Here are some things I think I am thinking about this weekend.

1) The labor market continues to soften.

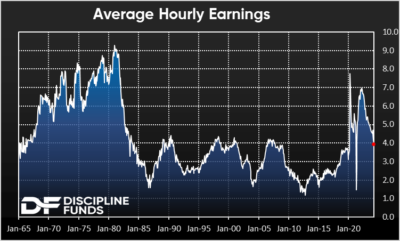

Friday’s employment report was just right. Not too hot and not too cold. But it also showed very clear signs of a softening labor market as I discussed earlier in the week when we got the JOLTS report and the quit rate. As expected, the quit rate was indicative of lower hourly earnings and the recent rate of 3.9% is the lowest year over year gain in hourly earnings in a long time. There were other signs of softness as well including a decline in hours worked, a continued downtrend in temporary employment, etc. And like our inflation readings it’s trending in the right direction, but slower than we hoped.

The markets loved the news because it’s all consistent with lower future demand and inflation, but not collapsing demand that would be indicative of recession. And after a few sticky inflation readings and persistently better than expected employment reports this softness was welcome news. Stocks and bonds both loved it because it’s more consistent with the soft landing narrative and reduces the odds of the inflation resurgence worries.

It probably doesn’t change the Fed’s view all that much, but it’s definitely something that will reinforce their desire to cut at some point this year. Now the question going forward is does this softness persist or does it start to get materially softer as the Fed sits higher for longer….

2) Small Habits with a Big Impact

I loved this question from Twitter where someone asked: “what financial habit has made the biggest impact in your life?” The answer for me is that I’ve never missed a credit card payment in my life so I’ve never incurred high interest debt burdens.

We talk a lot about how kids don’t learn basic finance in school, but for me the only lesson I really needed to understand about money from a young age was that you should always try to spend less than you make and never incur high interest debts. These two small lessons can have a big compounding effect in the long term.

Debt isn’t inherently good or bad, but certain types of debt can be disastrous. In general, high rate debt like credit card debt is bad and certain types of low interest debt can be beneficial when the ROI is high(er) on the corresponding assets. And as a general rule I think it’s smart to assume that any debt with an interest rate higher than a 50/50 stock/bond portfolio’s expected return, is a bad debt. So, if you have an 8% interest loan of some sort you can compare that to financial market returns like stocks and bonds and ask yourself “would I be smarter to invest cash in a diversified portfolio or pay down this debt in what is essentially a guaranteed 8% return on the loan?” Right now the bond market is yielding about 4.8% and the expected future return of the stock market is about 6.2% in my Defined Duration model. So a diversified portfolio of stocks and bonds probably won’t do much better than 5.5% per year in the coming 10 years. That’s potentially conservative, but it’s a good benchmark for expectations in an environment where bonds are high yielding but stocks are expensive.

The lesson from all this is that controlling high interest debt is every bit the superpower that generating good financial returns can be. But the debt maintenance has a far greater degree of certainty because it’s something you can more directly control. And that small habit can have big returns in the long-run.

3) Why Does the US Government Issue Bonds?

Update: It’s come to my attention that this clip was edited and appears spliced to take the comments out of context to make them appear worse than they are.

Here’s the weirdest economic clip you’ll see in a long time. Jared Bernstein is the Chair of the White House Council of Economic Advisers. Stephanie Kelton is the face of unorthodox economic school Modern Monetary Theory. In this clip Kelton asks:

“Why are we borrowing in a currency we print ourselves? I am waiting for someone to stand up and say ‘why do we borrow our own currency in the first place?'”

Bernstein is shown fumbling thru this question as if he doesn’t know why we issue bonds. I can’t tell if the footage is doctored or what, but it’s safe to say he doesn’t answer clearly and his response is bizarre. Meanwhile I am over here standing up and jumping with my hands up to answer Kelton’s question because she doesn’t seem to know the answer either. After all, in the MMT world bonds aren’t needed because we can just print money so MMTers would have us believe that the whole government bond market is a big charade based on misunderstandings. Except it’s not at all and its existence has a very specific purpose.

We issue bonds because the government is trying to control money demand when it runs a deficit. Yes, we could theoretically just print dollars when we run government deficits, but the present system is designed largely around bank deposits and banks as the dominant money issuers via credit markets. So issuing bonds and paying interest on them has an important knock-on effect across the entire economy by increasing and decreasing money demand over time. Typically when the Fed raises interest rates you’ll see rates rise in governments bonds and across the entire economy. This increases the demand for money and money-like instruments and also raises benchmark rates which makes it more expensive to borrow.

The result is that you end up with higher money demand because government bond holders are more willing to hold their high interest bearing safe instrument and borrowers are more likely to borrow less because credit becomes less accessible when these underlying benchmark instruments adjust for the rate change. And issuing longer duration instruments has a multirplier effect by increasing the likelihood that a saver will hold onto a high interest bearing instrument as opposed to the alternative where they’re holding a low interest bearing instrument (and therefore more likely to spend for investment or consumption).

And this is precisely what’s playing out in real-time. Of course, the MMT advocates believe we shouldn’t issue bonds at all and they think interest rates should be pegged permanently at 0% because they don’t believe interest rates impact the economy meaningfully. Which is pretty interesting in the scope of the current environment because it’s becoming increasingly clear that higher rates are slowing aggregate demand and helping bring down inflation. In any case, it’s kind of disturbing that famous economists like Kelton and Bernstein don’t understand one of the very first things we all learn in finance and economics regarding the way interest rates and term premiums can impact demand….

NB – One of my favorite things in the world is to grow our own pumpkins for Halloween. I’ll be planting our pumpkins from seed this weekend. The kids love it and they’re generally easy to grow except that you do need a lot of space for it. Plus it’s a good hedge against pumpkinflation since the seeds cost a couple bucks and you can get dozens of plants out of it and potentially dozens of pumpkins. And the nicest part about pumpkins is that you can’t really plant them too early (depending on where you are) because they’re incredibly hardy. The only downside is they take a long time to mature so it’s good to get going now and invest in your October pumpkins today. It’s also Kentucky Derby weekend and Cinco De Mayo so I hope you have something fun planned. Have a wonderful weekend.