened policy worrying about a 1970s scenario that was unlikely. I expect the Fed Funds Rate to revisit the 3% level in the coming years. But not before we spend most of this year at or near 5%. And we’ll either get to that 3% level slowly via a soft landing or we’ll get there quickly when the Fed backpedals during a hard landing. Unfortunately, the hard landing scenario looks increasingly likely.