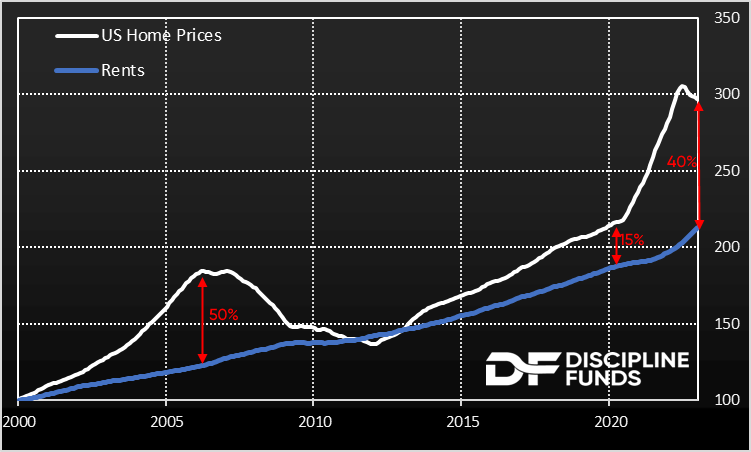

If I had to distill our macro view into a single chart it would be this – house prices vs rents. COVID created an incredible disequilibrium in the housing market where house prices surged 40%+ and rents are only just playing catch-up. It’s part of what has caused inflation to linger as rents have a lagging impact on CPI and have yet to roll over substantially in the Owners Equivalent Rent data. But this chart is interesting because the discrepancy has a fundamental impact on the future of home prices and the economy.

People have to live somewhere. And they can either rent or buy. This chart reflects the massive discrepancy in the cost of renting vs the cost of buying. While rents have increased substantially in recent years it is still far more desirable to rent in most places when compared to buying. If we assume that the market is remotely efficient then these prices should converge. Perhaps not entirely, but we shouldn’t expect a 40% disequilibrium to sustain itself. Especially not in an environment where the demand for buying is drying up as the Fed raises rates aggressively and the average mortgage rate surges back to 7%.

I don’t intend to sound alarmist. In fact, we’ve been vocal that this isn’t a repeat of 2008. That’s primarily because you won’t have the forced sellers defaulting on residential real estate en masse. Our baseline view is that home prices will fall by 15-20% over the course of the next 2-3 years as rents increase more modestly by 10% over the same period. This would bring us roughly back in-line with where we were before COVID when housing earned a premium over renting. A 15-20% decline in housing is quite large by historical standards, but really is just a chink in the armor compared to where we’ve been. After all, a full retracement of the COVID boom would require a 30% decline in prices. Now that’s a bear market in real estate. But a more modest 15-20% decline is part of a healthy market correction in our view.

Are Inventories as Low as We Think?

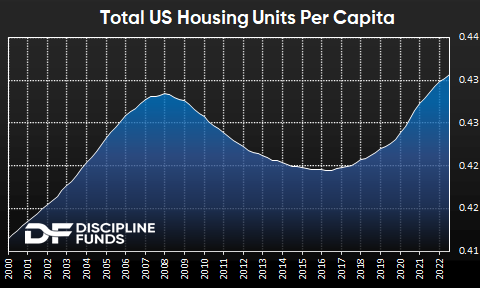

An equally interesting and related point has to do with housing supply. We often hear that house prices cannot fall because housing supply is low. But how true is this? If we look at total housing units in the USA relative to the total population the story looks quite different from the one in the mainstream media. In fact, housing inventory, by this metric, has never been higher. If you adjust it for only the working age and retired population then inventory is even higher.

Of course, this data is highly localized and we generally measure “inventory” by the number of units that are actually for sale. But from an aggregated market perspective there is no shortage of places to live. You don’t have to buy a house if you want to live somewhere. And that’s where the math on renting comes into play. There is no shortage of aggregate housing units, but there is a shortage of affordable homes to buy. Or, at least, that’s true at present. When we look only at inventory as units for sale we ignore the potential that many of the existing units could flood the market in the future. We also don’t fully account for the record high number of units currently under construction that are not yet for sale. But perhaps more importantly, this data doesn’t consider whether there is enough demand for this level of supply. Because, after all, if there are very few sellers and even fewer buyers then it’s not unreasonable to assume that the sellers will push prices lower as the low number of buyers demand lower prices. Said differently, to use a stock market analogy, if we were looking to buy a stock with a thin set of asking prices and a fundamental price that one bidder thinks is significantly lower than the current market price then that single bidder has pricing power despite the fact that there are only a few asking prices. And if the asks get desperate enough with a patient bidder then prices will fall regardless of the “low inventory”.

I’ve been saying this for well over a year now, but this environment remains one where patience is required. Housing is an inherently slow moving beast and we cannot expect anything to happen rapidly here. And as long as we’re in the process of housing price discovery it’s reasonable to assume that a weak housing market will put downward pressure on the broader economy.