We founded the concept of Countercyclical Indexing by answering some simple questions:

- Is a “balanced index” like a 60/40 stock/bond portfolio actually balanced?

- Does it make sense to rebalance back to a fixed weight allocation when we know that the underlying “passive” market capitalization is dynamic?

- Can we implement a similarly passive strategy that better aligns an investor’s risk profile with the underlying dynamic market cap changes?

A standard indexing strategy such as a 60/40 stock/bond portfolio has many wonderful characteristics. It’s diverse, low fee and tax efficient. The financial industry refers to this portfolio as a “balanced index”, but the reality is that this portfolio is not very balanced at all. The reason a 60/40 portfolio cannot be reasonably called “balanced” is because it generates ~85%+ of its risk from the 60% slice thereby resulting in an unbalanced risk profile overall. Rebalancing this portfolio back to 60% stocks reduces the procyclicality of the portfolio, but still exposes the investor to very unbalanced risks over time. For instance, a 60/40 portfolio fell 31% during the 2008 financial crisis almost entirely because its 60% stock market slice declined by 51%. In other words, most of the risk in this portfolio came from the much more volatile equity component.

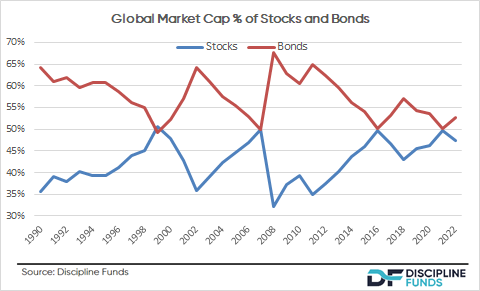

One cause of these exaggerated risks is that this portfolio deviates significantly from the Global Financial Asset Portfolio (the actual market cap weighted portfolio of financial assets) and this exaggerates the risk skew by creating a portfolio that is inherently more procyclical than the actual underlying market capitalizations of stocks and bonds. This results in outsized behavioral risk at times because the portfolio is always rebalancing back to 60% even though that 60% slice becomes riskier when the stock market booms (like 2008 or 1999) and less risky when the stock markets busts.

If an investor followed a truly “passive” approach they would let their stock/bond allocation float as the market caps change across time. The problem with this approach is that the relative market caps are highly dynamic and tend to boom and bust across time as investors overreact on the upside and downside. This means that if we purchased a truly passive portfolio we would end up being overweight stocks after they’ve boomed and underweight stocks after they’ve busted. This doesn’t make sense.

A 60/40 allocation is an improvement over the actual market caps because it’s somewhat “countercyclical” in the sense that it is always overbalancing back to 60/40. For instance, when the 60% slice grows into 70% the 60/40 countercyclically offsets the underlying equity market growth. And when the portfolio drops to 50/50 the 60/40 portfolio countercyclically rebalances the portfolio back to 60% equities. The problem here is that the 60% slice dominates the portfolio volatility and rebalancing back to this fixed overweight stock allocation leaves you exposed to very large drawdowns because you’re rebalancing back to an inherently unbalanced starting weight. A truly “balanced” approach would reduce the equity weight AND mitigate the cyclical risk in the equity component by overbalancing AWAY from it when it grows out of line with its average market cap weight. In other words, a truly balanced index should have a more balanced starting benchmark (closer to the GFAP) and a rebalancing methodology that reduces the inherent procyclical risk in the equity component.

Most importantly, what this does is better align an indexer’s profile with their exposure to various asset classes over the course of the market cycle because you’re essentially reducing risk to permanent loss as stocks become riskier and you’re increasing your exposure to stocks as they become less risky (when they decline in relative value). This is extremely important as the main factor in investment performance is not stocking picking or generating market alpha, but YOUR BEHAVIOR. Countercyclical Indexing creates a plan that systematically rebalances a portfolio so that you’re always rebalancing against your behavioral biases. This helps keep the investor more disciplined through thick and thin. And the beauty is, you can do this in a highly tax and fee efficient manner if you have the patience to actually let the approach play out over time.

Why Countercyclical Indexing Works

- The strategy magnifies William Bernstein’s “rebalancing bonus” by rebalancing in a manner that is more consistent with the GFAP.

- The strategy takes advantage of Ray Dalio’s “risk parity” concept by creating better parity between the risks of stocks and bonds in a portfolio.

- It can be low fee, tax efficient and just as passive as other traditional indexing strategies.

- The strategy optimizes for behavioral alpha instead of market alpha thereby creating a portfolio you’re more likely to stick with even in tough times.

Read our white paper on Countercyclical Indexing here.

* It should be noted that even a static allocation that rebalances is always rebalancing back to imbalanced degrees of risk during the market cycle. That is, a 60/40 is actually a much riskier portfolio late in the market cycle than it is early in the market cycle. This leaves the investor who buys the 60/40 in 2009 owning a much less risky portfolio than the investor who buys a 60/40 in 2007.